HDFC Bank NOC Letter: A NOC is a legal document that you receive after the closure of a loan account or in simple words when a person pays their loan in full. This means that the borrower has no outstanding amount toward the lender. Once the lender gives NOC to the borrower they have no right over the collateral. It also means that there are no future legal consequences from your debt. The NOC letter can only be issued by the Lender only. The lender could be any agency, organization, institute, or even an individual in a few cases.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

- What are the Different Charges of NOC?

- Steps To Get NOC Letter from HDFC Bank

- How to Get Original NOC?

- How to get a Duplicate NOC Online?

- How to get a Duplicate NOC Offline?

- Things To Know Related to NOC

- Documents Required To Apply For A NOC

- Importance of NOC

- Details Mentioned in the Form to Apply for NOC

- FAQ’s on HDFC Bank NOC Letter

What are the Different Charges of NOC?

| Different types of NOC | Charges Of NOC |

| Original NOC | No charges – NIL |

| Duplicate NOC | INR 500 + taxes per request |

| Special NOC | INR 500 + taxes |

Steps To Get NOC Letter from HDFC Bank

A NOC is obtained by the bank after the settlement of a loan, which means that there is no outstanding amount that needs to be settled. A NOC is needed against all different types of Loans be it car loans, personal loans, house loans, two-wheeler loans, etc.

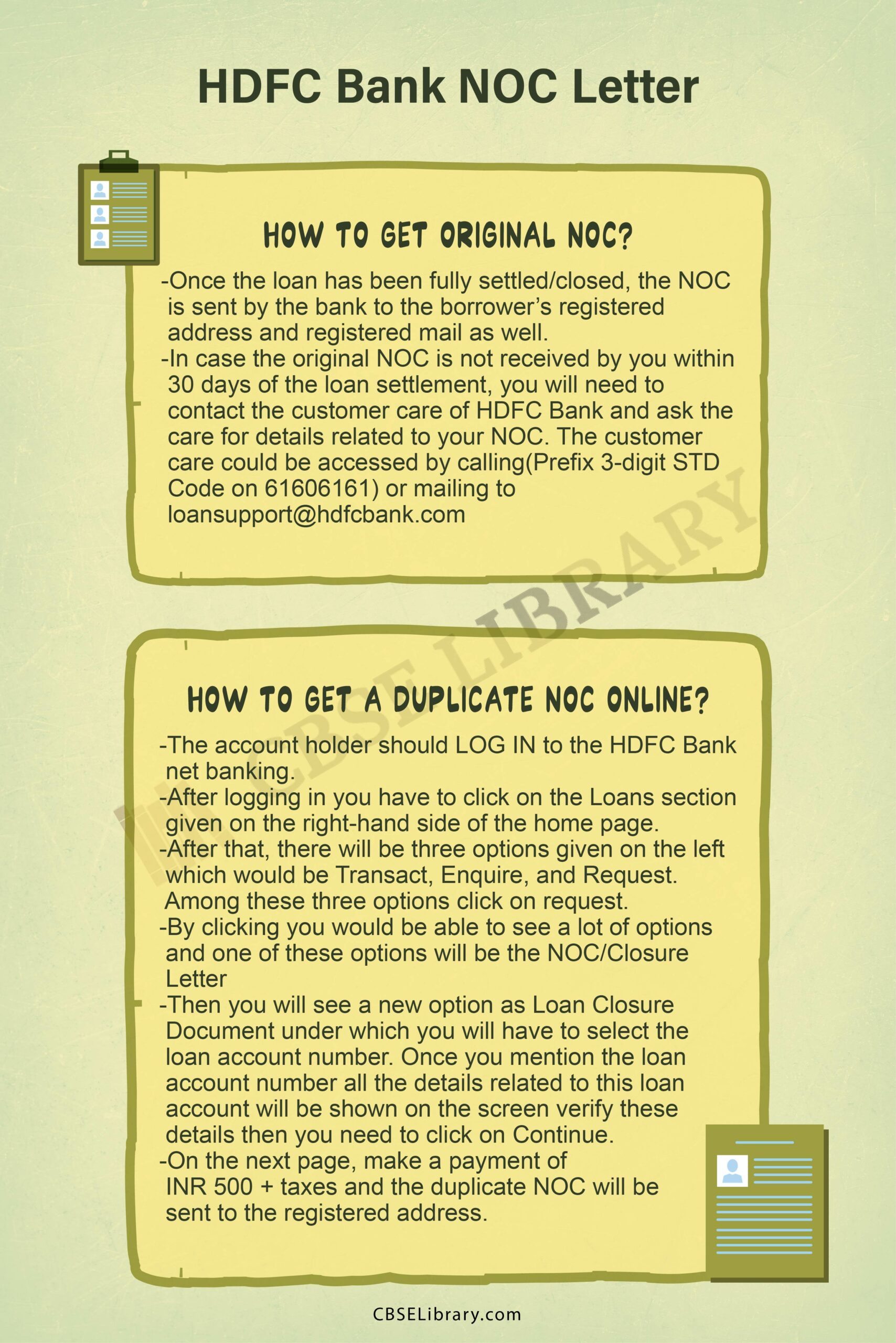

How to Get Original NOC?

