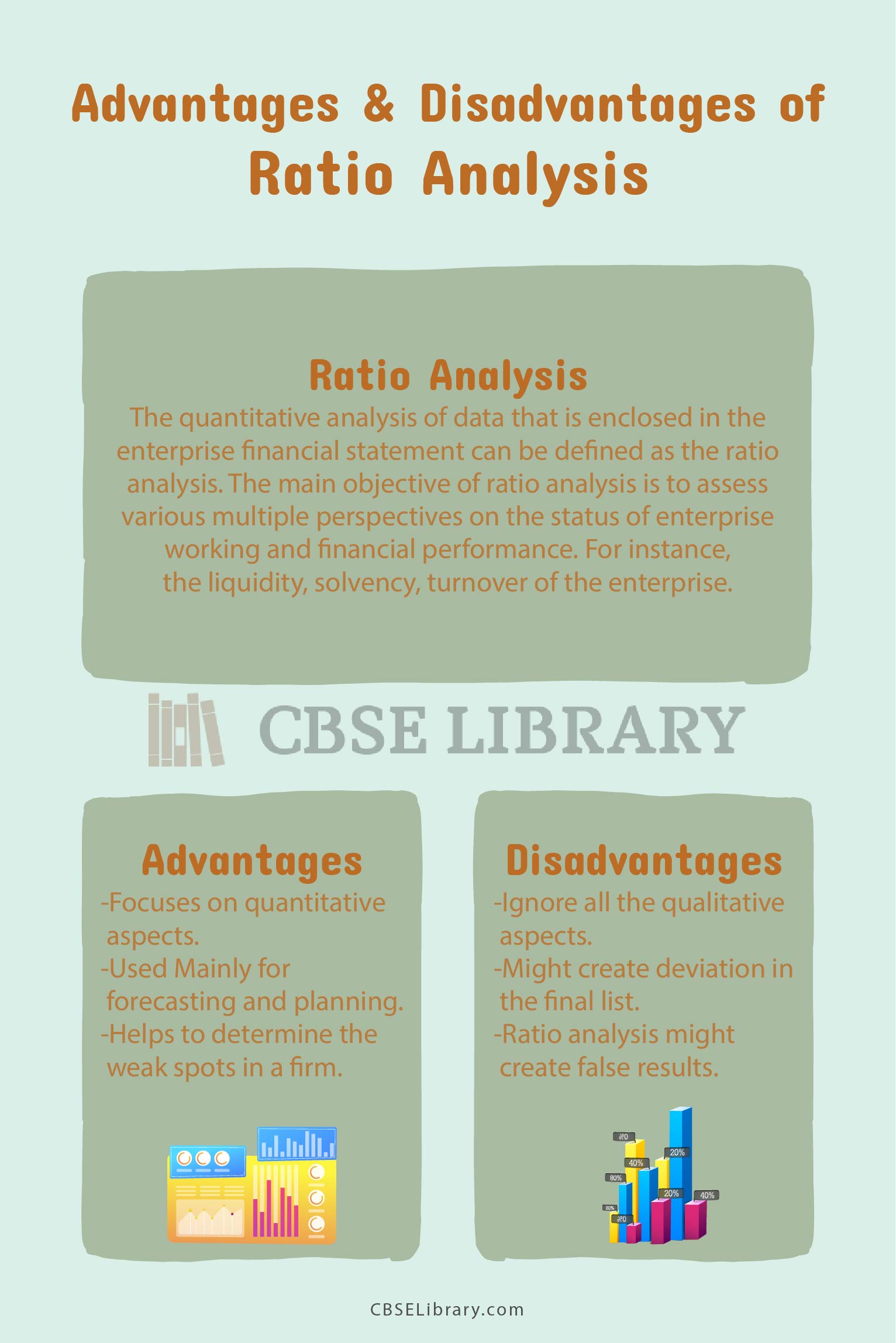

Advantages And Disadvantages Of Ratio Analysis: The quantitative analysis of data that is enclosed in the enterprise financial statement can be defined as the ratio analysis. The main objective of ratio analysis is to assess various multiple perspectives on the status of enterprise working and financial performance. For instance, the liquidity, solvency, and turnover of the enterprise. We can also say that ratio analysis is the method of analyzing and comparing financial data by computing meaningful statements and value percentages rather than using the line items of financial statements.

The ratio analysis is mainly useful for the analysts acting outside the business as their primary source of information about an enterprise is the financial statement. The corporate insiders generally have the access to all the operational information about the organization or company, hence ratio analysis is less useful to the corporate insiders.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Ratio Analysis? Advantages and Disadvantages of Ratio Analysis 2022

As mentioned above, ratio analysis is the method of analyzing and comparing financial data by computing meaningful statements and value percentages rather than using the line items of financial statements. The concept of ratio analysis can be broadly classified into six silos. They are liquidity ratio, solvency ratio, profitable ratio, efficiency ratio, coverage ratio, and market prospect ratio.

