Private Limited Company Advantages and Disadvantages: Private limited companies, as defined in Section 2 (68) of The Companies Act, 2013, are companies with limited liability and are held privately. They do not freely transfer their shares to the public as other public companies do. A private limited company has all its profits and liabilities belonging solely to the company and investors may not be responsible for the company’s debts.

A private limited company is generally owned by small businesses. A private limited company’s members have limited liability based on the number of shares they own, and the company shares cannot be traded publicly.

Private Limited companies are the most popular form of business registration in India since they are easy to set up, provide limited liability protection to shareholders, have the ability to raise equity funds, and are considered separate legal entities. Thus, millions of small and medium-sized businesses, whether family-operated or managed by professionals, have set themselves up as Private Limited companies. This article examines private limited companies and discusses them in detail.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is a Private Limited Company? Advantages and Disadvantages of Private Limited Company 2022

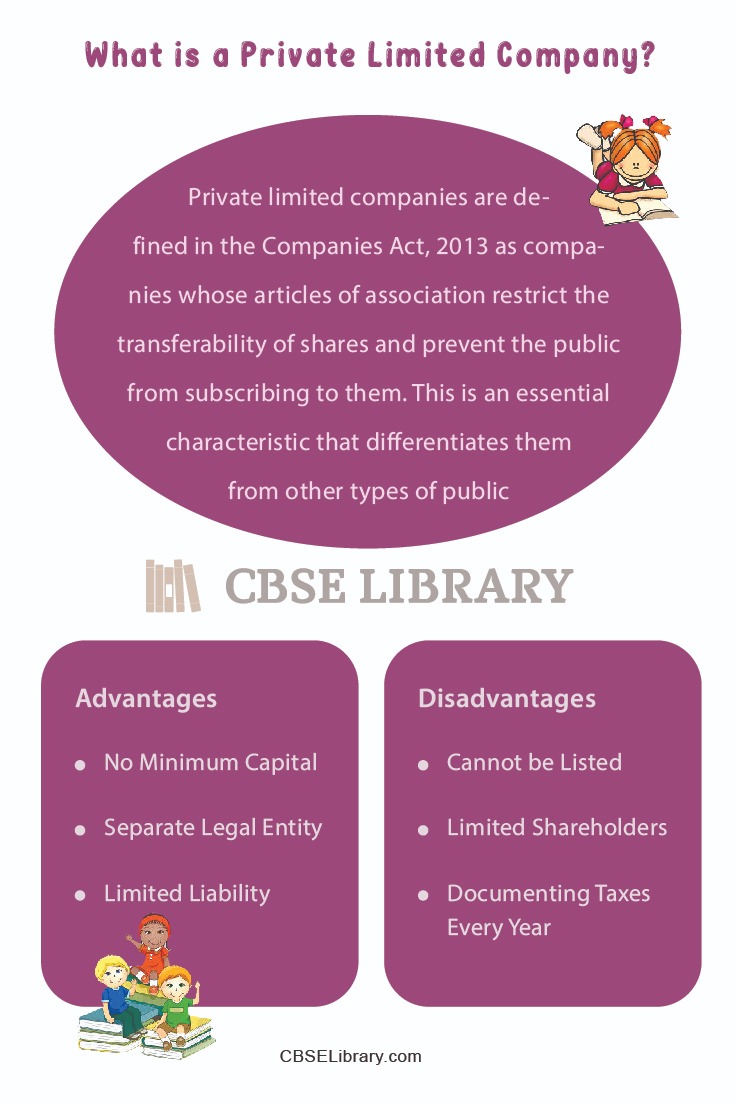

Private limited companies are defined in the Companies Act, 2013 as companies whose articles of association restrict the transferability of shares and prevent the public from subscribing to them. This is an essential characteristic that differentiates them from other types of public companies.

A minimum of two directors and a maximum of fifteen directors are required for a private limited company. At least two shareholders are required for the legal distribution of shares and up to a maximum of two hundred shareholders.

