ATM Advantages And Disadvantages: Gone are the days when you used to stand in a long queue and wait for your turn to deposit or withdraw money. Sometimes, you used to get late to the bank, or sometimes tokens for withdrawal money were at the brim for all banking customers to avail of the banking services. Now, that wait is over because an automated teller machine or ATM has come your way. Instead of waiting for your turn to come, you can go to the ATM and withdraw/deposit your desired amount anywhere, anytime in India.

However, you are aware that nothing is perfect in this world, if there is an advantage, there will be a few disadvantages too. Many disadvantages have been given to ATMs as well. So, today, on this page, we will have a look at some of the advantages and disadvantages of ATMs.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is ATM? Advantages and Disadvantages of ATM

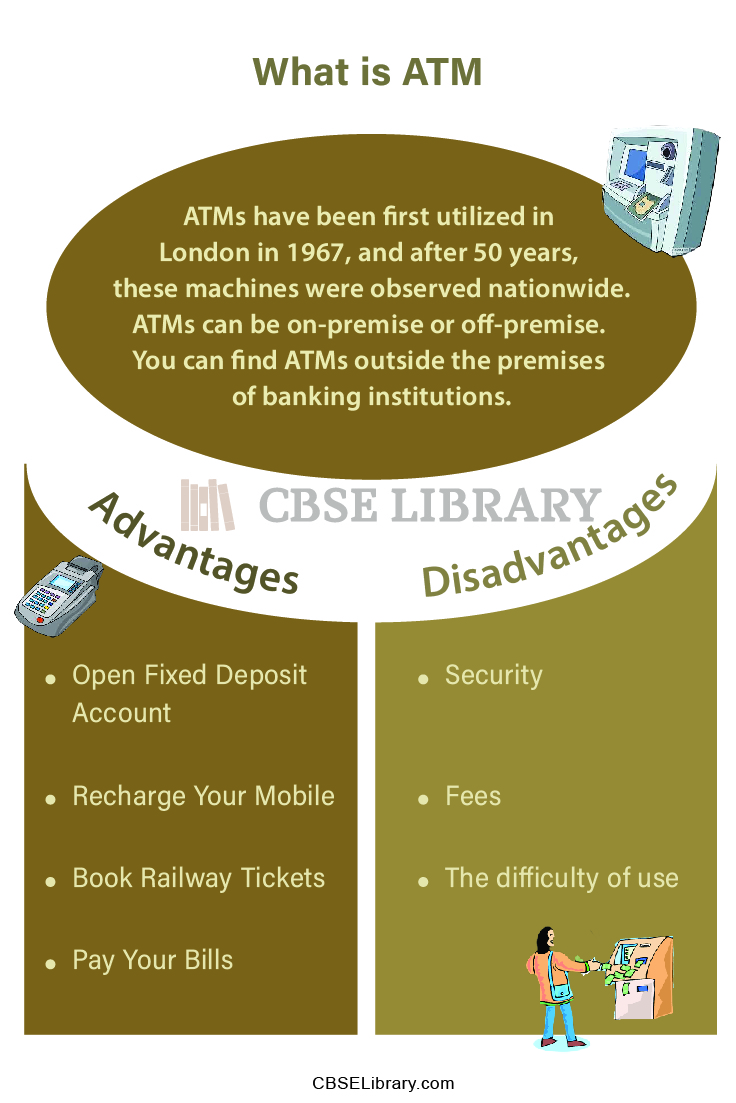

ATMs have been first utilized in London in 1967, and after 50 years, these machines were observed nationwide.

ATMs can be on-premise or off-premise. You can find ATMs outside the premises of banking institutions. Clients experience greater choice, convenience, and availability, whilst banks can improve their sales from transactions, reduce operational costs and maximize groups of workers’ resources.

Off-premise ATMs are generally located in locations along with airports, grocery and convenience stores, and buying facilities in which there may be a comfy need for cash.

ATMs are simple data terminals with four outputs and printing devices. They must hook up with a host of processors and communicate through it. The host processor works like an Internet Service Provider (ISP), a portal through which all of the diverse networks of ATMs end up handy to the bank account holder with both a credit card and debit card.

- Advantages of ATM

- Disadvantages of ATMs

- Comparison Table for Advantages and Disadvantages of ATM

- FAQ’s on ATM Advantages And Disadvantages

Advantages of ATM

- Open Fixed Deposit Account: You can easily open a fixed deposit with your bank by using an ATM. All you need to do is, just select ‘Open Fixed Deposit’ on the ATM menu, select the duration for which you want to open an account, enter the amount and confirm the other required details.

- Recharge Your Mobile: ATMs do provide prepaid services through which you can recharge your or your friends’ mobile, just click on the ‘Mobile Recharge’ option, enter the mobile number and confirm the details.

- Book Railway Tickets: PSBs like SBI and PNB, among others, provide you the facility to select locations on railway premises. So far, only long-distance reserved tickets are issued this way.

- Pay Your Bills: Now, it is easy to pay your utility bills like your phone bill, electricity bill, and gas bill through ATMs. All you need to do is, just register the biller on the bank’s website before you make the payments.

Disadvantages of ATMs

Though ATMs provide advantages, it comes with some disadvantages as well. Now, let us go through some of the disadvantages of ATMs:

- Security: Deposit/withdrawal at branch visits is secure as bank representatives confirm your identity, while at ATMs, it is just the reverse for a person performing the transaction. So, the person inserting a bank card and personal identification number doesn’t assure his/her identity. Like if the bank card is stolen and the number ascertained, an unauthorized person may breach the details of an account holder.

