Kerala Plus Two Accountancy Previous Year Question Paper Say 2018 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTING

(Scores: 40)

Answer all questions from 1 to 3, each carries 1 score. (3 × 1 = 3)

Question 1.

Choose the item, which is not directly added to the ‘Capital Fund’ of a not-for-profit organization:

(a) Entrance Fees

(b) Legacy

(c) Subscriptions

(d) Life membership fees

Answer:

(c) Subscriptions

Question 2.

On admission of a partner, the sacrificing ratio will be:

(a) Old ratio

(b) Equal sacrifice

(c) Specified ratio

(d) Any of these

Answer:

(d) Any of these

Question 3.

Agnes, Anila and Seena are partners sharing profits in the ratio of 5 : 3 : 2. What will be the new profit sharing ratio, if Agnes retires from the firm?

Answer:

New Profit sharing ratio = 3 : 2

Answer any 2 questions from 4 to 6, each carries 2 scores. (2 × 2 = 4)

Question 4.

In the absence of agreement between the partners, how will you deal with the following in respect of a partnership firm?

(a) Interest on advances by partners

(b) Profit sharing ratio

Answer:

a) Interest on advances:- In the absence of agreement, the partner shall be entitled to get an interest, on advance at the rate of 6% p.a.

b) Profit sharing ratio:- Profit sharing equally by all partners.

Question 5.

List out any four situations in which a court may order dissolution of a partnership firm.

Answer:

The court may order a partnership firm to be dissolved on any of the following situations:

- When a partner becomes insane.

- When a partner becomes permanently incapable of performing his duties as a partner.

- When a partner persistently commits breach of partnership agreements.

- When a partner is guilty of misconduct which is likely to affect the business of the firm.

Question 6.

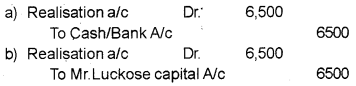

Pass Journal Entries for the treatment of ‘Realisation expenses’ spent by the firm, under the following situations:

(a) When realization expenses of ₹ 6,500 are incurred and paid by the firm.

(b) When realization expenses of ₹ 6,500 met by Mr. Luckose, one of the partners on behalf of the firm.

Answer:

Answer any 5 questions from 7 to 12, each car-ries 3 scores. (5 × 3 = 15)

Question 7.

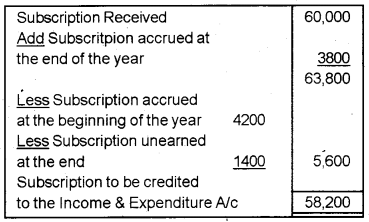

The Receipts and Payments Account of a club shows ₹ 60,000 as the subscription received during 2016 – 17. Accrued subscription at the beginning of the year was ₹ 4,200 and that at the end of the year was ₹ 3,800. There was no unearned subscription on 01.04.2016, but that on 31.03.2017 was ₹ 1,400.

Prepare a statement showing the amount of subscription to be credited to the Income and Expenditure Account for the year ending 31.03.2017.

Answer:

Question 8.

Explain the treatment of following items in the financial statements of a charitable institution:

(a) Sale of periodicals

(b) Payment of honorarium

(c) Legacies

Answer:

a) Sale of Periodicals: Shown on the income side of the Income and Expenditure A/c.

b) Payment of honorarium: Shown on the expenditure side of the Income and Expenditure A/c.

c) Legacies: It is shown on the receipts side of the Receipts and Payment A/c and is directly added to capital fund in the balance sheet. If it is of a small amount may be treated as income and shown on the income side of the income and expenditure a/c.

Question 9.

The book of Shija and Sundas showed that the capital employed in their business a.s on 31.03.2017 was ₹ 3,00,000 and ₹ 2,00,000 respectively. On admission of Sudha, they agreed to value goodwill of the firm on the basis of 3 years purchase of the average super profits of the last 5 years. The normal rate of return of similar businesses is 10%. The profits of last 5 years were:

| Year | ₹ |

| 2012 – 13 | 40,000 |

| 2013 – 14 | 50,000 |

| 2014 – 15 | 55,000 |

| 2015 – 2016 | 70,000 |

| 2016 – 2017 | 85,000 |

Find the value of firm’s goodwill.

