Advantages And Disadvantages Of ATM: Automated Teller Machine or ATM is an electronic device installed by the bank that allows customers to perform financial transactions with the bank from any location and at any time even beyond banking hours. The bank account holder accesses the ATM through an ATM card which is unique for each customer and carries his identity. ATMs are convenient for customers to perform activities such as cash withdrawals, deposits, balance checking, and other operations. ATMs enable customers to perform financial transactions on their own without the involvement of bank staff. ATM operates using a stable internet connection, requires an ATM card to get activated, and after matching the card’s information dispenses cash as per the amount specified by the user.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is an ATM? Advantages and Disadvantages of ATM 2022

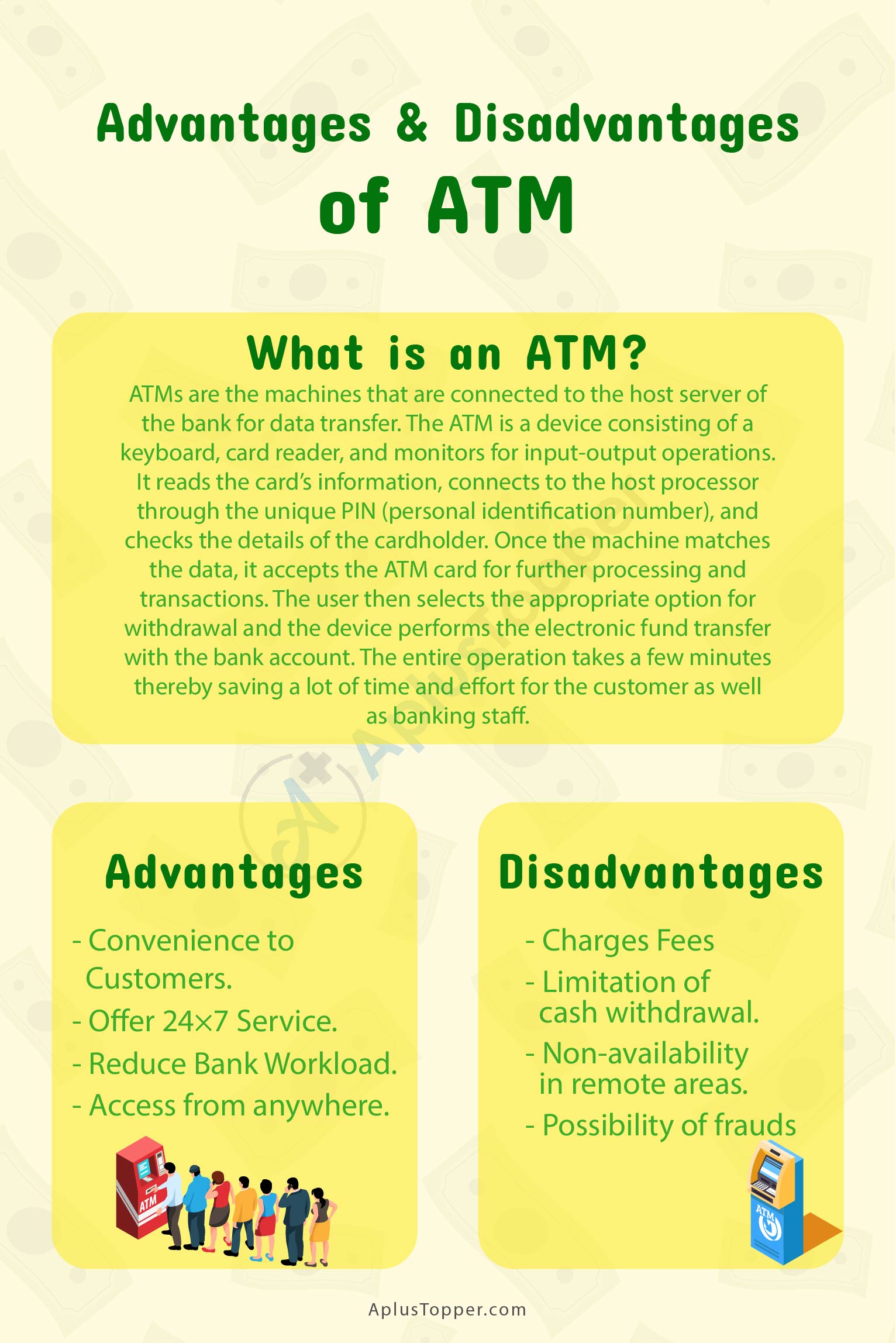

ATMs are the machines that are connected to the host server of the bank for data transfer. The ATM is a device consisting of a keyboard, card reader, and monitors for input-output operations. It reads the card’s information, connects to the host processor through the unique PIN (personal identification number), and checks the details of the cardholder. Once the machine matches the data, it accepts the ATM card for further processing and transactions. The user then selects the appropriate option for withdrawal and the device performs the electronic fund transfer with the bank account. The entire operation takes a few minutes thereby saving a lot of time and effort for the customer as well as banking staff.

