PACL Bank Verification Letter: The full form of PACL is Pearls Agrotech Corporation Limited. PACL refund status can be checked by the customers by visiting www.sebipaclrefund.co.in. They can also call on the helpline number – 022 61216966 or email at [email protected]. The format of the PACL refund document will be available in pdf, jpg, or jpeg. Only Policy Holder, Guardian and Nominee are eligible to apply for PACL refund. PACL Banker’s Verification Letter is pertinent to all banks. To get SEBI PACL Refund, you need to present Banker’s Verification Letter.

R.M. Lodha Committee is that board of trustees that was framed by SEBI to investigate the question of Subrata Bhattacharya versus SEBI and in other related matters following the bearings of the Hon’ble Supreme Court of India. The Lodha Committee has selected the Chairmanship of the previous Chief Justice of India, Hon’ble Justice R.M. Lodha. The Committee declared to auction and discard every one of the properties of PACL, in any case, the discounts interaction. As guaranteed, SEBI India has discounted more than 1 lakh financial backers whose asserting sum really depended on Rs. 2500 and presently SEBI has welcomed guarantee applications from petitioners who contributed more than Rs. 2500 in PACL properties.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

SEBI has delivered every one of the insights about the PACL properties seized. Around 29,000 such properties, 13,863 extra properties have been seized and deal continues are in progress. This plainly suggests SEBI currently has that much add up to repay discounts to every one of the financial backers. In this, the second round of discounts has started and inquirers can record their discount claims till April 30th, 2019. Certain individuals accept that this is plainly being done to win a few votes as the Lok Sabha races are expected in May. That may be the situation, yet at this moment we ought to just zero in on the continuous discounts process so not so much as a solitary update on PACL discounts is missed.

- PACL Bank Verification Letter Format

- How to Download PACL Bank Verification Letter?

- How to Apply for PACL Refund?

- Things to Know About PACL Bank Verification Letter

- FAQ’s on PACL Bank Verification Letter

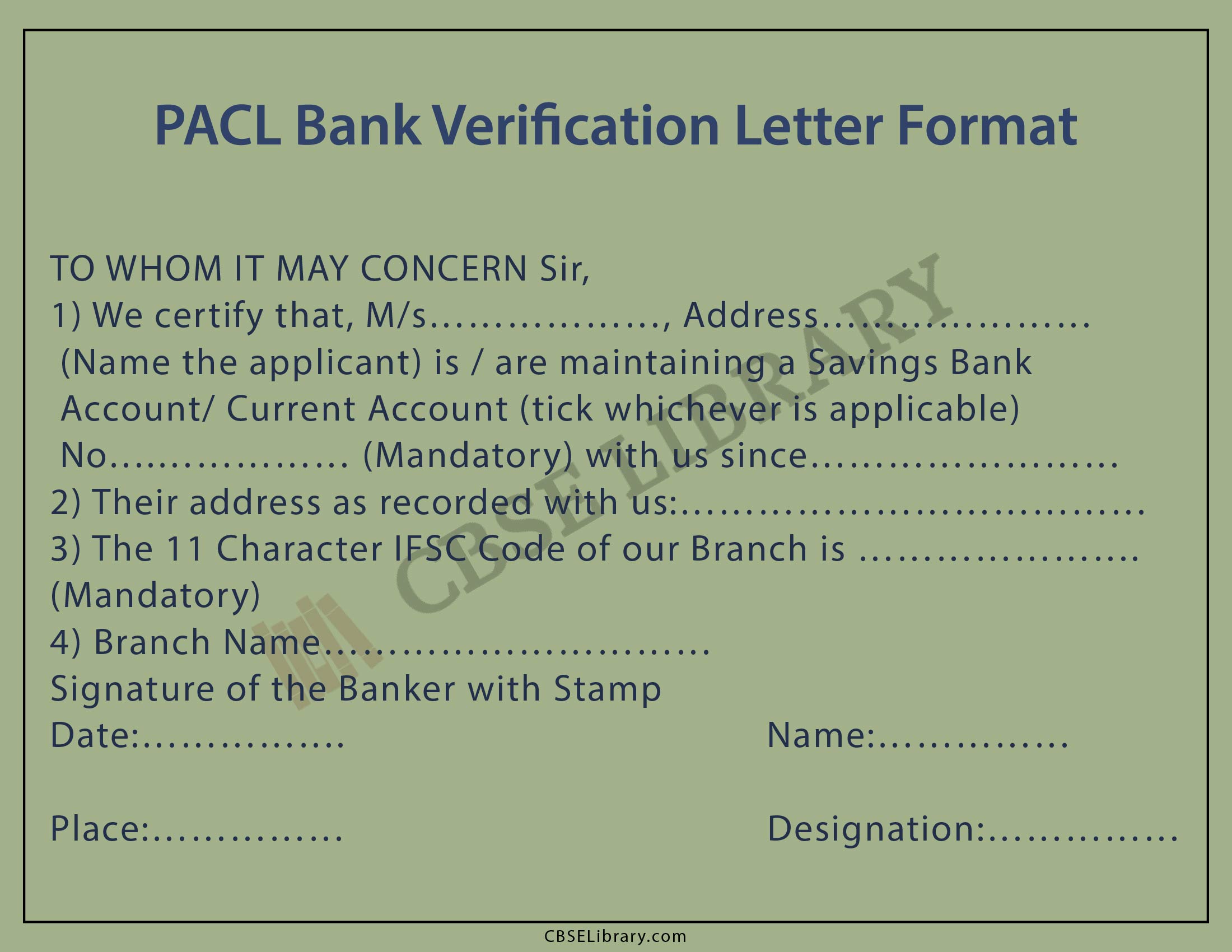

PACL Bank Verification Letter Format

To get the SEBI PACL refund from the back, one has to write the application letter to the bank. Below is the format one can follow to write the letter.