Answer:

Goodwill = Super profit × No. of years purchase

Super profit = Average profit – Normal profit

![]()

= 60000

Normal Profit = Captal employed × Normal rate of return

= 500000 × 10/100 = 50000

Super profit = 60000 – 50000 = 10000

Goodwill = 10000 × 3 = 30000

Question 10.

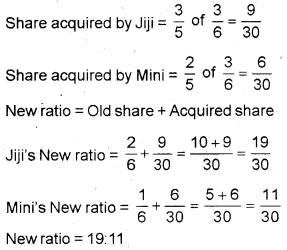

Tiji, Jiji and Mini are partners sharing profits in the ratio of 3 : 2 : 1. Tiji retires from the firm and her share is taken up by Jiji and Mini in the ratio of 3 : 2. Calculate the new profit sharing ratio.

Answer:

Old ratio = 3 : 2 : 1

Question 11.

Distinguish between ‘Dissolution of a partnership’ and ’Dissolution of a firm’ in accounting point of view.

Answer:

| Dissolution of Partnership | Dissolution of Firm |

| 1. The business is not terminated. | 1. The business of the firm is closed. |

| 2. A change in the existing agreement between partners. | 2. Dissolution of agreement between all partners. |

| 3. Assets and liabilities are revalued and new balance sheet is drawn. | 3. Assets are sold and liabilities are paid off. |

Question 12.

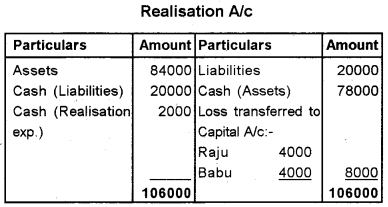

Find out the amount of profit or loss to be shared among partners on dissolution of a firm, from the given details;

(a) Firm paid realisation expenses of ₹ 2,000.

(b) The book value of assets other than cash and bank balance was ₹ 84,000

(c) External liabilities of ₹ 20,000 are settled in full.

(d) Firm realised ₹ 78,000 from the sale of assets.

(e) The partners Raju and Babu are equal partners in the firm.

Answer:

Answer any 2 questions from 13 to 15, each carries 5 scores. (2 × 5 = 10)

Question 13.

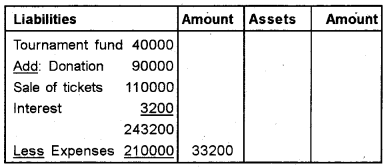

(a) Show the following items in the Balance Sheet of a Volley Ball Club, for the year ended 31.03.2017. (3)

| Items | ₹ |

| Tournament expenses | 2,10,000 |

| Tournament fund as on 1.4.2016 | 40,000 |

| Interest on the fund investment | 3,200 |

| Donations for tournament | 90,000 |

| Sale of tournament pass tickets | 1,10,000 |

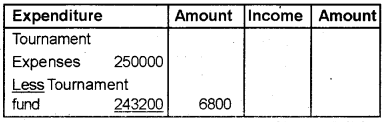

(b) How the tournament fund will be shown in the, financial statements of the club, if the tournament expense was ₹ 2,50,000 during the year 2016 – 17.

Answer:

a) Balance sheet as on 31.03.2017

b) Income and Expenditure A/c

Question 14.

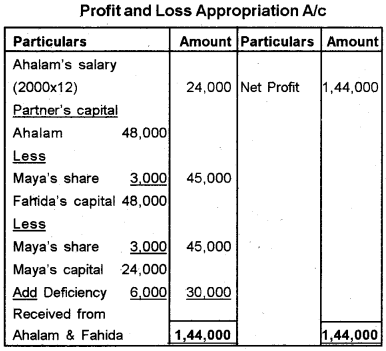

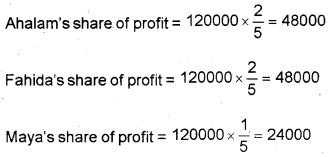

Ahalam and Fahida were partners in a business with profit sharing ratio of 2 : 1. On 01.04.2016, they admitted Maya as a new partner for 1/5 share in profits. They also guaranteed a minimum profit of ₹ 30,000 to Maya. The old partners agreed to meet the deficiency in the guaranteed profit equally. The new profit sharing ratio among the partners is 2 : 2 : 1 respectively. The profits of the firm for the year ended 31.03.2017, before charging salary to Ahalam @ ₹2,000 per month, amounted to ₹ 1,44,000. Prepare a Profit and Loss Appropriation account.