- Advantages of ATM

- Disadvantages of ATM

- Comparison Table for Advantages and Disadvantages of ATM

- FAQ’s on Advantages And Disadvantages Of ATM

Advantages of ATM

- Convenience to Customers: ATMs allow customers to do financial transactions at their convenience. The bank account holder can avail of various banking services from any convenient location with the flexibility of time schedule even beyond banking hours. Nowadays ATMs are installed at all important places which facilitate the withdrawal of money by customers as per their requirements. They don’t need to visit the bank and stand in queues for cash withdrawal but can get the same service from any ATM in a nearby location.

- Offer 24×7 Service: ATM service is available round the clock and does not have any fixed time schedule for operations. So customers have access to their bank accounts all the time and they can withdraw their money at any time as per their convenience or in case any emergency arises.

- Reduce Bank Workload: ATMs provide customers with some facilities that are available in banks so customers can avoid visiting the bank that saving time. As the customers avail themselves of the banking services by themselves through ATM without visiting a bank, there is a huge reduction in workload in banks. There is no requirement to attend to customers for cash withdrawal, deposits, or balance inquiries. ATM thus becomes an efficient tool in reducing the work pressure on banks and provides flexibility to its operations.

- Access from anywhere: Customers can access their accounts through ATMs from any part of the country or even outside the country. ATM machines are installed in many important places which people can access while traveling. Customers don’t need to carry much cash and they can easily withdraw money any place as per their requirement.

Disadvantages of ATM

- Charges Fees: There are certain charges involved for withdrawal of money beyond a specified amount or the number of transactions within a specified time limit. Also withdrawal of money from an ATM that is not under the same bank as the cardholder also incurs additional cost.

- Limitation of cash withdrawal: There are certain restrictions on cash withdrawal using ATMs as specified by banks. The limitations can be on the number of transactions as well as the amount of money that can be withdrawn within a fixed time. This creates a problem if anyone requires withdrawing a large amount.

- Non-availability in remote areas: Sometimes banks in rural areas and some remote places have limited facilities to operate ATMs. The machines installed in rural areas also do not function properly all the time or often fall short of cash.

- Possibility of frauds: There are a number of reported incidents nowadays about fraud involving ATM cards. The ATM card may be misused if the secret information is accessed by others. The hackers through various unscrupulous activities can get access to the account and transfer money.

