Kerala Plus One Accountancy AFS Improvement Question Paper Say 2018 with Answers

| Board | SCERT |

| Class | Plus One |

| Subject | Accountancy |

| Category | Plus One Previous Year Question Papers |

Time Allowed: 21/2 hours

Cool off time: 15 Minutes

Maximum Marks: 80

General Instructions to Candidates

- There is a ‘cool off time of 15 minutes in addition to the writing time.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and the only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures, and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Answer all questions from 1 to 7. Each carries 1 score. (7 × 1 = 7)

Question 1.

Choose a current asset of a vegetable merchant from the following.

(a) Building

(b) Furniture

(c) Stock of vegetables

(d) Weighing machine

Answer:

(c) Stock of vegetables

Question 2.

Which accounting concept/principle states that every business transaction has a dual or twofold effect?

Answer:

Dual Aspect Concept

Question 3.

Salary paid to Krishnaveni debited to her personal account. Identify the type of error.

Answer:

Error of Principle

Question 4.

On 8/01/2018 Varun draws a 2 months bill on Sudheer for ₹ 27,000/-. If the due date of the bill fall on Sunday, what will be the next due date of the bill?

Answer:

Preceding Saturday

Question 5.

Credit purchase can be ascertained as the balancing figure in the ………. account from incomplete records.

Answer:

Total Creditors A/c

Question 6.

MIS stands for …………

Answer:

Management Information System (MIS)

Question 7.

The interface used for inputting data to a database is called ……………

Answer:

Forms

Answer all questions from question number 8 to 13, each carries 2 scores. (6 × 2 = 12)

Question 8.

Mention any two internal users of accounting information.

Answer:

Internal users of accounting information

- Management

- Employees

- Financial Officers

Question 9.

List any two objectives of preparing a trial balance.

Answer:

- To ascertain the arithmetical accuracy of ledger accounts.

- To help in ascertaining errors

Question 10.

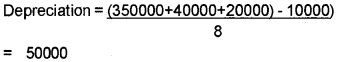

The original cost of a Machinery ₹ 3,50,000/-, Erection charges ₹ 40,000/-, Pre operating cost ₹ 20,000/-, Salvage value after 8 years were ₹ 10,000/-. Calculate the annual depreciation of the Machinery.

Answer:

Question 11.

What is mean by Marshalling of Assets and Liabilities?

Answer:

Marshaling denotes the order in which the assets and liabilities are shown in the balance sheet. They are arranged either in the order of liquidity or in the order of permanence.

Question 12.

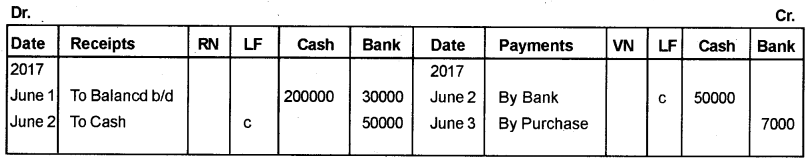

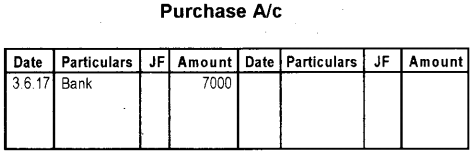

From the following extract of Cashbook, post them to respective ledger accounts.

Cash Book

Answer:

Question 13.

List out four limitations of Computerized Accounting System.

Answer:

- Huge Training Cost

- Staff opposition

- System failure

- Inability to check unanticipated errors

Answer any 5 questions from question numbers 14 to 19, each carries 3 scores. (5 × 3 = 15)

Question 14.

Explain the following accounting concepts.

a) Business entity concepts.

b) Matching concept

c) Objectivity concept

Answer:

a. Business Entity Concept:

This concept assumes that the entity of business is different from its owners. The business is treated as a unit or entity separate from the person who control it.

b. Matching concept:

Under ths concept, all the expenses as well as the revenues of a particular period should be accounted or otherwise it should be matched.

c. Objectivity concept:

According to this concept, accounting transactions should be recorded in the manner so that it is free from the bias of accountants and others.

Question 15.

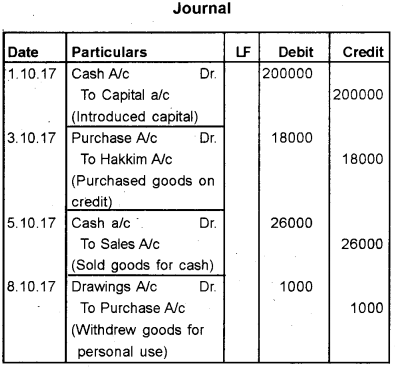

Journalize the following transactions.

2017, October

1 Started a business with cash ₹ 2,00,000/-

3 Purchased goods from Hakkim ₹ 18,000/-

5 Sold goods to Vinu for cash ₹ 26,000/-

8 Withdraw goods for personal use ₹ 1000/-

Answer:

Question 16.