Answer:

Note:

New Profit sharing ratio = 2 : 2 : 1

Net Profit = 144000 – 24000 = 120000

Guaranteed minimum profit to Maya is 30000. So the deficiency of 6000 (30000 – 24000) shall be borne by Ahalam and Fahida equally.

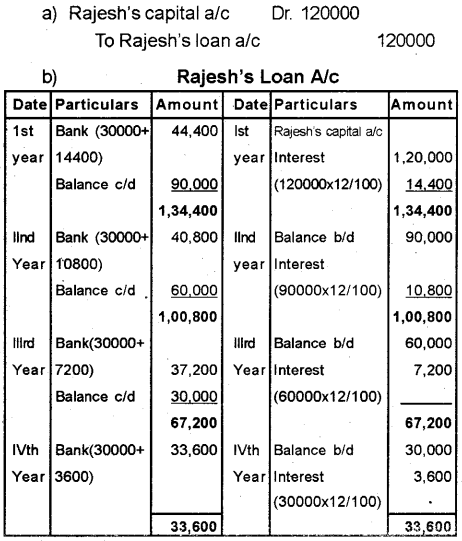

Question 15.

Prakash, Rajesh and Sareesh are equal partners in in a firm. Rajesh retires from the firm. On the date of retirement ₹ 1,20,000 become due to him, Prakash and Sareesh promises to pay him in ‘4’ equal instalments at the end of every year, plus accrued interest @ 12% p.a. on the unpaid balance.

(a) Pass journal entry for the amount due to Rajesh on the date of retirement.

(b) Prepare ‘Rajesh’s loan account’, till the amount is fully paid off.

Answer:

Answer Question No.16, which carries 8 scores. (1 × 8 = 8)

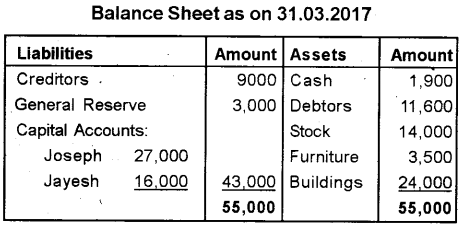

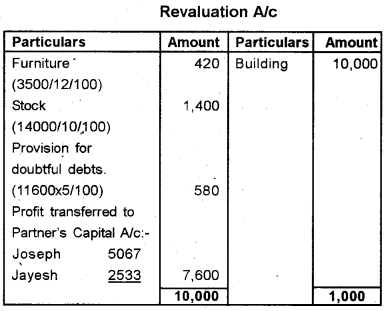

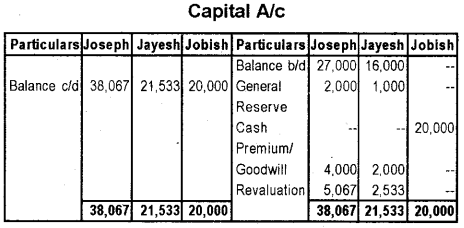

Question 16.

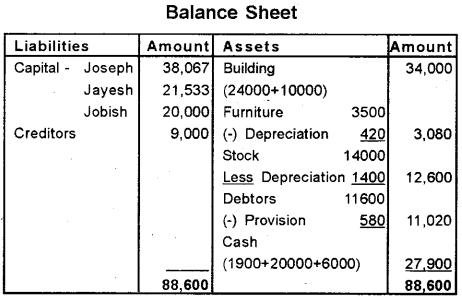

Following Balance Sheet shows the financial position of Joseph and Jayesh, sharing profits and losses in the ratio of 2:1.

They agreed to admit Jobish into partnership and give him 1/4 share in profits, with the following terms:

(i) Jobish should bring in ₹ 20000 as his capital and ₹ 6000 as his share of goodwill in cash.

