Nifty beES Advantages and Disadvantages: Nifty BeES (Benchmark Exchange Traded Scheme)—the initial exchange-traded account (ETF) in India—seeks to deliver interest repays that approximately conform to the amount recoveries of insurances as exemplified by the S&P CNX Nifty Index. Nifty BeES, a variety of interest and common account departments, trade on the equity market component of NSE (National Stock Exchange). Each Nifty BeES unit is 1/10th of the S&P CNX Nifty Index significance.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What are Nifty beES? What are the advantages and disadvantages of a Nifty beES?

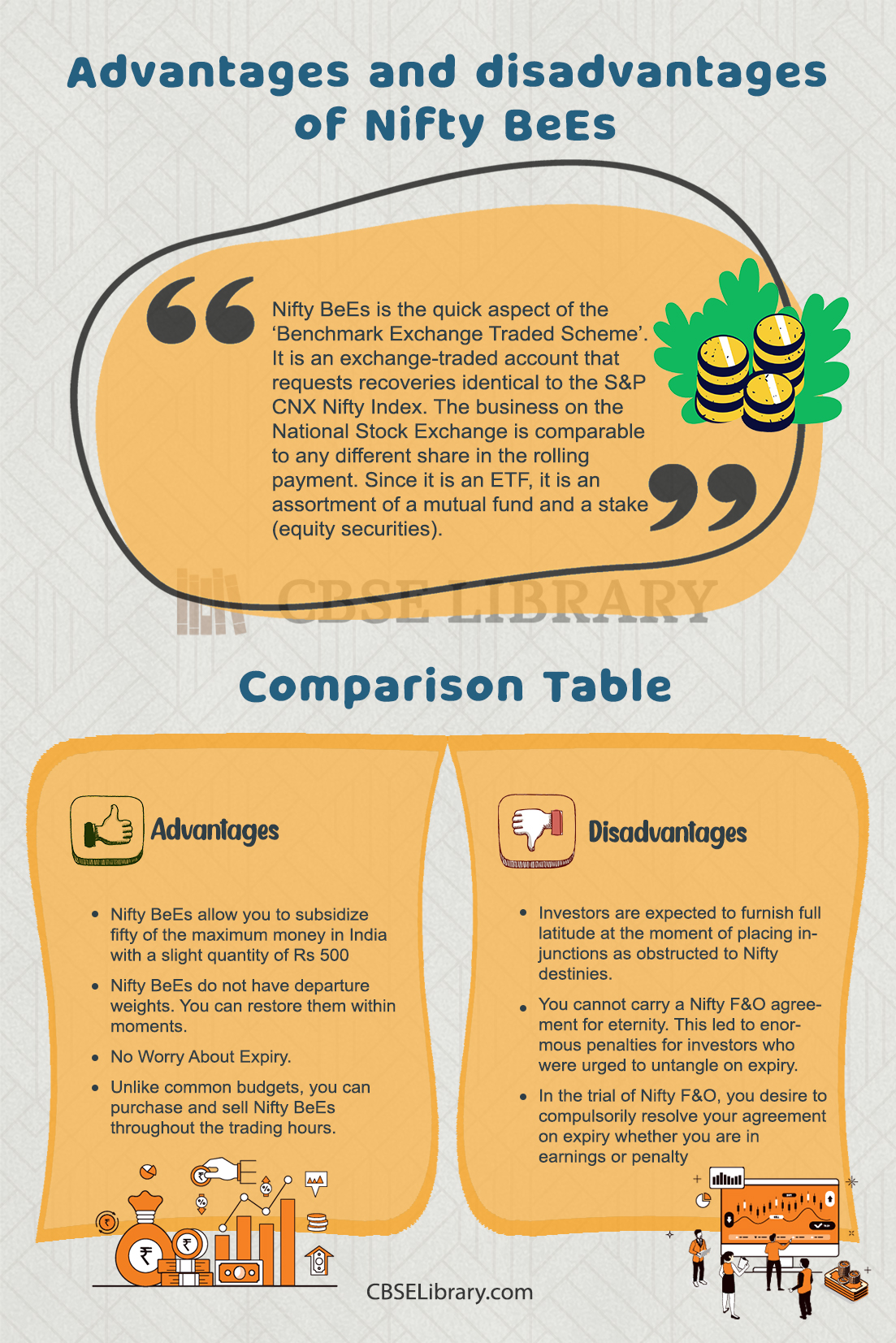

Nifty BeEs is the quick aspect of the ‘Benchmark Exchange Traded Scheme’. It is an exchange-traded account that requests recoveries identical to the S&P CNX Nifty Index. The business on the National Stock Exchange is comparable to any different share in the rolling payment. Since it is an ETF, it is an assortment of a mutual fund and a stake (equity securities).

- Advantages of Nifty BeEs

- Disadvantages of Nifty BeEs

- Comparison Table for Advantages and disadvantages of Nifty BeEs

- FAQ’s on Nifty beES Advantages and Disadvantages

Objectives of Nifty beES

- The Prime Purpose of the Nifty BeEs is very watery as they exchange on the money demand. One can also position insufficient decrees for these ETFs. Heretofore Nifty BeEs interpret the S&P CNX Nifty Index, and the investor is educated about the portfolio at all moments. Also, underwriting in Nifty Bees ETF gives diversification as the investor can subsidize 50 various corporations by buying just one department.

- Nifty Bee is an ETF and hence requests diversification for investors. The common account invests in 50 different corporations, and accordingly, when investors buy one department of an ETF, they give instant diversification and hence circulate the danger. Also, donating to Nifty BeEs is very reasonable as the payments are curbed to 0.8%.

- The interested purpose of Nifty BeES is to furnish interest refunds that, before payments, almost correspond to the full rescues of insurances as affected by the S&P CNX Nifty Index

Benefits of Nifty beES

There are numerous windfalls of Nifty Bees:-

- Simple and Economical: Peddling and selling of NiftyBeES are as easy as property insurance trading. One can acquire and sell through any NSE aerodrome at the existing demand taxes. The underlying portfolio of Nifty BeES nearly duplicates the S&P CNX Nifty. The NiftyBeES scheme is a no-load strategy. In additional messages, the aggregate expenditures, encompassing the supervision payments, are not more than 0.80% of the Daily Average Net Assets.