Sunitha’s Cash Book showed an credit balance of ₹ 12000/- but her passbook showed an overdraft of ₹ 20000/-. State any three reasons for this disagreement between cash book and passbook balances.

Answer:

- Cheque issued but not presented for payment.

- Cheque paid into bank but not yet collected.

- Direct deposit by a customer into the bank account.

- Interest and dividends collected by the bank.

Question 17.

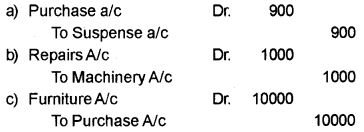

Rectify the following errors.

a) Purchase daybook is undercast by ₹ 900/-

b) Repairs on Machinery ₹ 1000/- debited to Machinery a/c.

c) Purchase of Furniture ₹ 10000/- from Sabari Recorded through Purchase daybook.

Answer:

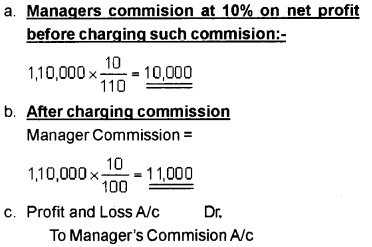

Question 18.

Calculate manager’s commission on the notional profit of ₹ 1,10,000.

a) 10% on net profit before charging such commission.

b) 10% on net profit after charging such commission.

c) Pass a common adjusting entry for the manager’s commission.

Answer:

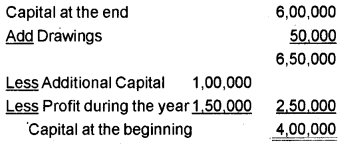

Question 19.

From the following information, calculate capital on 1st January, 2017.

a) Capital on 31.12.2017 ₹ 6,00,000.

b) Drawings made during the year 2017 ₹ 50,000/-

c) Profit made during the year 2017 ₹ 1,50,000/-

d) Capital introduced on 1.07.2017 ₹ 1,00,000

Answer:

Answer any 5 questions from question numbers 20 to 25, each carries 4 scores. (5 × 4 = 20)

Question 20.

Briefly explain the qualitative characteristics of accounting information.

Answer:

Qualitative characteristics of accounting information:

a) Reliability – Accounting information will be reliable if it is free from errors.

b) Relevance – Information should be relevant and must be available in time.

c) Understandability – Accounting information should be easily understood by its users. The information must be clear, brief and intelligible.

d) Timeliness – Accounting information must be available timely. If not, it loses its ability to influence decisions.

e) Comparability – Accounting information should facilitates inter-firm as well as intra-firm comparison.

Question 21.

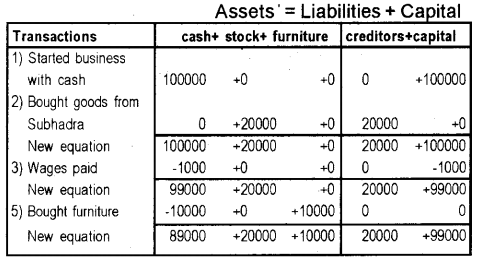

Show the effect of the following transaction on assets, liabilities and capital through accounting equation.

2017, June

1 Started. business with cash ₹ 1,00,000/-

2 Bought goods from Subhadra ₹ 20,000/-

3 Wages paid ₹ 1,000/-

5 Bought furniture ₹ 10,000/-

Answer:

Assets = Liabilities + Capital

1,10,000 = 20,000 + 99,000

Question 22.

State any four distinctions between Bills of Exchange and Promissory Note.

Answer:

Difference between Bill of Exchange and Promissory Note:

| Bill of Exchange | Promissory Note |

| 1. It is drawn by the creditor. | 1. It is drawn by the debtor. |

| 2. There are 3 parties i.e. drawer, drawee and payee. | 2. There are two parties i.e. Promisor and Promissee. |

| 3. It contains an order to make payments. | 3. It contains a promise to make payment. |

| 4. It needs acceptance by the drawee. | 4. It does not need any acceptance |

Question 23.

Compute the cost of goods sold for the year 2017 with the help of the following information.

Sales ₹ 12,00,000/-

Purchases ₹ 7,00,000/-

Wages ₹ 50,000/-

Carriage inwards ₹ 12,000/-

Stock on 1-1-2017 ₹ 1,00,000/-

Stock on 31.12.2017 ₹ 1,17,000/-

Answer:

Cost of goods sold = Opening stock + Purchases + Direct expenses – Closing Stock

= (100000 + 700000 + 50000 + 12000) – 117000

= 862000 – 117000 = 745000

Question 24.

