Balance Confirmation Letter: A balance Confirmation Letter is an official letter issued to the creditors from the bank to confirm the balance as per the books or records. The letter will include invoice number, date, order reference number, amount details, etc. This letter crosschecks the payments to verify the correct amount during the whole year.

Test Balance affirmation letter configuration and Payment affirmation letter to Creditors from the bank. These letters are to cross-check installments to confirm the genuine sums/figures during a year, certain time span, or one installment as it were. You can modify this letter according to your prerequisites.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

A Balance Confirmation Letter is a letter from the bank to its client affirming certain insights concerning the client’s record with the bank and a few offices profited from the bank during a specific monetary year. The letter goes about as proof for the inspectors of the organization for year-end review purposes.

Balance Confirmation Letter Format

Make sure to keep in mind the following points before writing a balance confirmation letter.

- Find out to whom you are writing or addressing the letter

- Format the letter (Grammar and spelling check)

- Salutation/Greetings

- Introduce yourself

- Write the body of the letter

- Close the letter with gratitude

- Your’s sincerely/faithfully

Balance Confirmation Letter for Bank

A bank confirmation letter approves that a bank has a credit extension set up with one of its clients. Bank affirmation letters are commonly given to business clients vouching for their financial soundness. The format of the balance confirmation letter for the bank includes the following details:

- Reference number

- Date of the letter

- Manager of the bank

- Bank name

- Branch name

- Address

- Subject of the letter

- Salutation (Dear Sir/Madam, Mr./Ms./Mrs.)