- Convenience and Liquidity: The NiftyBeES is documented and exchanged on the capital demand (NSE). Therefore, one can buy it during marketing hours in a day. Investors can respond to a chance quickly and niche restricted injunctions. One can clasp their Nifty BeES interests in their DP report along with other portfolio holdings.

- Neutral and Transparent: There is no budget manager predisposition for this ETF. In different messages, the achievement of these funds is sure of on the S&P CNX Nifty Index and the demand and allowance in the demand. And not on the account manager’s exploration and examination. Since the Nifty BeES copies the S&P CNX Nifty, the department owners can realize where and how much is subsidized in a percentage at any provided moment

- Diversification and Equitable Structure: Allotting in one department of the common account gives disclosure to fifty percent of S&P CNX Nifty. Accordingly, offering a reasonable sweep of threat and diversification. Nifty BeES has an extraordinary “in-kind” device for buying and selling by marketing a pre-defined portfolio. Through this long-term, investors do not survive the tax of short-term trading, unlike other open-ended mutual funds. In other phrases, it separates the long-term investors from short-term trading action.

How to Invest in Nifty beES?

- One can invest in Nifty BeES through their trading and Demat account. Just like purchasing equity securities (stock), one can buy Nifty BeES.

- Unitholders can buy and sell anytime during the trading day at the prevailing market prices. Furthermore, these transactions attract some brokerage fees similar to that of buying equity securities.

- One can invest in Nifty BeES either through the lump sum or systematic investment plan route. For lump-sum investing, the investors have to buy the units at a real-time price.

- Lump-Sum investing is often preferable when markets are corrected cyclically. While for SIP investing, investors can pick a date and start their monthly installments.

Advantages of Nifty BeEs

There are many advantages of Nifty beES:-

- Low-cost investment: Nifty BeES is a very economical investment avenue. While it gives you a diversified portfolio like mutual funds, the expenses involved are meager.

