Indira Gandhi Essay: Indira Gandhi, the first and the only women Prime Minister of India till date, is also considered as one of the boldest and dynamic leaders in the world. Indira Gandhi fought all odds against her to fight terrorism and undemocratic values in the country. She sacrificed her own life for the sake of the nation.

In this Indira Gandhi Essay, we shall be talking about her personality and the landmark decisions she took as the topmost leader of the country which has an impact even in the 21st century. We shall also be talking about what her elevation to the prime Minster’s office to the women empowerment and the movement of feminism around the world means.

You can read more Essay Writing about articles, events, people, sports, technology many more.

Long and Short Essays on Indira Gandhi for Students and Kids in English

If you are searching for Indira Gandhi essay, then we have provided two types of essays here. A long 600-word Indira Gandhi Essay and a short 200-word Indira Gandhi Essay for students of class 6, 7, 8, 9 and 10. Both essays can be used for an essay writing competition, test, assignment, holiday homework, and exam.

Long Essay on Indira Gandhi 600 Words in English

Indira Gandhi Essay is usually given to classes 7, 8, 9, and 10.

Indira Gandhi, born on 19th November 1917 in Uttar Pradesh, was the daughter of the former and the first Prime Minister of India, Pandit Jawaharlal Nehru. Indira Gandhi, during her childhood, was one of the brightest and most intelligent students in the school. She was considered to have taken up leadership roles right from school and college days. And the things she learnt as a kid helped grow as one of the greatest leaders the world has ever seen. After the untimely death of former Prime Minister of India, Lal Bahadhur Shastri, Indira Gandhi took the responsibility of running the country as the third Prime Minister of India on 24th January 1966. Having born in a family of freedom fighters and seasoned politicians, the political game of Mrs Indira Gandhi was strong as ever. Before becoming the Prime Minister, she was Information and Broadcasting minister as well.

Her tenure as Prime Minister of India was filled with ups and downs. It was under her visionary leadership that India won the war against Pakistan in 1970. She played a pivotal role in creating the country of Bangladesh and freed it from the control of Pakistan (formerly known as East Pakistan). In the year 1970, she nationalized all the banks in India. This move provided a strong economic forum for the country. The impact of the nationalization of banks is seen even in the 21st century.

For today’s youth, given the changing power dynamics in the country, know very less about the legend of Indira Gandhi. She is most popularly known in the country for imposing emergency upon the nation in the year 1977. While many people criticise her for this move because of the breakdown of law and order and creating a state of authoritarianism in a democratic country, Indira Gandhi imposed emergency to curtail the anti-democratic and anti-national elements. Even though she knew that it would affect her election prospects, she went ahead and imposed the National Emergency Act, because, for a leader like Indira Gandhi, the country is a higher priority than herself.

In this Indira Gandhi Essay, we shall also be talking about what her Prime Ministerialship represents for women in the world and not just talk about what she has done for the country. Being the first and the only women to hold the most powerful position in the country, former Prime Minister Indira Gandhi was the first to break the glass ceiling in a country where women are discriminated in all spheres of life. Till today, the United States of America could not break the glass ceiling and all the presidents of the USA are male till date. But Indians, long back in the 1970s, put their trust in a female leader and the results can be seen. India was among the fastest-growing economies in her regime. Her elevation to power pushed and gave confidence to hundreds and thousands of women around the world to break the stereotype and succeed in their lives.

The most tragic aspect of Mrs Indira Gandhi’s life was that she was assassinated by her own bodyguard while she was serving for the country selflessly. After the emergency was lifted, as expected, she lost elections. But in her second term of the office, she got back into the leadership role at a time when the Khalistan movement was at its peak. The demand for a separate sovereign country for Sikhs in Punjab was growing older and uglier by the day. There was intelligence information that terrorists were hiding in the golden temple at Amritsar with hoards of arms and ammunition.

To prevent violence and terror activities from being unleashed on the country, Indira Gandhi approved Operation Blue Star, to eliminate these terrorists from inside the temple. Ths decision was seen as anti-Sikh movement and turned into a religious fight against Indira Gandhi. Things took a tragic turn on 31st October 1984 when she was killed in cold blood. Indira Gandhi, from being one the most loved and respected leader in the world succumbed to hatred and politics of India.

Short Essay on Indira Gandhi 200 Words in English

Indira Gandhi Essay is usually given to classes 1, 2, 3, 4, 5, and 6.

Indira Gandhi was the first and the only women Prime Minister of India till date. She is considered to be the most courageous and bold leader not just in India, but in the whole world. Being the first female Prime Minister of India, she gained massive respect amongst the world community and especially the women empowerment organisation across the world.

Besides being someone who broke the gender stereotype and made it to the top echelons of our country, she is known for her bold and cold decisions that she took during her tenure that stabilised the democratic values of our country. She declared a national emergency to curtail the anti-national and anti-democratic activities from the opposition party. Many critics refer to the emergency as the black and dark days of our country. She lost the elections thereafter but soon in the 1980s, she gained back the popularity for the second term in office. As much as the first term was a roller coaster ride, the second term was filled with anger and hatred by the Khalistan movement.

