Bank Account Blocked Reopen Request Letter: A saving bank account can be inoperative or dormant if not used for two years. And when the account turns inoperative, the account holder cannot avail of any facility through that account. Banks also mark those accounts inoperative after a year or two, in case any customer cannot respond to emails, letters, invoices or calls. The policy ensures that the money is kept safe and banks remain proactive throughout this process. The Reserve Bank of India (RBI) has directed banks to undertake reviews of accounts which are inoperative and there are no credit or debit transactions taking place during that particular time. Bank also provides information to the customer in writing and tries to draw out the reason. If the customer replies to the bank then the account becomes operative.

To regulate the dormant account customers need to go to the nearest branch of the particular bank and have to activate the dormant account through an application. A bank can activate the dormant account the next business day and may take time to process the whole thing. RBI allows the bank to regulate the customer’s account based on the risk category of the account holder. Banks can only permit the customer to operate their accounts on receiving KYC documents and banks can also ask for verification of the signature. RBI never charges any amount for the activation of dormant accounts.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

- Steps To Write Bank Account Blocked Reopen Request Letter

- Documents Required To Reactivate Bank Account

- How To Write A Letter To Reactivate Or Reopen A Blocked Bank Account?

- Letter To Reactivate Or Reopen Blocked Bank Account Sample

- FAQ’s on Bank Account Blocked Reopen Request Letter

Steps To Write Bank Account Blocked Reopen Request Letter

- Step 1: The account holder should visit the respective branch of the bank.

- Step 2: The holder should write an application to reactivate the dormant bank account so that they can perform transactions or payments on a regular basis.

- Step 3: The account becomes active on the next business day and sometimes it takes 2-3 days to activate the account after surveying the risk category of the depositor.

Documents Required To Reactivate Bank Account

Documents required are as follows;

- Application letter is mandatory as it is needed to be submitted to the respective bank.

- Signature of the first account holder as well as the joint account holder is another important thing.

- One should submit KYC (Know Your Customer) documents.

- Further includes PAN card and Id Proofs.

- Financial transaction document is also needed to show.

How To Write A Letter To Reactivate Or Reopen A Blocked Bank Account?

To write a letter to reopen a blocked bank account following steps are required to justify the proper format of the letter. Let’s discuss this in detail.

- The first one should mention the date on the top left-hand side of the letter. One should use proper templates while writing a letter.

- One should first address the name of the respective bank including the branch name and address of the bank. These things should be in three lines only.

- Then after leaving a space, one should address the name of the account holder, full address and contact number of the account holder while keeping in mind that everything should start from the left-hand side of the letter.

- After that one should write the subject for example (Request to reactivate or reopen my blocked bank account). The subject should address the issue in clear language.

- Furthermore, addressing Respected Sir/Madam, one can start his or her opening lines by writing a short introduction or one can provide various details like the account holder’s name, address, branch name, and contact number and mention the reason why he or she was not using the bank account for a long duration.

- With the change in a paragraph, one can write the main body of the letter and raise their issues in a detailed manner.

- Then again changing the paragraph that is in the 3rd paragraph one can conclude his or her demands and issues by requesting the bank to support actively.

- Lastly, one can show gratitude by thanking the authority and a signature as well as the name of the account holder is required within curved brackets.