- Once the loan has been fully settled/closed, the NOC is sent by the bank to the borrower’s registered address and registered mail as well.

- In case the original NOC is not received by you within 30 days of the loan settlement, you will need to contact the customer care of HDFC Bank and ask the care for details related to your NOC. The customer care could be accessed by calling(Prefix 3-digit STD Code on 61606161) or mailing to [email protected]

How to get a Duplicate NOC Online?

These are a few steps to follow to apply for a duplicate NOC

- Step 1: The account holder should LOG IN to the HDFC Bank net banking.

- Step 2: After logging in you have to click on the Loans section given on the right-hand side of the home page.

- Step 3: After that, there will be three options given on the left which would be Transact, Enquire, and Request. Among these three options click on request.

- Step 4: By clicking you would be able to see a lot of options and one of these options will be the NOC/Closure Letter

- Step 5: Then you will see a new option as Loan Closure Document under which you will have to select the loan account number. Once you mention the loan account number all the details related to this loan account will be shown on the screen verify these details then you need to click on Continue.

- Step 6: On the next page, make a payment of INR 500 + taxes and the duplicate NOC will be sent to the registered address.

How to get a Duplicate NOC Offline?

- Visit any HDFC Bank branch with all the necessary documents – PAN Card, Aadhaar Card or Voter Card, RC copy (in case of vehicle loan), an authorization letter(in case of the third party).

- Fill “Request Form” for a duplicate NOC

- Submit the required documents in the original and self-attested copy.

- After verification of documents and loan closure status, pay a fee for a duplicate copy of NOC (INR 500 + taxes)

Things To Know Related to NOC

They are as follows;

- In the case of a house loan, the NOC must bear the relevant information related to the property like the address of the house, the name of the customer, and also the loan account number also a copy of this NOC needs to be submitted to the registrar of properties to get the lien of hypothecation struck off failure to which means that the lender is still the owner of that property and the borrower cannot sell this property without doing so. Also in case of insurance claims the money would be paid to the lender only.

- The first NOC is provided free of cost to the borrower but if you misplace it and you need a duplicate NOC you will have to pay an additional amount for the same.

- Also if you misplace the NOC you will have to file an FIR and a copy of this complaint you will need to submit to the bank along with other loan details to get a duplicate NOC.

- The amount of NOC charges varies on the basis of loan type.

Documents Required To Apply For A NOC

The documents required are as follows;

- Customer details and related documents – PAN Card, Aadhaar Card, etc

- Details related to the loan- loan amount, loan account number, duration of the loan, etc.

- The name of the person on whose name the NOC should be issued.

Importance of NOC

Before discussing the steps to get NOC one should understand the need for it

- The lender would have no right over the collateral.

- It also helps in improving your credit score which is helpful in getting a loan in the future.

- A borrower can finally sell the collateral property after getting the NOC.

- It helps in the settlement of insurance claims.

Details Mentioned in the Form to Apply for NOC

- Date on the day of applying.

- Loan A/C number

- In the name of (Name of the customer)

- In case of Vehicle Loan- Make and Model, Engine number, Registration number, chassis number.

- Purpose of NOC(need to select the most appropriate option)

- Documents which need to be attached with the application

- Personal details – Mobile number, Phone number, email id, etc

- Name and Signature of the Customer

FAQ’s on HDFC Bank NOC Letter

Question 1.

How long does it take to get a No Objection Certificate from HDFC?

Answer:

Form-35 is sent by post along with the loan closure letter for all the eligible loan accounts within a maximum of 15 working days.

Question 2.

Is NOC and Form 35 the same?

Answer:

As evidence for inactive hypothecation, the lender will normally give NOC and Form 35 (Notice of Termination of an Agreement of Hire-Purchase/Lease/Hypothecation). The NOC must be submitted to the RTO within 3 months past the date of issuance.

Question 3.

How can I get NOC from HDFC mobile app?

Answer:

After paying all the installments, ask your bank for a no-objection certificate (NOC). This document will state that there is no outstanding amount on this account number. The bank will send the NOC to you by post within 15 working days. The customers of HDFC Bank can also get the NOC on NetBanking through the website and also via the mobile app.

Question 4.

What is the hypothecation charge?

Answer:

It refers to a charge initiated on any portable property wherein the borrower has possession of the possessions but the creditor has the right to implement and take control and ownership of this property in case of a default by the borrower.

Question 5.

What is a NOC?

Answer:

A NOC stands for no objection certificate which is a legal document provided after the settlement of a loan account. It is provided by the lender to the borrower.