The company or enterprise can pay off the short-term debt, this ability is known as the liquidity ratio. This ratio includes the current ratio, working ratio, and capital ratio. A type of ratio that compares the company’s debt with its asset, earnings, and equity to determine the likelihood of the company staying at a long haul can be defined as the solvency ratio. It is also known as the leverage ratio.

Now, the ratio that conveys a message that how well a company can earn profit by their operation is known as the profitability ratio. Gross margin, profit margin, return on investment, and so on are examples of profitability ratios. A ratio that analyses how efficiently the company can use its assets and liability to maximize its profits is known as the efficiency ratio, also known as the activity ratio. The most commonly used ratio to analyze the fundamental basis of the enterprise is known as the market prospect ratio.

To recall, the quantitative analysis of data that is enclosed in the enterprise financial statement can be defined as the ratio analysis. It has its own merits and demerits in ratio analysis. The following points mentioned below analyze their advantages in detail.

- Advantages of Ratio Analysis

- Disadvantages of Ratio Analysis

- Comparison Table for Advantages And Disadvantages Of Ratio Analysis

- FAQ’s on Advantages And Disadvantages Of Ratio Analysis

Advantages of Ratio Analysis

Some advantages of ratio analysis are as follows:

- Analyzing the Financial Position: Ratio analysis is considered an important tool that can be used to analyze the financial position of an organization or enterprise. The evaluation of the financial position can determine the true financial conditions of the owners, creditors, bankers, and investors of the organization.

- Used for Planning and Forecasting: The ratio analysis can be used to determine the trends in various important prospects of an organization such as profit, cost, and sales. It is used to calculate relevant accounting data with the help of last year’s financial statements and data.

- Helps in Simplifying the accounting information: By computing accounting ratios, it simplifies the whole information that is contained within the financial statement of the organization. It makes understanding the financial data easy for investors and managers.

- Locating the Weak spots of a Company: Ratio analysis plays a major role in locating the weak spots of a company. This is done easily with the help of financial statements. These statements analyze every aspect of the business and deliver it to the respective management.

- Comparison between various firms: A firm can be broadly classified into two types; inter-firm and intra firm. Ratio analysis calculates the financial statements that can be used to compare the performance of different firms. It is also used to determine the difference between an efficient and non or in-efficient firm.

Disadvantages of Ratio Analysis

The following points mentioned below analyze the disadvantages of ratio analysis.

- False Results: We are aware of the fact that all the data are evaluated from the financial statements. But, the statements can lead to misleading or false results. The data present in a financial statement may be incorrect and can contain various figures that affect the ratio analysis.

- Use of Historical Information: The information that is used to compute the ratios is based on historical and past figures. These figures do not include the current situation and are based on past conditions. Thus, the ratio analysis prepared may be incorrect.

- Do not focus on the qualitative aspect: Ratio analysis mainly focuses on the quantitative aspect of the organization and ignores all the qualitative aspects of the firm. It is important to focus on the qualitative aspect as they play a vital role in the functioning of the organization.

- Deviation in the Final Result: In ratio analysis, there is no fixed standardized concept that is established to compute all the ratios and data. This leads to creating a deviation in the final result.

- Ignore all the price changes: The price level changes are not included in the financial statements of the company as it is prepared to present periodically. Hence, the ratio analysis ignores all the changes in the price.

Comparison Table for Advantages And Disadvantages Of Ratio Analysis

| Focuses on quantitative aspects. | Ignore all the qualitative aspects. |

| Used Mainly for forecasting and planning. | Might create deviation in the final list. |

| Helps to determine the weak spots in a firm. | Ratio analysis might create false results. |

FAQ’s on Advantages And Disadvantages Of Ratio Analysis

Question 1.

What do you mean by Ratio Analysis? Mention their types.

Answer:

Ratio analysis is the method of analyzing and comparing financial data by computing meaningful statements and value percentages rather than using the line items of financial statements. It is classified into six types. They are liquidity ratio, solvency ratio, profitable ratio, efficiency ratio, coverage ratio, and market prospect ratio.

Question 2.

What do you mean by Liquidity Ratio?

Answer:

The company or enterprise can pay off the short-term debt, this ability is known as the liquidity ratio.

Question 3.

Mention some disadvantages of Ratio Analysis.

Answer:

The concept of ratio analysis comprises both merits and demerits. Some disadvantages of ratio analysis are, it may lead to false results, based on historical facts and so on.