Advantages And Disadvantages Of Credit Rating: According to The Economic Times, “Credit rating is an analysis of the credit risk associated with a financial instrument or a financial entity.” It is completely based on the credential as well as the financial status of the entity done in terms of lending and borrowing. In America, TransUnion, Experian and Equifax are the three major credit reporting agencies. Credit rating can not be a static number rather it remains dynamic based on new information which is provided by financial institutions. If anyone misses a payment and then tries to apply for new credit at that point, the information gets forwarded to credit reporting agencies. One can have high as well as low credit scores based on their previous payment history. There are different credit rating scales from (AAA-D) to represent the risk and company’s creditworthiness. For example, AAA refers to the lowest or no credit risk. AA denotes a very good credit rating, A refers to low credit risk, BBB refers to average credit risk, B is high credit risk or low credit rating, C denotes very poor credit rating and D is considered as Defaulted. The company’s future potential should be based on current performances, profit-making projects and the ability to pay the debt.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is a Credit Rating? What are the advantages and disadvantages of Credit Rating?

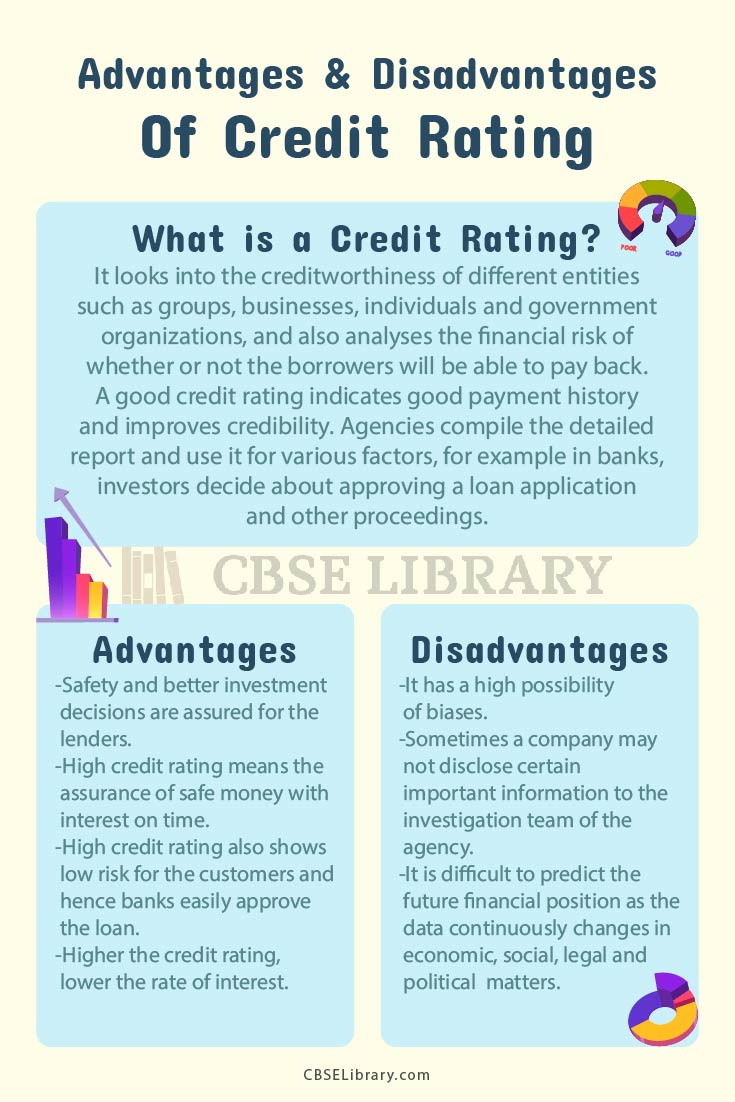

It looks into the creditworthiness of different entities such as groups, businesses, individuals and government organizations, and also analyses the financial risk of whether or not the borrowers will be able to pay back. A good credit rating indicates good payment history and improves credibility. Agencies compile the detailed report and use it for various factors, for example in banks, investors decide about approving a loan application and other proceedings. There are differences between credit rating and credit score, credit rating determines whether an entity can make payments on time or not with such a report, a person is entitled to bank loans. Whereas in credit scores, a number between 300 and 900 is provided to individuals to rate their creditworthiness.