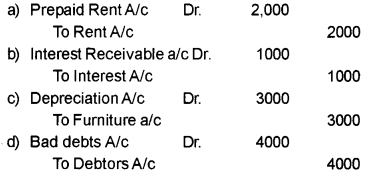

Pass the adjusting entry on the following transactions.

a) Prepaid rent ₹ 2,000/-

b) Interest due but not received ₹ 1,000/-

c) Depreciation on furniture ₹ 3,000/-

d) Bad debts ₹ 4,000/-

Answer:

Question 25.

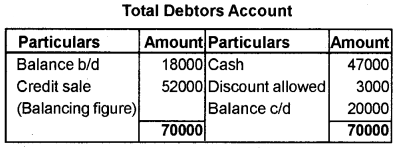

Calculate total sales for the year 2017 from the following data.

Cash sales during 2017 ₹ 12,000/-

Debtors on 1.1.2017 ₹ 18,000/-

Cash received from debtors during 2017 ₹ 47,000/-

Discount allowed during 2017 ₹ 3000/-

Debtors on 31.12.2017 ₹ 20,000/-

Answer:

Total Sales = Cash sales + Credit sales

= 12000 + 52000 = 64000

Answer any 2 questions from question numbers 26 to 28. Each carries five scores. (2 × 5 = 10)

Question 26.

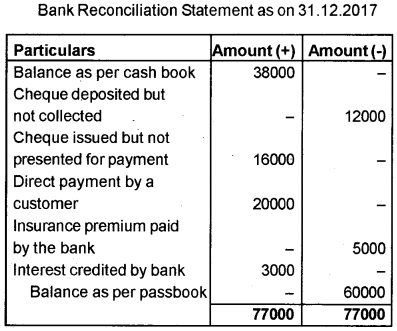

Prepare a Bank Reconciliation Statements as on 31st December, 2017 from the following information:

a) Cash bookdebit balance on 31.12.2017 ₹ 38,000/-

b) Cheque deposited into bank during 2017 but not collected in the year ₹ 12,000/-

c) Cheque issued during 2017 but not presented for paymnet ₹ 16,000/-

d) Direct payment by a customer on 30.12.2017 not recorded in cash book ₹ 20,000/-

e) Insurance premium paid by the bank as per standing instruction, not appeared in cash book ₹ 5,000/-

f) Interest credited by bank ₹ 3,000/- not appeared in cash book.

Answer:

Question 27.

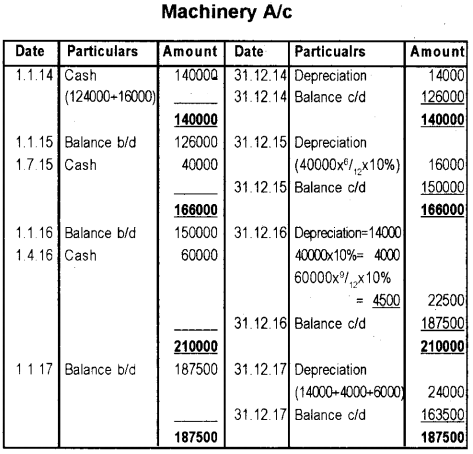

Anakha purchased a Machinery on 01.01.2014 for ₹ 1,24,000/-. Installation charges were ₹ 16,000/-. On 01.07.2015 an additional machinery purchased for ₹ 40,000/- On 01.04.2016 another machinery bought for ₹ 60,000/-. Prepare Machinery account by charging depreciation @ 10% on original cost from 2014 to 2017 assuming that the books are closed on every 31st December.

Answer:

Question 28.

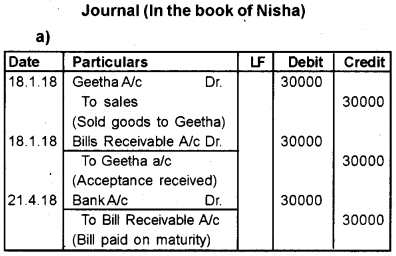

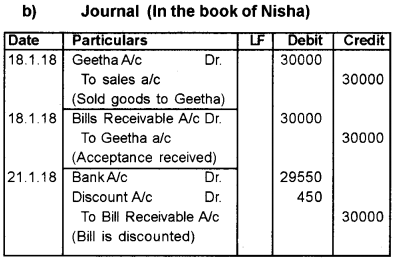

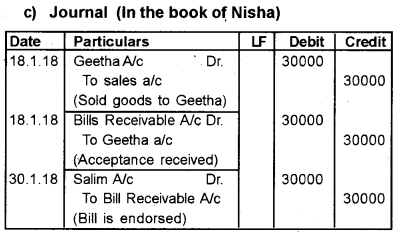

Nisha sold goods to Geetha for ₹ 30,000/-. On 18.01.2018 and drew upon her a bill of exchnage payable after 3 months. Geetha accepted the bill and returned the same to Nisha. Record the journal entries in the books of Nisha based on the following cirumstances.

a) Nisha kept the bill till due date and Geetha met the bill.

b) Nisha discounted the bill @ 6% p.a. on 21.01.2018.

c) Nisha endorsed the bill to Salim on 30.01.2018.