- Body of the letter

- Account number

- Term loan account number

- Cash credit A/c number

- Letter of credits

- Bank Guarantees

- Closing the letter

- Your’s faithfully/Sincerely

- Name and Designation of the sender

- Signature

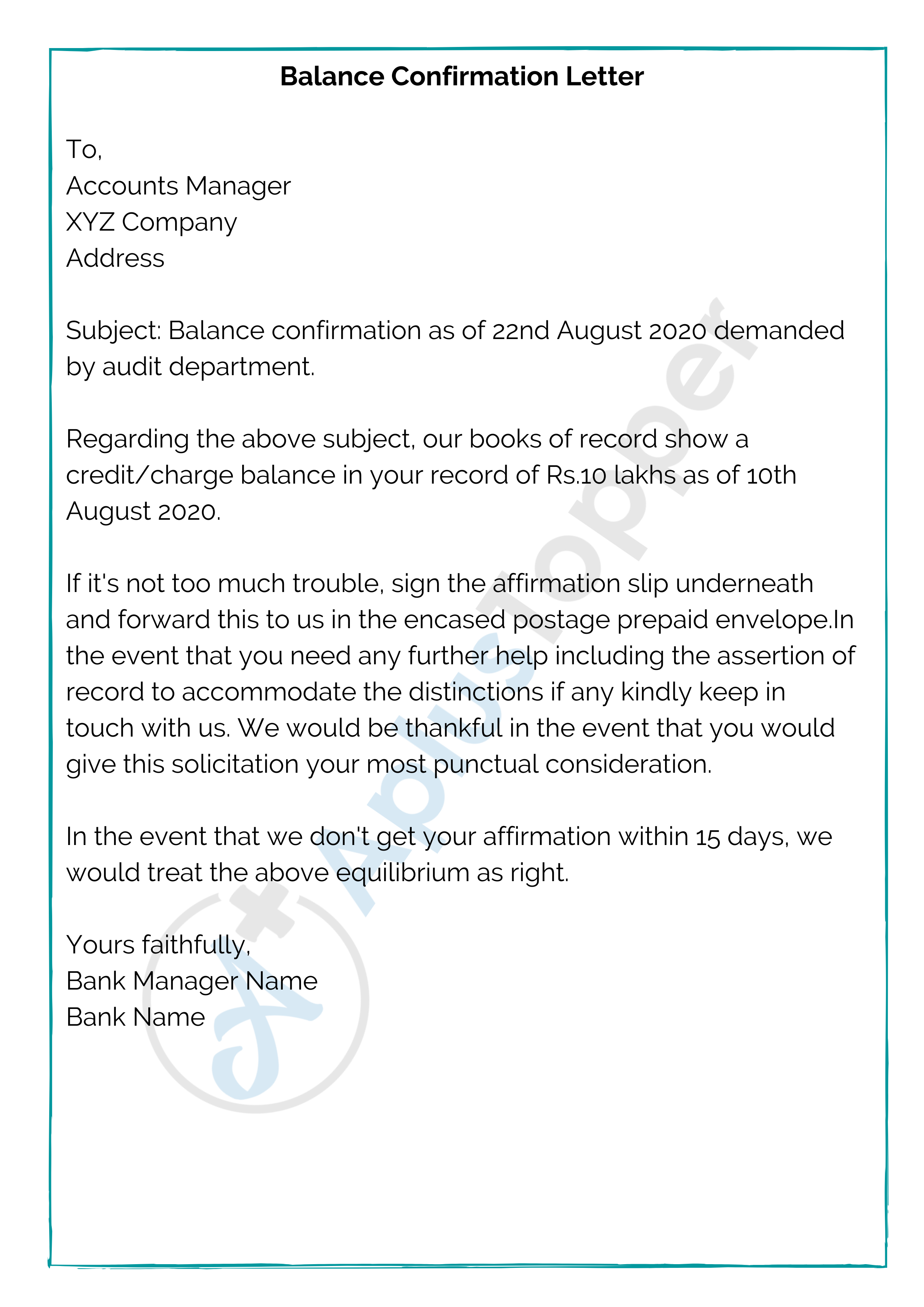

Balance Confirmation Letter Example

| To, Accounts Manager XYZ Company AddressSubject: Balance confirmation as of 22nd August 2020 demanded by audit department.Regarding the above subject, our books of record show a credit/charge balance in your record of Rs.10 lakhs as of 10th August 2020. If it’s not too much trouble, sign the affirmation slip underneath and forward this to us in the encased postage prepaid envelope. In the event that you need any further help including the assertion of record to accommodate the distinctions if any kindly keep in touch with us. We would be thankful in the event that you would give this solicitation your most punctual consideration. In the event that we don’t get your affirmation within 15 days, we would treat the above equilibrium as right. Yours faithfully, Bank Manager Name Bank Name |

