Advantages and Disadvantages of Online Trading: Online trading is a prevalent process for the online transaction of financial products. Brokers are now providing different financial instruments, like bonds, stocks, ETFs, commodities, etc., on their online platforms.

What is Online Trading? Advantages and Disadvantages of Online Trading 2021?

Previously, a buyer had to call his brokerage firm to ask them to request to buy stocks of a specific company. Then the broker would have informed him about the price, and then the transaction would have taken place. It was a pretty long method.

But now, the online trading platform has become popular due to its various advantages. It also provides profitable deals. However, there are a few drawbacks to internet trading.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

To better understand online trading, this article will talk about the advantages and disadvantages of online trading.

- Advantages of Online Trading

- Disadvantages of Online Trading

- Comparison Table for the Advantages and Disadvantages of Online Trading

- FAQs on the Pros and Cons of Online Trading

Advantages of Online Trading

- Elimination of intermediaries: With the help of online trading, direct transactions are made. This results in the complete avoidance of a broker. Visiting a broker’s office and asking them to buy a sale is a tiresome and lengthy process. You can avoid all these with online trading. For someone unable to finance a broker, online trading is the best option available to them.

- Fast transactions: The amount deposition becomes easier since immediate deposition can be done from the linked bank account to the other account for shares. The profit after-sale can also be quickly deposited in the connected bank account. On top of that, the best thing is that one can carry out all this information from the comfort of their home since everything is online. You can also check the transaction details instantly and at any time you want.

- Monitor investments all the time: The online trading platform provides a lot of very advanced tools. Mobile trading apps are available, which can help individuals stay in touch with the market and monitor their investments anytime they want. They can see their investment performance and can make their strategies and plans based on that. If there are fluctuations in the price in the market, one can immediately see it and plan things out based on that.

- Reduces costs: Online trading helps in reducing transaction costs. It also reduces the high fees paid to the broker. It is seen that $5 to $10 is required for buying and selling stocks online. The exchange trading funds are also bought at discounted rates given by the brokerages online.

- Customized support: On an online trading platform, trained and experienced executives are present. They provide tailored support for all their customers. They are ready to help at all times with even the littlest of issues. Whether it is a technical problem or having problems handling the online platform, they are always there to answer your concerns and help you. Investors can also set up SMS or emails to get notifications regarding the buying and selling of targets.

- One point access: There are several exchanges available in India. An investor can find any business in India where various commodities and securities are regularly traded. Some of the leading exchanges that are leading in India are:

- Bombay Stock Exchange

- The National Commodity and Derivatives Exchange

- The Multi Commodity Exchange and

- National Stock Exchange

Therefore, an online trading account helps an individual get instant access to these leading exchanges through a shared trading platform that helps in the wealth creation of investors.

Disadvantages of Online Trading

- Overinvesting: Online trading is straightforward to learn. Since the learning process is much easier, investors may end up spending a lot of money in very little time. This may also lead to overinvesting. There are high chances that investors will make poor decisions regarding their investment choices. The Securities and Exchange Commission also warned traders that even though trading online requires a nanosecond, you should make accurate investment decisions.

- Incomplete trading: In online trading, investors may have the misconception that their trade was insufficient. This misconception might lead them to make their trade again, double the cost they had to pay. Assuming that the business was incomplete without initially seeing confirmation of the fact is also a mistake.

- The personal relationship with brokers is missing: Since online trading eliminates intermediaries, the relationship between an investor and a broker also diminishes. Previously, brokers helped investors understand the feedback mechanism results and how they affected the market. But in online trading, from creating an investment strategy to understanding feedback mechanisms, everything has to be managed by the investor alone.

- Dependency on the internet: As the name says it all, if one has no internet connection, then doing trading online is impossible. The process of online trading is entirely internet-based. If, while investing in an important trade, an individual’s internet connection is slow, they might lose out on that particular trade, which may cause a considerable loss.

- Addictive: Online trading is highly addictive. According to a study published in Addictive Behaviours journal, online trading can lead one to experience a specific high, which is quite similar to the experience of gambling. The study also states that short-term trading strategies are chosen by investors, which includes investing in extremely risky stock offerings. The offerings might bring in huge profits, but simultaneously there is a high risk of loss.

- Poor customer service: An investor might have to wait longer than usual to place a trade during volatile markets because certified traders cost money. Also, if the individual’s internet connection is down, they must place specific trades over the phone, which is not always possible. There is also a chance that the brokers might prioritize high-net-worth clients, which will make the average investors wait for a long time.

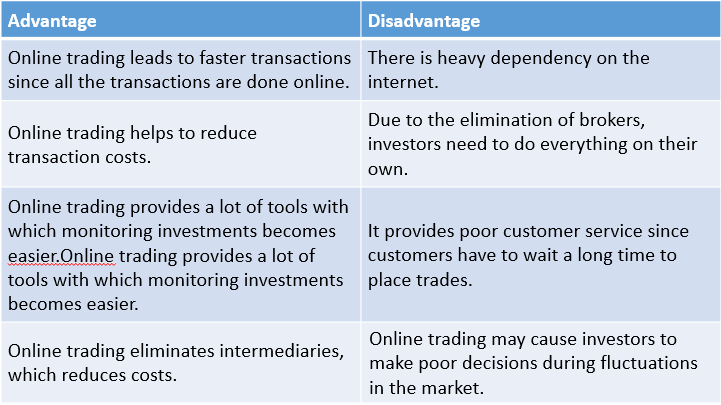

Comparison Table for Advantages and Disadvantages of Online Trading

| Advantages | Disadvantages |

| Online trading leads to faster transactions since all the transactions are done online. | There is heavy dependency on the internet. |

| Online trading helps to reduce transaction costs. | Due to the elimination of brokers, investors need to do everything on their own. |

| Online trading provides a lot of tools with which monitoring investments becomes easier. | It provides poor customer service since customers have to wait a long time to place trades. |

| Online trading eliminates intermediaries, which reduces costs. | Online trading may cause investors to make poor decisions during fluctuations in the market. |

FAQ’s on Pros and Cons of Online Trading

Question 1.

Is the involvement of brokerage firms still present?

Answer:

Even if the customers place orders through the internet, they do not have direct access to the securities market and, thus, a brokerage firm is needed to execute their trade orders.

Question 2.

How to ensure safety while trading online?

Answer:

To ensure safe online trading, you must:

- Consider online safety and browsing the internet safely.

- Use a VPN connection that is secured.

- Avoid easy passwords and choose strong passwords for safety.

- Verify the information you provide

- Be careful of stock spam

Question 3.

What is the process of online trading?

Answer:

Firstly, a Demat and trading account needs to be opened with a stockbroker. Once the account is opened, you can log in and add money to your trading account through your bank. Now you can buy and sell shares online using your trading account. The trading account is also used to view historical data, stock prices, and fluctuations in the market.