- Advantages of Private Limited Company

- Disadvantages of Private Limited Company

- Comparison Table for Private Limited Company Advantages and Disadvantages

- FAQ’s on Private Limited Company Advantages and Disadvantages

Characteristics of Private Limited Company

- Members: According to the Companies Act of 2013, a minimum of two members and a maximum of 200 members are necessary to form a corporation.

- Paid-up capital: It must have a minimum paid-up capital of Rs 1 lakh or a greater amount as determined by the Board from time to time.

- Minimum subscription: The minimum subscription is the amount obtained by the corporation that equals 90% of the shares issued within a specified time period. If the company does not obtain 90% of the funds, it will be unable to continue operations. A private limited corporation can issue shares to the public without requiring a minimum subscription.

- Name: The word “private limited” must appear after the name of any private company.

- Limited liability: Each member’s or shareholder’s liability is limited. It means that if a firm experiences a loss in any way, its shareholders may be forced to sell their own assets to make up the difference. The shareholders’ personal assets remain unaffected.

- Perpetual succession: In the perspective of the law, the corporation continues to exist even if one of its members dies, becomes insolvent, or declares bankruptcy. As a result, the company can continue to exist indefinitely. The company’s existence will continue indefinitely.

Documents Required for forming a Private Limited Company

Memorandum of Association: The aim of forming a company, the type of the firm, the company’s goal, and the capital clause are all discussed in the memorandum of association. It is a corporate document that defines a company’s relationships with shareholders and specifies the company’s goals. It is also referred to as a charter of the company.

Article of Association: The internal operating system of the business is discussed in this document. It goes over the management process, each member’s tasks and obligations, dividend policy, shareholder meetings, and director appointments.

After submitting the essential paperwork for registration, the directors obtain a certificate or licence. The Registrar of Companies (ROC) in India issues this document, which serves as the primary means of company authentication.

Other documents: ID proof (PAN card, Aadhaar card), address proof (ration card, voter id), rental agreement, NOC from the property owner, and a copy of the sale deed for the held property for all directors and shareholders of the company are among the other documents.

Advantages of Private Limited Company

No Minimum Capital: It is possible to form a Private Limited Company without a minimum capital requirement. The Authorized Share Capital of a Private Limited Company might be as low as Rs. 10,000.

Separate Legal Entity: In the eyes of the law, a Private Limited Company has a distinct legal personality, which means the company’s assets and liabilities are distinct from the Directors’ assets and obligations. Both are counted separately. Management and ownership are separated in a Private Limited Company, thus managers are liable for the company’s success as well as its failure.

Limited Liability: Because a person’s liability is restricted, the personal assets of members will not be used to pay the company’s debts if the firm becomes financially distressed for whatever reason.

For example, if a Private Limited Company accepts a loan and is unable to repay it, the members are only liable to pay the number of their shares, i.e. the unpaid share value, towards their own shareholding. This means that if you have no outstanding balance due on the number of shares you own, you are not liable for any debt owed to the company, even though the debt/credit balance is still owed.

Secrecy: A private limited company is essentially a family concern. It is not necessary to make its activities and judgments widely known. It is not compelled to publish its financial statements or keep them open to public review. As a result, it is in a better position to keep the secrecy of its economic activities.

Disadvantages of Private Limited Company

- Cannot be Listed: Shares in the stock market cannot be cited, which means that the posting of organisations for the initial sale of stock is not possible.

- Proprietorship Division or Ownership Division: A notable impediment to a private restricted organization’s consolidation is that it requires at least two executives and investors, resulting in the division of offers.

- Documenting Taxes Every Year: It’s crucial to keep track of your records at Companies House every monetary year, as they’ll be public. The majority of the time, a Chartered Account is used to document the evaluations for your private restricted business.

- Limited Shareholders: The number of investors or persons in a Pvt Ltd or Private Limited Company cannot exceed 50.