Mrs Indira Gandhi was assassinated in cold blood on the 31st of October, 1984 due to anti-Sikh movements against her because the decisions she took to eliminated terrorist activities inside the golden temple in Amritsar through Operation Bluestar.

10 Lines on Indira Gandhi Essay in English

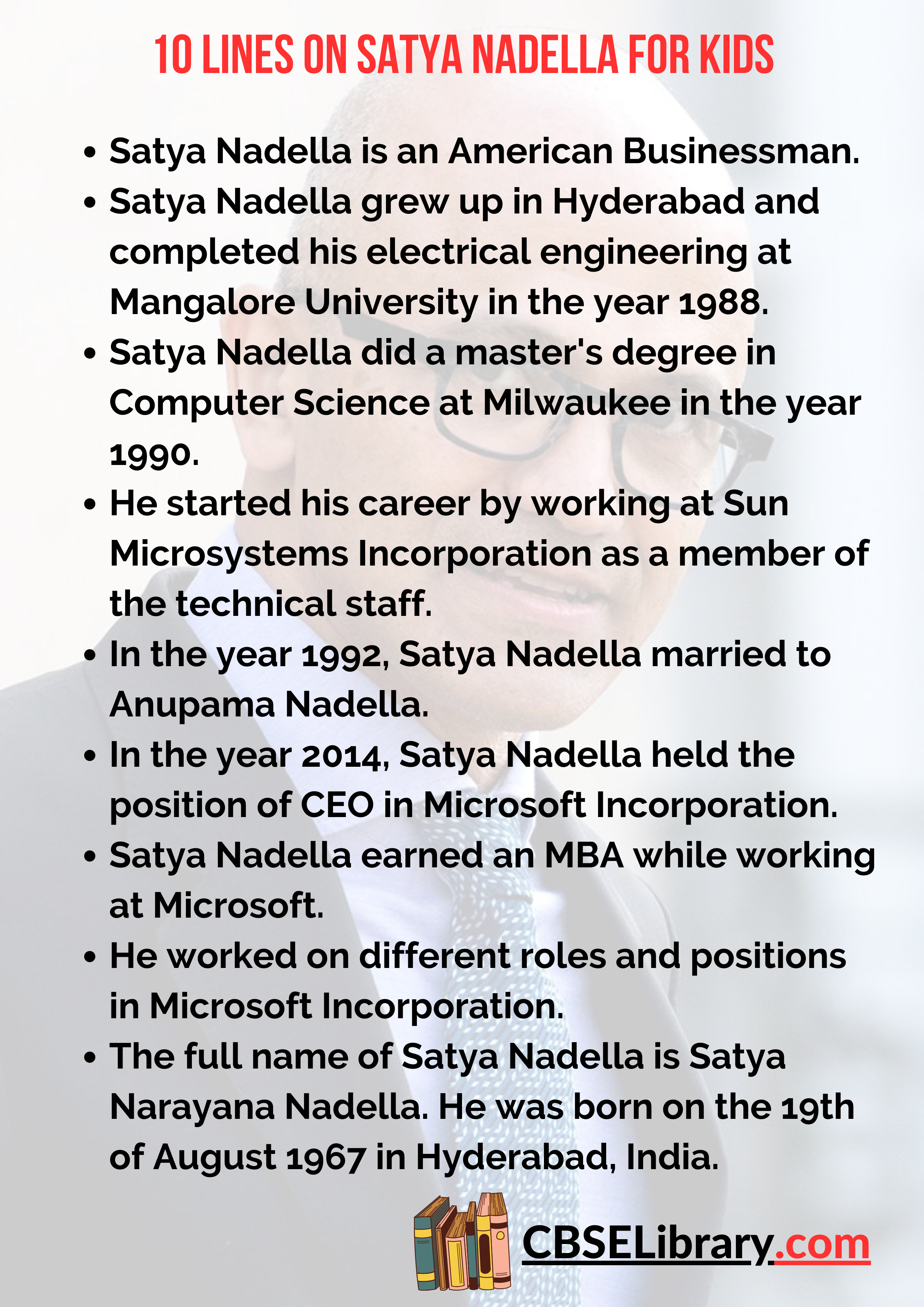

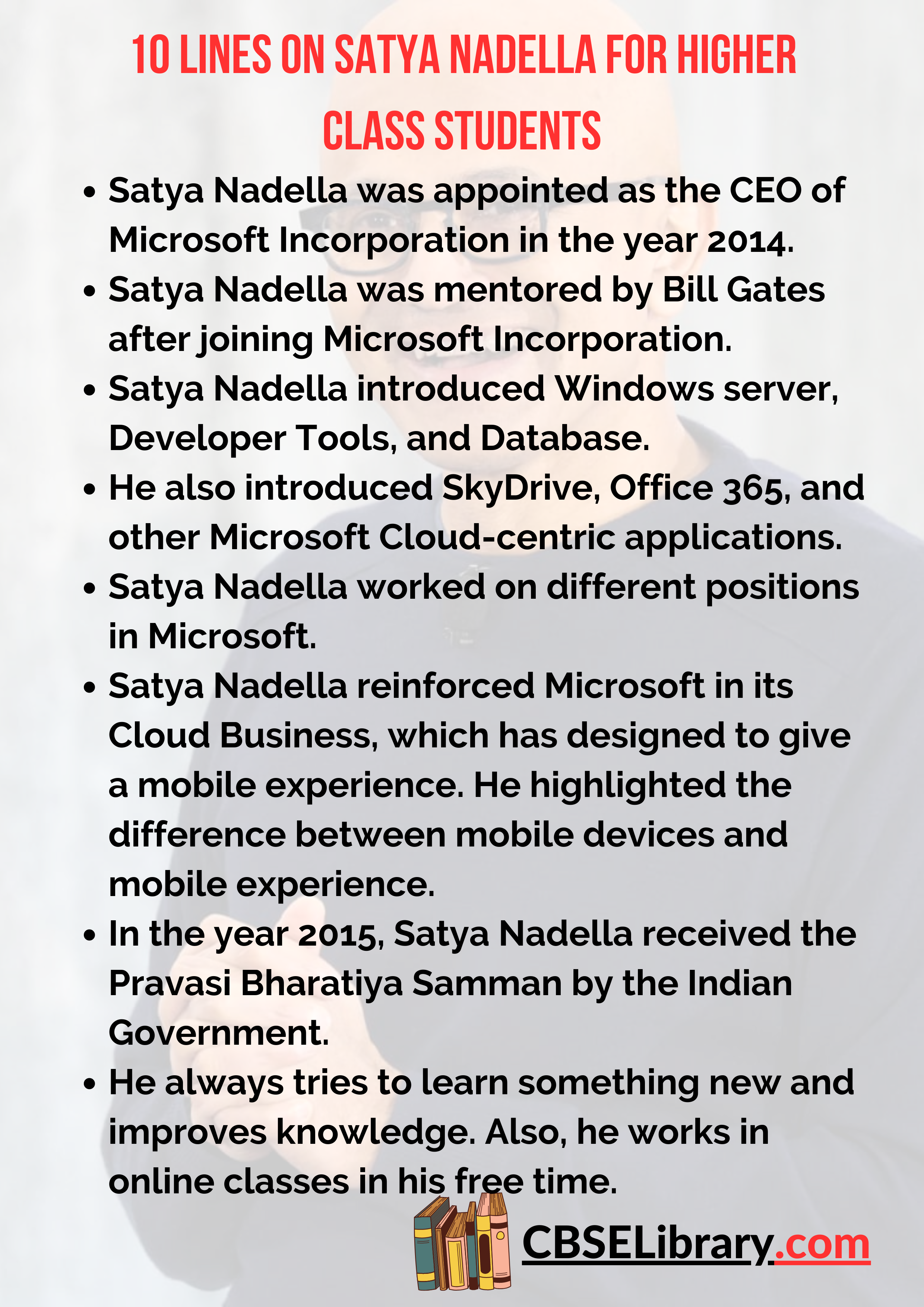

- Indira Gandhi was the first and the only female Prime Minister of India

- Indira Gandhi was the daughter of first Prime Minister of India, Pandit Jawaharlal Nehru

- Indira Gandhi was born in Uttar Pradesh on 19th November 1917.

- She became the first female Prime Minister of India in the year 1966.

- Her elevation to the top position gave inspiration to lakhs of women across the world to break gender stereotypes.

- She declared an emergency in the year 1977.

- Indira Gandhi was assassinated due to anti-Sikh sentiments across the country in the year 1984.

- Indira Gandhi was responsible for the complete nationalisation of banks in India.

- She is popularly known for her bold and brave decision during her first and second term as Prime Mister of India.

- Indira Gandhi gave a facelift for the feminist and women empowerment movements across the world.

FAQ’s on Indira Gandhi Essay

Question 1.

Who was Indira Gandhi?

Answer:

Indira Gandhi was the first female Prime minister of India. She was also the daughter of the first Prime minister of India Pandit Jawaharlal Nehru

Question 2.

How was Indira Gandhi killed?

Answer:

Indira Gandhi was shot dead by her Sikh bodyguards in the year 1984 after the completion of Operation Bluestar

Question 3.

Was Indira Gandhi related to Mahatma Gandhi?

Answer:

No, Indira Gandhi was not related to Mahatma Gandhi. Her husband Feroz Gandhi took the name of the father of the nation after being inspired by his freedom movement.

Question 4.

Why did Indira Gandhi declare an emergency?

Answer:

Indira Gandhi declared an emergency in 1977 to keep law and order in the country stable because of the massive protests and riots instigated by the opposition party