- Ease of buying: Since Nifty BeES is listed on the stock exchange, it is available to all investors. With a Demat account, one can purchase the scheme in real-time. The minimum investment is Rs.500. There is no maximum limit to the investment which makes Nifty BeES suitable for small and large investors alike.

- Transparent for investors: Nifty BeES imitates the Nifty 50 index. There is no prejudice or bias exercised by the fund manager when allocating the portfolio. The portfolio allocation also matches the benchmark index, making the scheme completely transparent for investors.

- Inflation-adjusted returns: The stock market is interlinked to the economy. Hence, economic inflation is considered in the movement of the stock market. As such, the returns that one gets from Nifty BeES are inflation-adjusted and relevant for long-term needs.

- Liquidity: There is no lock-in period or maturity tenure under Nifty BeES. You can exit from the scheme and redeem your investment at your discretion. No exit load is applicable on redemption, and you can sell off your units in real-time on the stock exchange.

Disadvantages of Nifty BeEs

There are some drawbacks of Nifty beES-

- Risk: Nifty Bee is an equity-oriented procedure. As such, it is endangered by volatility threats. You should have the enthusiasm to assume the danger if you donate to the technique. Tremors at Shorter Velocities.

- Error: Though the procedure follows the S&P CNX Nifty Index, the retrievals might not conform due to the prospect of a search misconception.

- Less Diversification: For some localities or unfamiliar products, investors might be limited to large-cap merchandise due to a slight fraction of equities in the demand index. A lack of orientation to mid-and small-cap organizations could leave conceivable improvement alternatives out of the measure of investors.

- Costs Could Be Higher: Most species relate trading ETFs with trading other reserves, but if you relate ETFs to financing a special product, then the expenses are higher. The virtual delegation expended to the vendor might be the equivalent, but there is no administration expense for the money.

Comparison Table for Advantages and disadvantages of Nifty BeEs

| Advantages | Disadvantages |

| Nifty BeEs allow you to subsidize fifty of the maximum money in India with a slight quantity of Rs 500 | Investors are expected to furnish full latitude at the moment of placing injunctions as obstructed to Nifty destinies. |

| In Nifty Bees, the budget manager does not fluctuate from Nifty’s portfolio allowance. This way investors are conscious of where their wealth is subsidized | In the trial of Nifty F&O, you desire to compulsorily resolve your agreement on expiry whether you are in earnings or penalty |

| Nifty BeEs do not have departure weights. You can restore them within moments. | You cannot carry a Nifty F&O agreement for eternity. This led to enormous penalties for investors who were urged to untangle on expiry. |

| No Worry About Expiry. | As per SEBI’s latest guidelines to evaluate risk classes, involvement in the Nippon India ETF Nifty BeES appears under the Very High-risk classification. |

| Unlike common budgets, you can purchase and sell Nifty BeEs throughout the trading hours. | It expects full perimeter i.e. the total significance of the contract at the time of positioning decrees. Whereas a nifty prospect requires as low as a 10% perimeter provision of the entire agreement significance. |

FAQ’s on Nifty beES Advantages and Disadvantages

Question 1.

What are Nifty beES?

Answer:

Nifty BeES is an exchange-traded budget that duplicates the S&P CNX Nifty Index. It is the initial ETF submitted by the standard in 2002 January. It exchanges on the National Stock Exchange and hence can be purchased or peddled in dematerialized setup only.

Question 2.

should I subsidize Nifty beES?

Answer:

The Nifty BeEs is a useful enterprise automobile that can not only furnish elevated rescues than most common accounts can but also keep up with the demand itself.

Question 3.

Are Nifty beES safe?

Answer:

Nifty BeES is a measure exchange-traded account that subsidizes 50 several companies of the S&P CNX Nifty. Since the common budget invests in properties, it is a volatile interest. Moreover, the firms in which Nifty BeES invests are vast and permanent. These firms have a strong path certificate. Therefore, the accomplishment of Nifty BeES is pendant on the percentage of CNX Nifty.

Question 4.

Do Nifty beES give dividends?

Answer:

The dividend is paid to the unitholder after deducting the applicable taxes at the source. The dividend is typically distributed within 30 days from the date of declaration of the dividend.