- Fees – Visit the branch doesn’t take a penny from your pocket, however, the atm’s service asks you for months if the transactions are beyond the limit. For example, new RBI rules as of January 1, 2022, n ATM transaction charge rate beyond the free limit of Rs. 20 + taxes was revised to Rs. 21 + taxes.

- The difficulty of use: The performance of the business at an ATM is faster compared to that of a human teller. However, while providing personalized instruction to the user, ATMs lack speed as compared to a human teller. This can result in longer waiting in a queue currently, which signifies that using the machine is struggling to complete a transaction.

Comparison Table for Advantages and Disadvantages of ATM

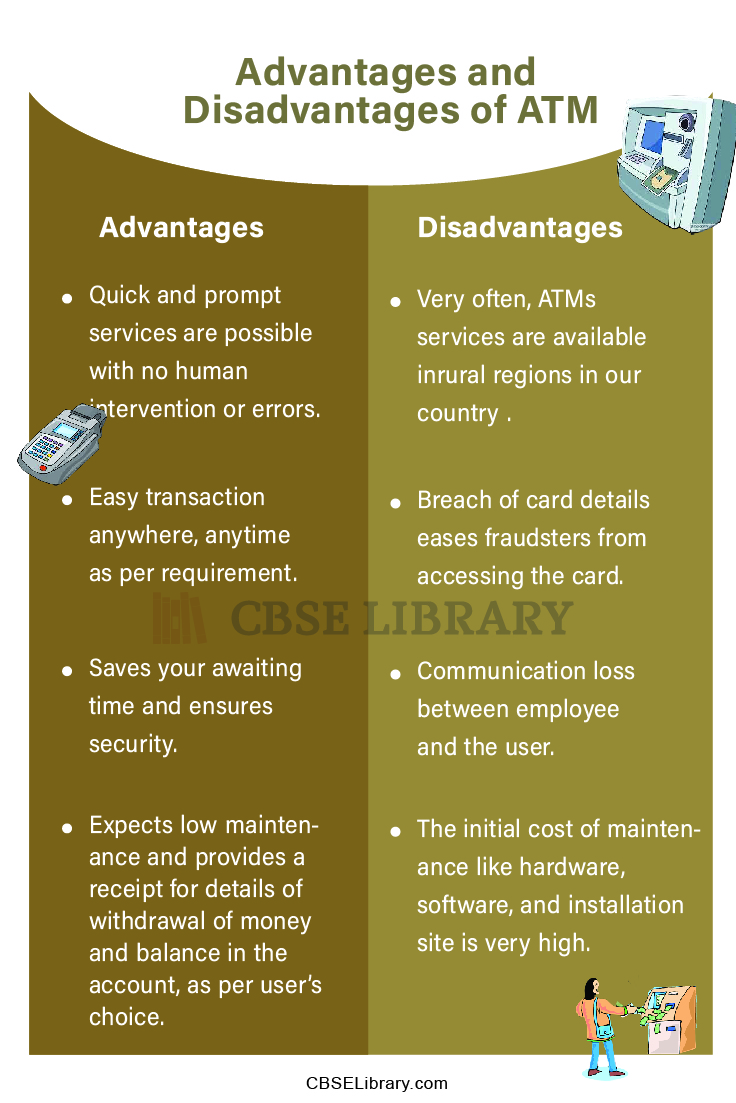

| Quick and prompt services are possible with no human intervention or errors. | Very often, ATMs services are available in rural regions in our country whereas bCSLA’s are available in the villages. |

| Convenient for travelers. | Many people still don’t know to use it and hesitate to operate the machine because of fear of losing the amount. |

| Provides 24 hrs services and reduces the workload on bank staff. | Bery often, due to lack of enough amount, the transaction gets halt and again customers have to visit the branch, which is additional wastage of time. |

| Easy transaction anywhere, anytime as per requirement. | Breach of card details eases fraudsters from accessing the card. |

| Saves your awaiting time and ensures security. | Communication loss between employee and the user. |

| Expects low maintenance and provides a receipt for details of withdrawal of money and balance in the account, as per user’s choice. | The initial cost of maintenance like hardware, software, and installation site is very high. |

FAQs on ATM Advantages And Disadvantages

Question 1.

What is ATM all about?

Answer:

An ATM is an esoteric computer that makes it easier to manage a bank account holder’s funds. Instead of waiting long at a bank in a queue, you can visit atm anytime anywhere to check account balances, withdraw or deposit money, print a statement of account activities or transactions, and even purchase stamps.

Question 2.

When did the ATM become popular?

Answer:

By the 1980s, money transactions via ATMs were5 easy, as these machines could handle many of the functions that were earlier performed by human tellers, such as check deposits and money transfers between accounts. Today, ATMs are as crucial for everyone just like cell phones and e-mail. For example, it was reckoned that in the fiscal year 2022, a total of 7,422 crore digital payment transactions were recorded, and this data was revealed by the government of India.

Above all, the value of digital payments in India is expected to grow three-fold to touch around $1 trillion in the next four years, as per CSLA’s (Corporate Finance & Capital Markets and Asset Management services) reckoning.

Question 3.

Who invented the ATM in India?

Answer:

It is recorded that in a hospital in Meghalaya, the ATM inventor John Adrian Shepherd-Barron got an automated teller machine.