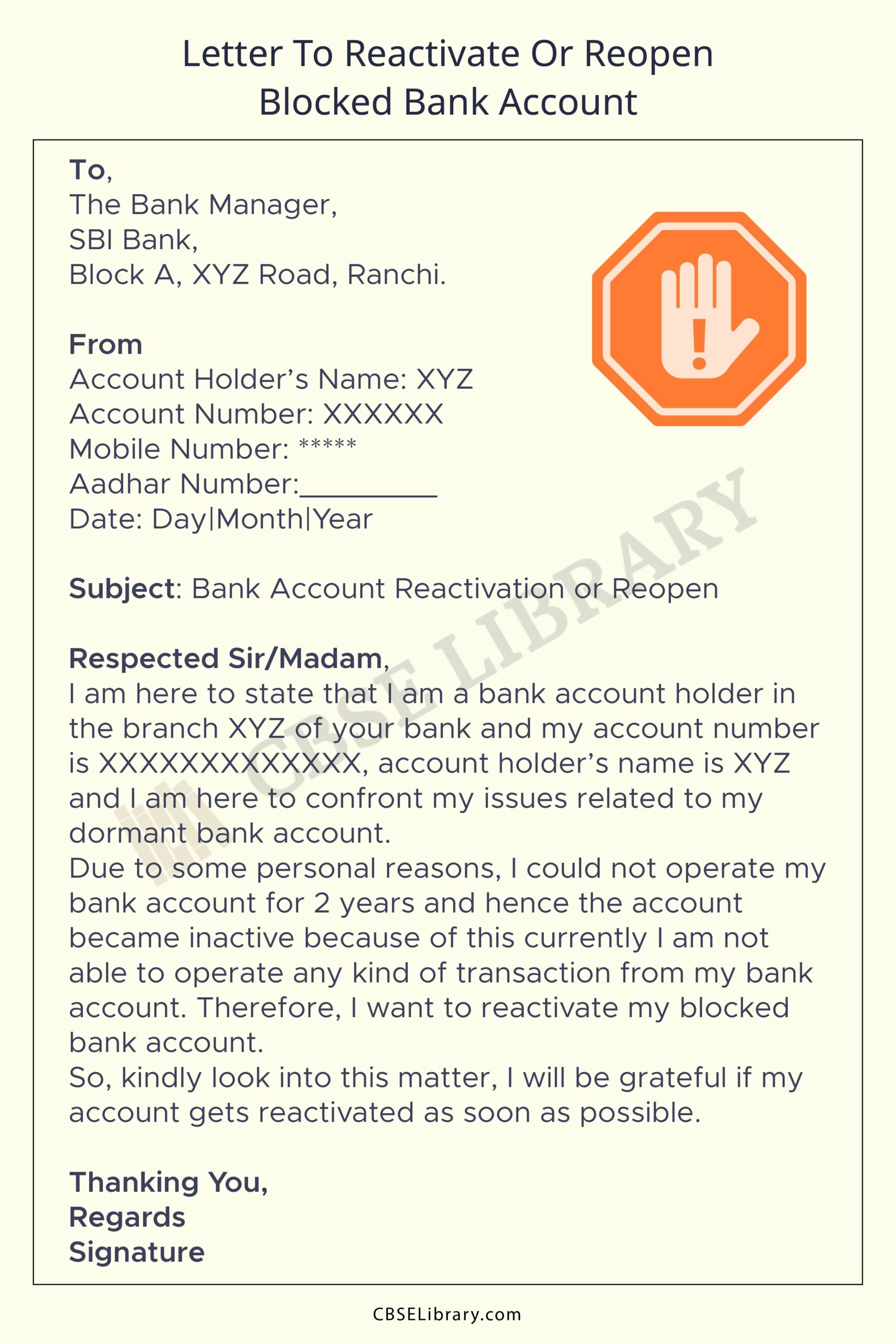

Letter To Reactivate Or Reopen Blocked Bank Account Sample

To,

The Bank Manager,

SBI Bank,

Block A, XYZ Road, Ranchi.

From

Account Holder’s Name: XYZ

Account Number: XXXXXX

Mobile Number: *****

Aadhar Number:________

Date: Day|Month|Year

Subject: Bank Account Reactivation or Reopen

Respected Sir/Madam,

I am here to state that I am a bank account holder in the branch XYZ of your bank and my account number is XXXXXXXXXXXXX, account holder’s name is XYZ and I am here to confront my issues related to my dormant bank account.

Due to some personal reasons, I could not operate my bank account for 2 years and hence the account became inactive because of this currently I am not able to operate any kind of transaction from my bank account. Therefore, I want to reactivate my blocked bank account.

So, kindly look into this matter, I will be grateful if my account gets reactivated as soon as possible.

Thanking You,

Regards

Signature

FAQ’s on Bank Account Blocked Reopen Request Letter

Question 1.

What is the activation of a dormant account?

Answer:

If any account has not been operated for more than 2 years then that account is considered to be a dormant account and to reactivate it one can visit the suggested branch of the bank with an application and ensure all the proper details asked by the bank.

Question 2.

How to activate blocked accounts in online mode?

Answer:

One can activate blocked bank accounts through various links like go to the service request section and then select “ Activation of Inactive Account”. One can seek help through Customer Care and make requests to activate the account.

Question 3.

What is KYC in banks?

Answer:

KYC stands for “Know Your Customer” and it helps in various identification processes and it prevents the banks from money laundering activities and criminal acts. It requires Id verification, document and face verification to regulate fraud.

Question 4.

Who is eligible for KYC?

Answer:

Indian citizens and residents of India who are above 18 years old are eligible for KYC. KYC will be eligible for minors and foreign residents very soon.