Mobile Banking Advantages and Disadvantages: At present mobile banking is spreading very rapidly around the globe. It is an application installed on a smartphone by which we can use services provided by the bank. Almost every bank offers a mobile application to its customers. More and more customers use the services. It is really helpful for easy credits and debits in one click. It comes with so many advantages and also some disadvantages. All smartphone users can easily access mobile banking. It saves the time and energy of the customers because we do not have to go to the bank every time for the services and we can do the same from our mobile phones.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Mobile Banking? Mobile Banking Advantages and Disadvantages 2022

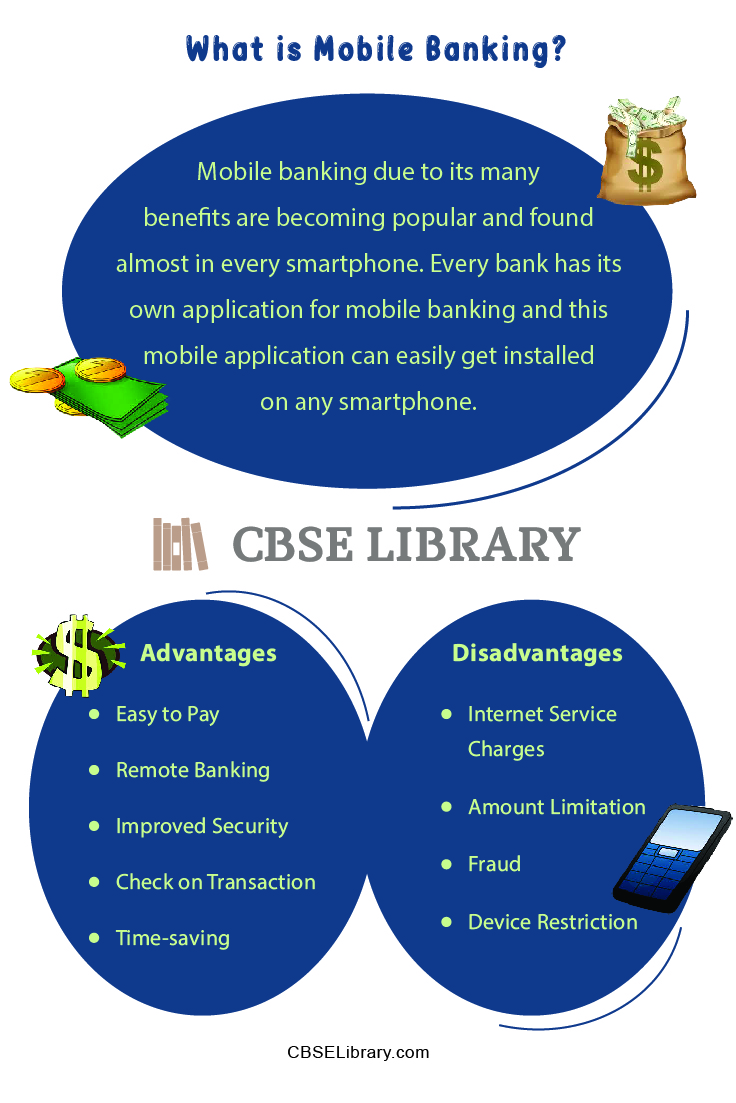

Today mobile banking is spreading very fast across the globe. Mobile banking due to its many benefits are becoming popular and found almost in every smartphone. Every bank has its own application for mobile banking and this mobile application can easily get installed on any smartphone. After installation, we have to create a username or user Id and password so that we can access the mobile banking app safely. Using the mobile banking service is securely safe. The various facilities that are provided by the bank in a mobile bank app are getting updates about the bank, bank statements, depositing checks, debits, and offers.

It is a better option to pay someone instead of visiting an ATM to get the money we can easily do it in mobile banking. So in a blink, we can transfer funds from one bank account to another bank account. In the recent situation when the covid cases were increasing mobile banking was used by everyone across the globe which made people easily shop or transfer funds without coming in contact with each other. The best benefit of mobile banking is the availability for 24 hours whereas normally banks open for a limited time. Also, it is an easy way to keep a check on your money usage. But it has some disadvantages also like it is totally internet-dependent and security can be a big concern.