Comparison Table for Private Limited Company Advantages and Disadvantages

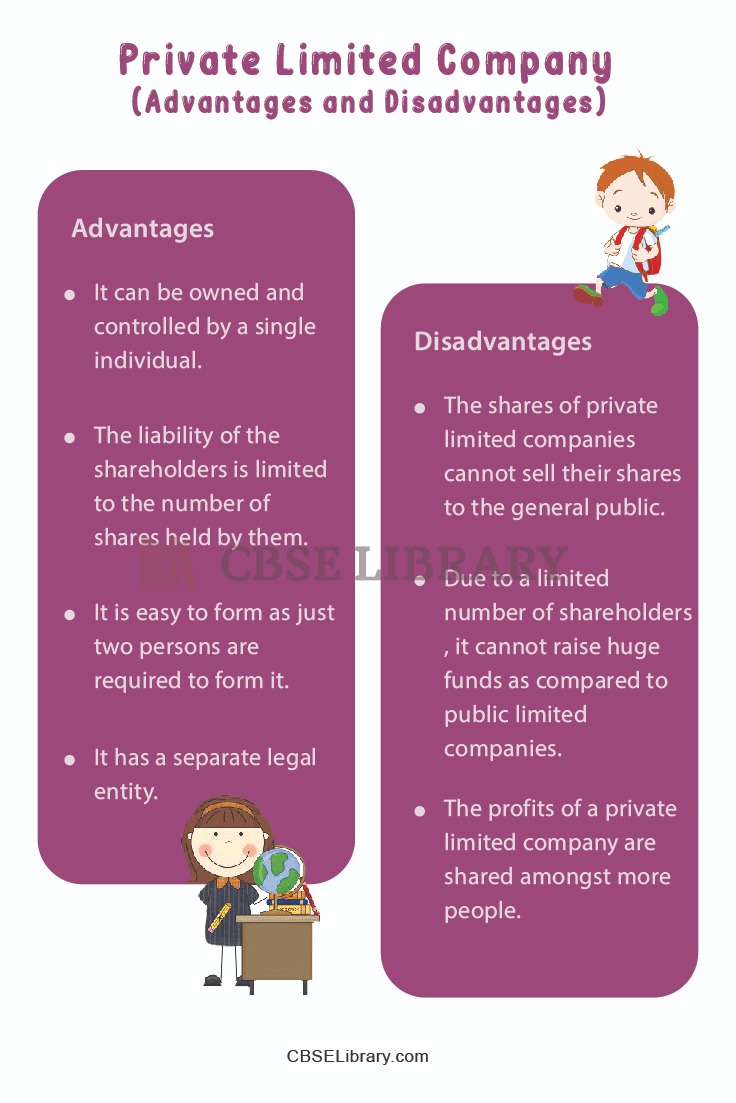

| Advantages | Disadvantages |

| It can be owned and controlled by a single individual. | The shares of private limited companies cannot sell their shares to the general public. |

| It has a separate legal entity. | Due to a limited number of shareholders, it cannot raise huge funds as compared to public limited companies. |

| The liability of the shareholders is limited to the number of shares held by them. | The profits of a private limited company are shared amongst more people. |

| It is easy to form as just two persons are required to form it. It can also begin operations as soon as it is incorporated. | It is not easy and simple to transfer shares of a private limited company. |

FAQ’s on Private Limited Company Advantages and Disadvantages

Question 1.

What are the minimum Requirement to start a Private Limited Company?

Answer:

There must be a minimum of two adult directors.

The Directors of a Private Limited Company should be Indian citizens and Residents of a country.

- A foreign national could be one of the other directors.

- Two shareholders are also required for a firm to exist.

- Shareholders might be individuals or legal entities.

Question 2.

Who owns a Private Limited Company?

Answer:

Private Limited Companies are privately held businesses. They are owned by their shareholders, and the total number of shareholders cannot exceed 200.

Question 3.

The number of directors a Private Limited Company has?

Answer:

At least one director and one incorporator are required for a private company. The directors and incorporators may be the same person, But, the word “person” includes a legal entity, Which means a trust or a legal entity can be the incorporator of a new company.

Question 4.

Is it possible for a single person to run a Private Limited Company?

Answer:

It is possible for an individual to form a private limited company as its sole shareholder and director or a private limited company can be formed with multiple shareholders.