Kerala Plus One Accountancy Notes Chapter 5 Trial Balance and Rectification of Errors

Summary:

Meaning of trial balance:

A statement showing the abstract of the balance (debit/credit) of various accounts in the ledger.

Objectives of trial balance:

The main objectives of preparing the trial balance are:

- To ascertain the arithmetical accuracy of the ledger accounts;

- To help in locating errors; and

- To help in the preparation of the final accounts.

Preparation of trial balance by the balance method:

In this method, the trial balance has three columns. The first column is for the head of the account, the second column for writing the debit balance and the third for the credit balance of each account in the ledger.

Format of a Trial balance

Trial Balance of ………………… as on March 31.2005

It is normally prepared at the end of an accounting year. However, an organisation may prepare a trial balance at the end of any chosen period, which may be monthly, quarterly, half yearly or annually depending upon its requirements.

In order to prepare a trial balance following steps are taken:

- Ascertain the balances of each account in the ledger.

- List each account and place its balance in the debit or credit column as the case may be. (If an account has a zero balance, it may be included in the trial balance with zero in the column for its normal balance).

- Compute the total of debit balances column.

- Compute the total of the credit balances column.

- Verify that the sum of the debit balances equal the sum of credit balances. If they do not tally, it indicates that there are some errors. So one must check the correctness of the balances of all accounts.

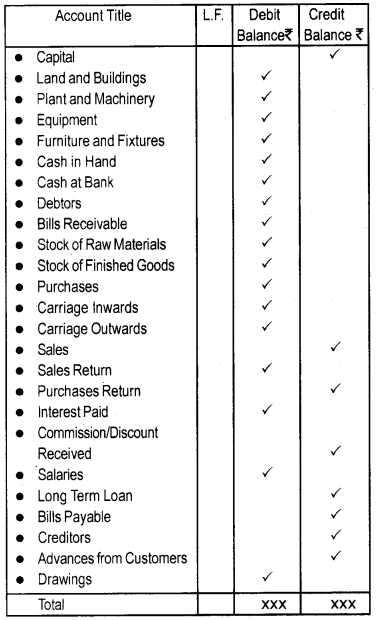

It may be noted that all assets expenses and receivables account shall have debit balances whereas all liabilities, revenues and payables accounts shall have credit balances.

Illustrative Trial Balance

Various types of errors:

1. Errors of commission:

Errors caused due to wrong recording of a transaction, wrong totalling, wrong casting, wrong balancing, etc.

2. Errors of omission:

Errors caused due to omission of recording a transaction entirely or partly in the books of account.

3. Errors of principle:

Errors arising due to wrong classification of receipts and payments between revenue and capital receipts and revenue and capital expenditure.

4. Compensating errors:

Two or more errors committed in such a way that they nullify the effect of each other on the debits and credits.

Rectification of errors:

Errors affecting only one account can be rectified by giving an explanatory note or by passing a journal entry. Errors which affect two or more accounts are rectified by passing a journal entry.

Meaning and utility of suspense account:

An account in which the difference in the trial balance is put till such time that errors are located and rectified. It facilitates the preparation of financial statements even when the trial balance does not tally.

Disposal of suspense account:

When all the errors are located and rectified the suspense account stands disposed off.