Since 1993 April, Credit Analysis and Research Private Limited have been offering credit rating services which include bank loans, debt, and recovery. Some credit rating agencies in India are Indian Rating and Research Private Limited, Credit Analysis and Research Limited, and Credit Rating Information Services of India Limited.

- Advantages of Credit Rating

- Disadvantages of Credit Rating

- Comparison Table on Advantages and Disadvantages of Credit Rating

- FAQ’s on Advantages And Disadvantages Of Credit Rating

Role of Borrowers and Lenders

In credit rating, there are two categories of people, one is the borrower and another is the lender.

- Borrowers: When any person or entity seems to have a higher credit rating then there will be low risk and therefore loan application gets approved more easily. Lenders like banks and other financial organizations also offer loans at low-cost interest rates for having high credit ratings.

- Lenders: Lenders can make better investments as they can decide the risk of the entity that is borrowing the money. When lenders know the credit rating of borrowers, they can rely on them that their money will be paid back in time with interest.

Types of Credit Rating

Credit ratings are grouped into two types:

- Investment-grade: These ratings refer to that time when there is a strong investment made and the borrower is preferably going to meet the terms of repayment.

- Speculative grade: In this rating or grade, shows that the investments are at high risk and maybe the entity will not be able to meet the terms of the repayment procedure with higher rates of interest.

Advantages of Credit Rating

There are many advantages of credit rating;

- Safe investment for investors: Based on the advanced information and ratings, investors get to know about their qualifications which they are supposed to meet or their expectations. Prior information is delivered to all the investors.

- Easy investment proposals: Credit rating agencies have a final rating structure after various considerations related to the particular instruments. Final ratings are denoted by alphabetical symbols, hence it has easy investment proceedings.

- Easy to bring up resources: A company with high-rated debts has higher chances to raise the funds in terms of( benefit to the company).

- Rating helps in growth: Ratings also attract investors. Highly rated companies never fall short of funds as investors get ready to invest in goodwill.

Disadvantages of Credit Rating

Disadvantages of credit rating are;

- Misrepresentation and biased rating: At certain levels, there is a high possibility of misrepresentation and the absence of quality rating which is problematic for the capital market industry.

- Static study: Sometimes present as well as past historic data of the company remains static, therefore it increases the risk of rating.

- Temporary adverse conditions: Company should maintain its goodwill as well as its standards as once it gets downgraded, it may affect the rating and result in impairing the name and the image of the company.

- Human bias: Investigation team at times suffer from human bias, personal matters of the employee might affect the rating.

Comparison Table on Advantages and Disadvantages of Credit Rating

They are as follows:

| Advantages of Credit Rating | Disadvantages of Credit Rating |

| Safety and better investment decisions are assured for the lenders. | It has a high possibility of biases. |

| High credit rating means the assurance of safe money with interest on time. | Sometimes a company may not disclose certain important information to the investigation team of the agency. |

| High credit rating also shows low risk for the customers and hence banks easily approve the loan. | It is difficult to predict the future financial position as the data continuously changes in economic, social, legal and political matters. |

| Higher the credit rating, lower the rate of interest. | The difference in rating creates a great deal of confusion in the minds of investors. |

FAQ’s on Advantages And Disadvantages Of Credit Rating

Question 1.

Name a few credit rating agencies in India.

Answer:

Transunion CIBIL, Equifax, Experian and CRIF Highmark are some agencies in India.

Question 2.

How to calculate credit rating?

Answer:

It completely depends upon the entity and what kind of records he or she has in the past and that helps in future to get loans from banks.

Question 3.

What is an AAA rating in the bank?

Answer:

AAA rating in banks refers to the highest safety in timely servicing of financial matters.

Question 4.

What is the full form of FICO?

Answer:

The full form of FICO is the Fair Isaac Corporation.