Answer:

Answer any 2 questions from question numbers 29 to 31. Each carries 8 scores. (2 × 8 = 16)

Question 29.

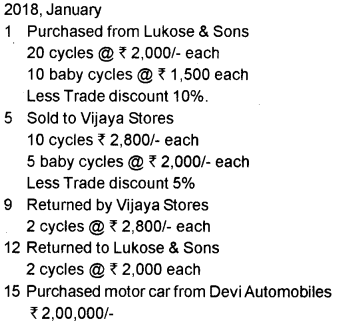

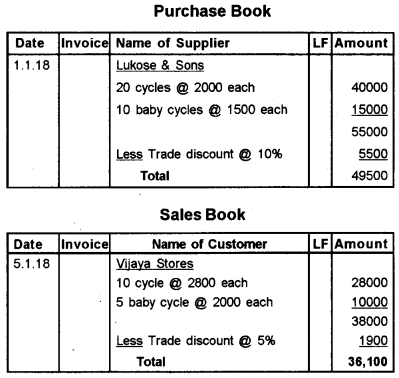

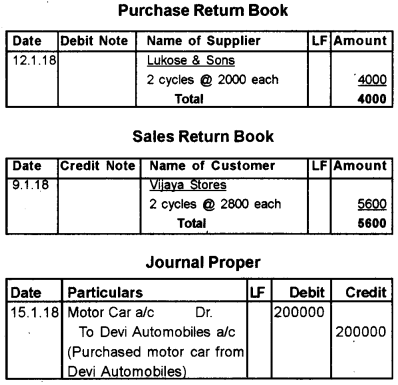

Prepare appropriate daybooks from the following transactions in the books of Suresh Cycles.

Answer:

Question 30.

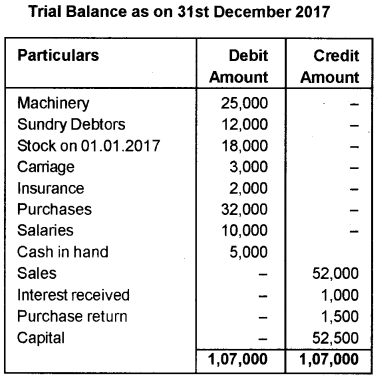

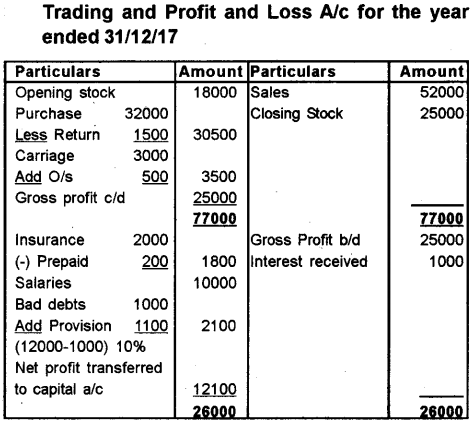

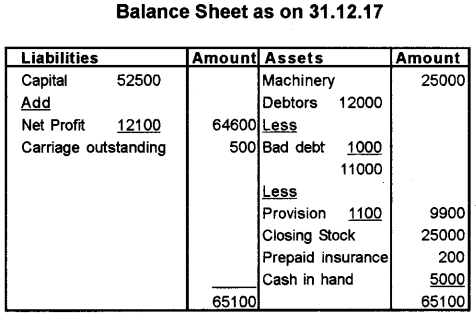

From the following Trial Balance of Krishna Sarees on 31st December, 2017, prepare Trading and Profit & Loss Account and Balance sheet as on that date.

Additional Information:

a) Stock on 31.12.2017 ₹ 25,000/-

b) Carriages outstanding ₹ 500/-

c) Insurance prepaid ₹ 200/-

d) Write off bad debts ₹ 1,000/- and provision for bad debts 10%.

Answer:

Question 31.

Explain the following with suitable examples.

a) Fixed asset

b) Source document

c) Compensating error

d) Attribute

Answer:

a. Fixed Assets:

Fixed assets are those assets held on long-term basis such as land, building, machinery, plant etc. These assets are used in the normal opera¬tions of the business.

b. Source Document:

It is a written document to be used in support of entry made in the accounts. These provide information about the trasactions involved and helps in verifying the correctness of books of accounts. For examples: the receipts, bills, invoices etc.

c. Compensating error:

These errors arise when a mistake made in one direction is compensated by another mistake made in the opposite direction, to the extent of same amount.

d. Attribute:

Attributes are some properties of interest or characteristics that further described the entity such as height, weight and date of birth in the case of a person and code and name in the case of ac-counts.