(ii) Furniture depreciated by 12% and stock depreciated by 10%.

(iii) Buildings appreciated by ₹ 10,000

(iv) Create provision for doubtful debts at 5% of debtors.

Prepare the Revaluation Account, Partners Capital Account and the New Balance Sheet.

Answer:

Part – B

COMPUTERISED ACCOUNTING

(Scores: 20)

Answer all questions from 1 to 3. Each carries 1 score. (3 × 1 = 3)

Question 1.

Name the Spreadsheet function used for calculating the annual depreciation under the fixed installment method.

Answer:

SLN

Question 2.

A Spreadsheet‘3D’chart has:

(a) ‘X’ axis

(b) ‘Y’ axis

(c) ‘Z’ axis

(d) All of these

Answer:

(d) All of these

Question 3.

Find the odd one among the computer software given below:

(a) GNU Khata

(b) Tally

(c) SAP

(d) Libre Office Base

Answer:

(d) Libre Office Base

Answer any 3 questions from 4 to 7. Each carries 2 scores. (3 × 2 = 6)

Question 4.

Business firms, more often, made use alphabets or symbols for codification. Identify the type of codes referred here. Give a suitable example for this type of codes.

Answer:

Mnemonic Codes

Eg. CB – Chicken Biriyani

MD – Masala Dosa

Tcr – Thrissur

Fm – Finance Manager

Question 5.

Give the absolute cell reference to represent the following in a Spreadsheet package:

(a) Cell at 8th column and 15th row

(b) Range of cells from 4th column and 5th row to 10th column and 20th row.

Answer:

a) $H$15

b) $D$5 : $J$20

Question 6.

Name any four types of charts available in a Spread¬sheet software.

Answer:

a) Line Chart

b) BarChart

c) Pie Chart

d) Area Chart

Question 7.

Explain the different methods of creating ‘FORMS’ in a data base software.

Answer:

a) Creation of Forms through Form Wizard:

Select a Table → Click on Create → More Forms → Form Wizard → Select the Fields → Next → Finish

b) Creation of Forms through Form Design:

Create → Form Design → Add Existing Fields → Select Fields from Table

Answer any 2 questions from 8 to 10. Each carries 3 scores. (2 × 3 = 6)

Question 8.

Explain any ‘3’ logical functions commonly available in Spreadsheet software packages, by giving relevant syntax.

Answer:

a) IF – It is used to test specific condition

Syntax : → = IF (Logical Test, Value if True, Value if False)

b) AND – Evaluate all the mathematical expressions located on other cells.

Syntax : → = AND (Logical Test 1, Logical Test 2, ……..)

c) OR – Evaluate at least one mathematical expression located in other cells.

Syntax : → = OR (Logical Test 1, Logical Test 2, ……..)

Question 9.

The ‘Basic Pay’ of an employee is supplied in ‘C4’ of a spread sheet. Give the appropriate formula in the following cells for his salary calculations.

(a) In D4, DA as 14% of the basic pay.

(b) In E4, HRA as ₹ 2,500 for the basic pay greater that ₹ 55,500 and for others ₹ 1,500.

(c) In F4, to calculate the gross pay.

Answer:

a) DA

D4 = 04*14%

b) HRA

E4 = IF(C4 > 55500, 2500, 1500)

c) Gross Pay

F4 = Σ(C4 : E4) or SUM(C4 : E4)

or = C4 + D4 + E4

Question 10.

Explain the uses or functions of following objects or elements of a DBMS software:

(a) Query

(b) Forms

(c) Reports

Answer:

a) Query is used to view, change and analyse data in different ways.

b) Forms are used to enter or modify data into a fable.

c) Report is used to create various reports based on Table, Query or both.

Answer the question number 11, which carries 5 scores. (1 × 5 = 5)

Question 11.

Explain any five features of the Accounting software – Tally/GNU Khata.

Answer:

Features of GNU Khata

- It is free and open source accounting software

- It is based on double entry book keeping

- All financial reports can be prepared

- Display of dual ledger facility

- Attachment of source document to vouchers is possible

- Linking of sales and purchase transactions to invoice.