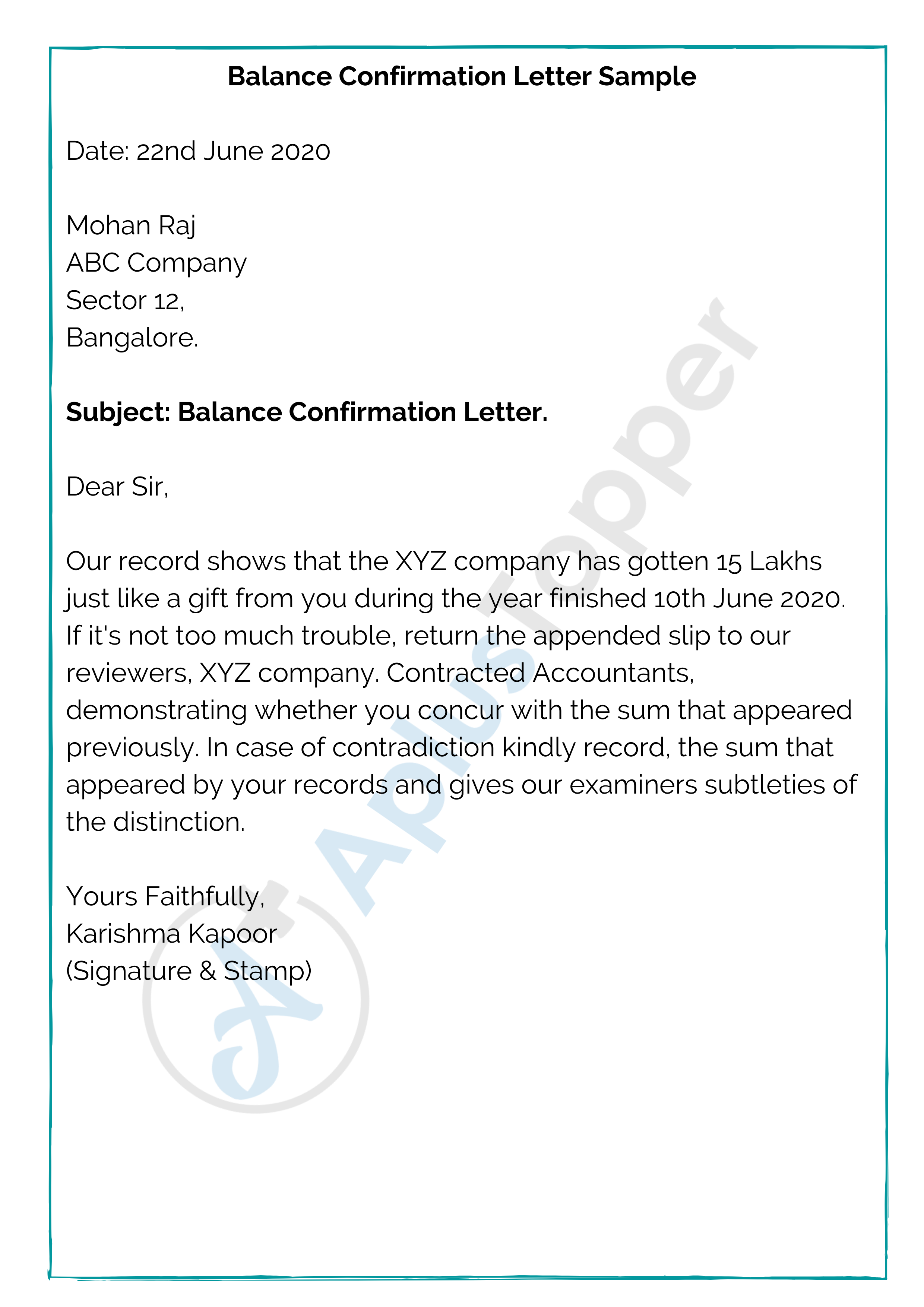

Balance Confirmation Letter Sample

Throughout a review, you may hear your evaluators allude to something many refer to as a “affirmation letter.” This is a letter that your examiner will convey to outsiders, like banks or providers, requesting that they affirm certain monetary data. Affirmation letters are significant in light of the fact that they give a free confirmation of your association’s accounts.

On the off chance that your records receivable shows that you owe cash to a specific merchant, your reviewer may send that seller an affirmation letter inquiring as to whether that sum is precise. Your evaluator may likewise send letters to different gatherings requesting that they check money, stock, notes payable, legitimate issues, contracts, or any irregular exchanges. Affirmation letters might be sent electronically or through the mail (frequently with a pre-tended to restore envelope included). Postage charges for the affirmation letters will typically be charged back to your association.

| Date: 22nd June 2020 Mohan Raj Subject: Balance Confirmation Letter Dear Sir, Our record shows that the XYZ company has gotten 15 Lakhs just like a gift from you during the year finished 10th June 2020. If it’s not too much trouble, return the appended slip to our reviewers, XYZ company. Contracted Accountants, demonstrating whether you concur with the sum that appeared previously. In case of contradiction kindly record, the sum that appeared by your records and gives our examiners subtleties of the distinction. Yours Faithfully, Karishma Kapoor (Signature & Stamp) |

FAQ’s on Balance Confirmation Letter

Question 1.

What is the Balance confirmation letter?

Answer:

A balance Confirmation Letter is an official document issued to the creditors from the bank to confirm the balance as per the books or records. It will include invoice number, date, order reference number, amount details, etc. The letter crosschecks the payments to verify the correct amount during the whole year.

Question 2.

Why is the balance confirmation letter important?

Answer:

Confirmation can be a successful device for getting examining proof for certain cases identified with budget summaries like presence claims in the event that it is arranged and utilized appropriately. For example, the confirmations identified with receivable records offsets can furnish us with persuading proof about presence claims.