Kerala Plus One Accountancy Notes Chapter 3 Recording of Transactions – I & II

Summary:

Meaning of source documents:

Various business documents such as invoice, bills, cash memos, vouchers, which form the basis and evidence of a business transaction recorded in the books of account are called source documents.

Meaning of accounting equation:

A statement of equality between debits and credits signifying that the assets of a business are always equal to the total liabilities and capital.

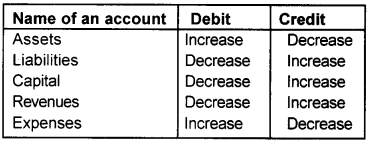

Rules of debit and credit:

An account is divided into two sides. The left side of an account is known as debit and the credit. The rules of debit and credit depend on the nature of an account. Debit and Credit both represent either increase or decrease, depending on the nature of an account.

These rules are summarised as follows:

Books of original entry:

The transactions are first recorded in these books in chronological order. Journal is one of the books of original entry. The process of recording entries in the journal is called journalizing.

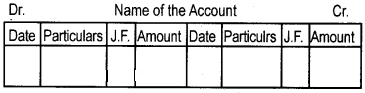

Format of Journal

Ledger:

A book containing all accounts to which entries are transferred from the books of original entry. Posting is process of transferring entries from books of original entry to the ledger.

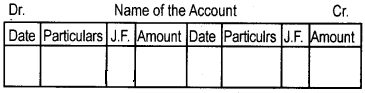

Format of a Ledger

Special Journals:

Special journals are also called day books or subsidiary books. Transactions that cannot be recorded in any special journal are recorded in journal is called the “Journal Proper.”

The special-purpose journals are:

- Cash Book

- Petty Cash Book

- Purchase Book

- Purchase Return Book

- Sales Book

- Sales Return Book

- Journal Proper

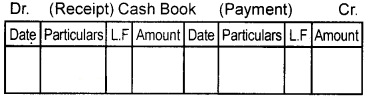

(a) Cash Book

A book used to record all cash receipts and payments. Cash book may be single column cash book, doulbe column cash book and three column cash book.

Single Column Cash book

This is cash book containing only one column for cash and prepared as cash account in ledger.

Format of Single Column Cash Book

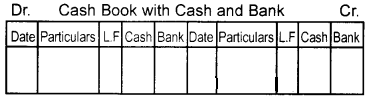

Double Column Cashbook:

This is cash book containing one more column for bank along with the cash column, it serves the purpose of cash and bank account.

Format of Double Column Cash Book

(b) Petty Cash Book:

A book used to record small cash payments

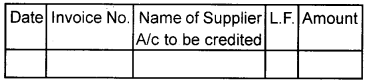

(c) Purchase Book / Purchase Journal:

A special journal in which only credit purchases are recorded.

Format of Purchase Day Book

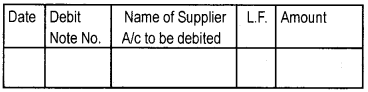

(d) Purchase Return Book:

A book in which return of purchased goods on credit is recorded.

Format of Purchase Return Book

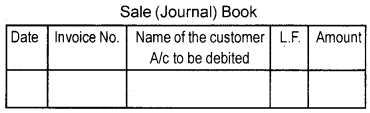

(e) Sales Book / Sales Journal:

A special journal in which only credit sales are recorded.

Format of Sales Day Book

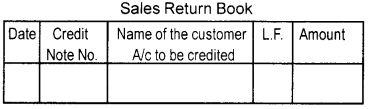

(f) Sales Return Book:

A special book in which return of goods sold on credit is recorded.

Format of Sale Return Book

Balancing the Accounts:

Accounts in the ledger are periodically balanced, generally at the end of the accounting period with the object of ascertaining the net position of each amount.

Balancing of an account means that the two sides are totaled and the difference between them is shown on the side which is shorter in order to make their totals equal. The words ‘balance carried down (c/d)’ is written against the amount of the difference between the two sides.

The amount of balance is brought down (b/d) in the next accounting period indicating that it is a continuing account until finally settled or closed. In case the debit side exceeds the credit side.

The difference is written on the side, if the credit side exceeds the debit side, the difference between the two appears on the debit side and is called debit and credit balance respectively. The accounts of expenses losses, gains, and revenues are not balanced but are closed by transferring to trading and profit and loss accounts.