PACL Bank Verification Letter Format TO WHOM IT MAY CONCERN Sir, 1) We certify that, M/s……………………, Address……………………… (Name the applicant) is / are maintaining a Savings Bank Account / Current Account (tick whichever is applicable) No….…………… (Mandatory) with us since…………………………………… 2) Their address as recorded with us:………………………………………… 3) The 11 Character IFSC Code of our Branch is ……………………….(Mandatory) 4) Branch Name………………………… Signature of the Banker with Stamp Date:……………. Name:……………………………………… Place:…………… Designation:…………………………….. |

How to Download PACL Bank Verification Letter?

- Go to official website i.e www.sebipaclrefund.co.in .

- Click on Bank Verification Letter link from the Downloads section

- It will be redirected to a different webpage where SEBI PACL Refund Banker’s Verification Letter PDF will be displayed.

- Click on the Download option

- Print the application letter and fill the required details

How to Apply for PACL Refund?

- Go to the homepage

- Click on register, mention your registration number, mobile number and enter the captcha.

- Click on send OTP

- Once received the OTP, enter the details and click on verify

- Enter the password for about 8 or more than 8 using letters and numbers

- Reconfirm your password by entering it again

- Click on register

- Your screen will show Registration Completed Successfully

- Now, click on login and enter the registration number and password

- Upload the required documents such as PAN card, Photo, chequebook/passbook, PACL certificate and receipt.

- Submit the documents

Things to Know About PACL Bank Verification Letter

- The current interaction doesn’t conceive a case application being made by a chosen one or a lawful successor. Likewise, just application for self can be made in the current cycle. Any choice, whenever taken by the Committee, concerning the receipt of guarantee applications from chosen people or legitimate beneficiaries, will be told at the appointed time.

- You can make a case application regardless of whether the Name on the PAN card varies with the Name showing up in the PACL certificate(s). You need to enter your Name as referenced on the Skillet card in the field for PAN Name, the Name as showing up in the PACL authentication in the field for PACL Certificate Name and transfer the supporting reports in the field given.

- The narrative confirmations as endorsed must be submitted with the case application, for the said guarantee application to be a substantial application. Subsequently, you want to apply for a PAN Card for the sake of the minor. The Income Tax Department has not referenced an age limit for benefiting a PAN card, and that implies that even minors are qualified to apply for it.

- The choice of discount will be taken by the Committee in the wake of checking the cases made by the candidate investor(s). The Committee will discount the amount(s) contributed, depending upon the corpus accessible with the Committee, on the premise to be chosen by the Panel. Instalment of interest isn’t conceived at this stage.

- The case sum is the aggregate sum that is determined after adding the sums as showing up in every one of the exceptional receipts of instalment regarding a specific PACL Enrollment Number. The case sum so entered by the financial backer in the case application structure is expected to be upheld by transferring the checked duplicate of the relating authentication given by PACL for the said PACL Registration number alongside the examined duplicate of the relating extraordinary receipt (s) of installment. For more noteworthy lucidity, if it’s not too much trouble, allude to the discount video. Further, the first of the checked duplicates transferred ought to be accessible to the financial backer. It is additionally explained that the development sum isn’t the cash sum.

- The Committee has not imagined any installments against lost or lost bond endorsements or potentially receipts at this stage.

- In the current course of getting guarantee applications, the financial backer presenting a case application ought to be in control of the first bond declaration and unique exceptional receipt(s) of installment, and will transfer the examined duplicate of the bond authentication alongside the checked duplicates of the remarkable receipt(s). Likewise, to present a case application, any covetous financial backer will need to transfer the filtered duplicates of the above records and be in control of the individual unique reports. For more prominent clearness, if it’s not too much trouble, allude to the discount video. The Committee has not conceived any installments against any affirmation given by PACL at this stage.

FAQ’s on PACL Bank Verification Letter

Question 1.

What is the format to write the PACL bank verification letter?

Answer:

Applicant should mention his/her name, address, account number, date of banking started, IFSC code, branch name, name, designation, date, place and signature.

Question 2.

What is PACL?

Answer:

PACL (Pearl Agrotech Corporation Limited) had fund-raised from people in general for the sake of horticulture and land organizations. SEBI observed that PACL had gathered over Rs 60,000 crore through illicit aggregate speculation plans (CIS) north of 18 years.

Question 3.

Why PACL was banned?

Answer:

The PACL Company, notwithstanding, has been restricted and boycotted in 2015 by SEBI. It was done on discovering that Pearls had tricked more than 58 million financial backers who had put their well-deserved cash in PACL. You might have a hard time believing SEBI had likewise brought up the issue about the working of PACL in 1999 however the data submitted to the high court was not adequate. PACL continues to maintain its business and SEBI again returned to the high court with more solid data that PACL is running a PONZI plot.