Comparison Table for Advantages and Disadvantages of ATM

| Advantages | Disadvantages |

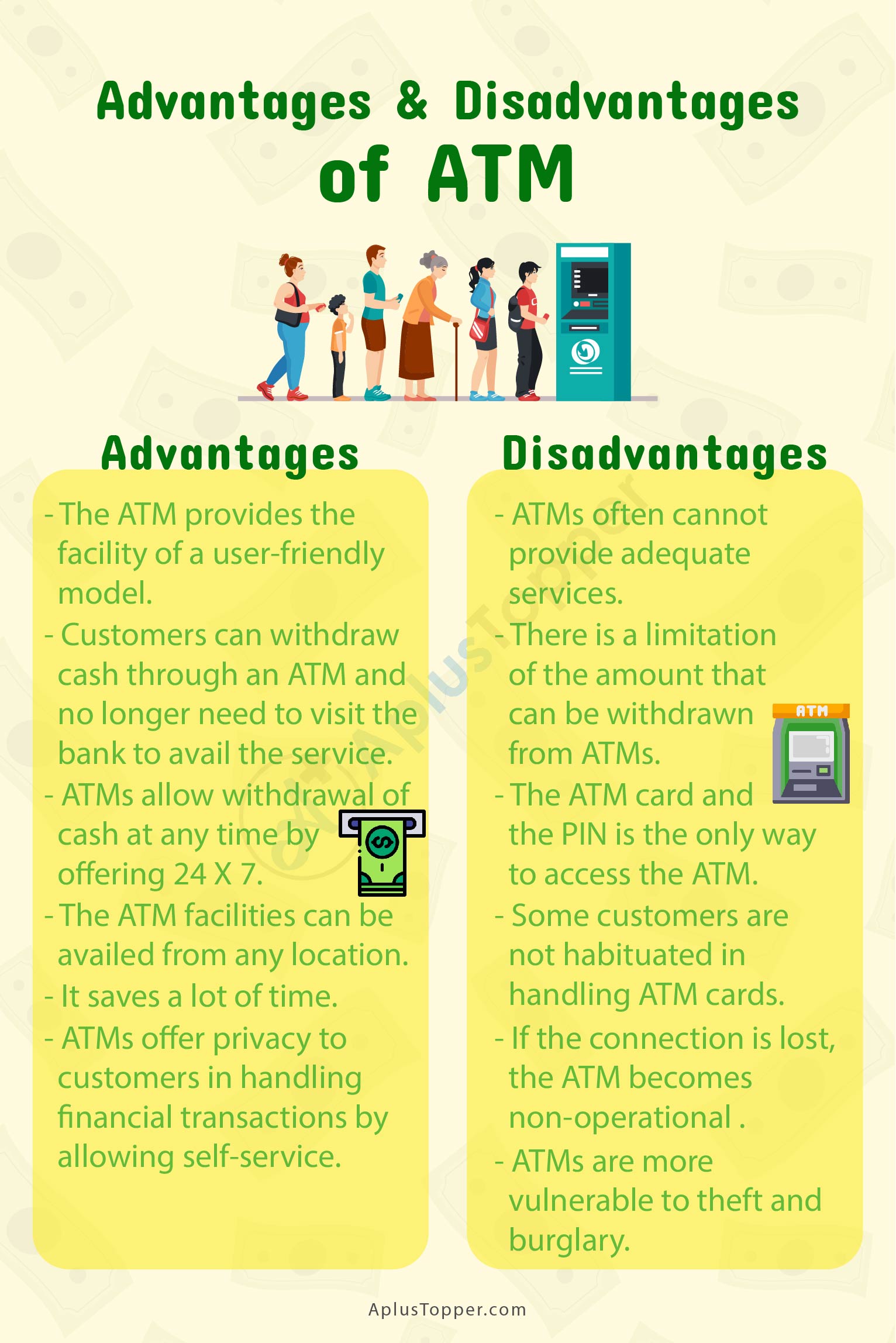

| The ATM provides customers the facility of a user-friendly model of self-service operations to withdraw money from the account in a quick and convenient way. | ATMs often cannot provide adequate services in a rural region in our country because banks that are available in the villages have mostly non-computerized branches. So ATM services cannot be provided in those areas. |

| Customers can withdraw cash through an ATM and no longer need to visit the bank to avail the service. This has allowed bank staff to handle fewer customers and has helped banks to reduce the workload to a great extent. | There is a limitation of the amount that can be withdrawn from ATMs. Banks also charge fees for the withdrawal of the extra amount of money within a specified time frame. Money that is withdrawn from other banks’ ATMs also incurs additional charges. |

| ATMs allow withdrawal of cash at any time by offering 24 X 7 service so anyone can withdraw money as per his convenience or on an urgent basis without visiting the bank or even beyond banking hours. | The ATM card and the PIN is the only way to access the ATM. If an ATM card is lost or PIN is disclosed, there is a possibility of fraud and misuse of the card by an unauthorized person that leads to unwanted money transfer from the account. |

| The ATM facilities can be availed from any location as ATMs are installed in different parts of the country which is an advantage for travelers. ATMs are available in many important places like railway stations, airports, hospitals, etc. facilitating people to withdraw cash as and when needed. | Some customers who are not habituated in handling ATM cards or may not have proper knowledge about ATM operations found it inconvenient and feel hesitant to use it. |

| The operations performed by ATMs do not involve any human intervention, so it saves a lot of time. Moreover, as the activities are controlled by the machine, there is less possibility of errors due to manual work. | The smooth operation of an ATM requires a stable connection between the device and the host server of the bank. If the connection is lost, the ATM becomes non-operational and it fails to provide customers the required facilities. |

| ATMs offer privacy to customers in handling financial transactions by allowing self-service. | ATMs are more vulnerable to theft and burglary especially in remote areas due to a lack of proper security measures like a bank. |

FAQ’s on Advantages And Disadvantages Of ATM

Question 1.

What is the full form of an ATM?

Answer:

The full form of ATM is Automated Teller Machine.

Question 2.

What is the primary use of an ATM?

Answer:

The primary use of an ATM is to withdraw money from the bank account through self-service using the debit card or ATM card.

Question 3.

Why does an ATM sometimes fail to dispense cash?

Answer:

ATM sometimes fails to dispense cash if its connection to the bank’s host server is lost or it has a shortfall of cash inside it.