Let us see in detail the various advantages and disadvantages in detail.

- Advantages of Mobile Banking

- Disadvantages of Mobile Banking

- Comparison Table between Mobile Banking Advantages and Disadvantages

- FAQs on Mobile Banking Pros and Cons

Advantages of Mobile Banking

There are many advantages of mobile banking. It is used by millions of people worldwide. During covid mobile banking became an essential part of everyone’s daily routine. Let us see some of the advantages of mobile banking which are as follows

- Easy to Pay: When we want to buy something we have to look for cash or an ATM to take out cash but when we have mobile banking it becomes very easy and quick. Mobile banking help in easy cashless payments. We can pay for shopping, rent, and paying bills, and very useful while travelling. We also do not have to worry about the exact amount available or not if we have money in the account we can easily pay without thinking much about the cash and change.

- Remote Banking: Since this is a mobile app banking it is convenient to take everywhere we want and use it wherever possible. Thus it is beneficial when we are on travel and we do not have much cash with us then mobile banking is really helpful. We do not have to search for ATMs and Banks.

- Improved Security: Mobile banking is very safe to use. It requires authentication every time while using it. Banks also update their app on a regular basis so the security feature must be up to date without any worry. It is safer than internet banking.

- Check on Transaction: Mobile banking is an easy way to keep a check on our expenses. Every time we make any payments we can easily check the statement and where the money was spent.

- Time-saving: As it is available on our smartphones we can easily access it anywhere and for money, we don’t need to go to the bank or ATMs. Thus it saves a lot of time as traveling time is saved and standing in a queue is also reduced.

- No Time Limit: Usually banks are open and close at a particular time but mobile banking gives the facility for 24 hours from any place. There is no time limit for using mobile banking which makes it better.

Disadvantages of Mobile Banking

Mobile banking has many advantages but there are some drawbacks. Let us discuss the disadvantage of Mobile banking which are as follows

- Internet Service Charges: Mobile banking is totally dependent upon the internet facility. If this facility is affected then mobile banking will also get disturbed. When the network is good then we can easily use the services otherwise we cannot access it. Thus this is the biggest disadvantage of mobile banking.

- Amount Limitation: in this, we cannot transfer funds above the given range by the bank. if we want to transfer a big amount at once then it is not always possible by mobile banking. There is a limitation on the amount of fund transfer.

- Fraud: In mobile banking, there is a chance of fraud because it is technology-based and many unauthorized people want to make benefit from doing fraud. Some people get into the trap and lose money.

- Device Restriction: Not all smartphones are able to install the mobile banking app. Thus it is restricted to some smartphones that have the facility to install the app. All the devices cannot access the app which is one of the limitations of mobile banking.

These were some of the advantages and disadvantages of mobile banking.

Comparison Table between Mobile Banking Advantages and Disadvantages

| Mobile banking advantages | Mobile Banking Disadvantages |

| Easy to use and good in instant payment | Without the internet cannot be accessed |

| We can access it from any place around the world | Limited amount can be transferred |

| We can trust on bank security facility of the app | Chances of fraud is more |

| We can keep a check on the transaction | Not accessible in all mobile phones |

| Available 24 hours | Installation charges may apply |

In comparing mobile banking advantages and disadvantages we can see there are more advantages than disadvantages so we can easily use it with some precaution.

FAQs on Mobile Banking Pros and Cons

Question 1.

What is Mobile banking? How can we use it?

Answer:

Mobile banking is an application provided by many banks installed on a smartphone by which we can use services provided by the bank. Almost every bank offers a mobile application to its customers. More and more customers use the services. It is really helpful for easy credits and debits in one click. It comes with so many advantages and also some disadvantages.

After installing the app, we have to create a username or user Id and password so that we can access the mobile banking app safely. Using the mobile banking service is securely safe. The various facilities that are provided by the bank in a mobile bank app are getting updates about the bank, bank statements, depositing checks, debits, and offers.

Question 2.

What is the benefit of using mobile banking?

Answer:

There are many advantages of mobile banking which are as follows

Easy to use: When we want to buy something we have to look for cash or an ATM to take out cash but when we have mobile banking it becomes very easy and quick. Mobile banking help in easy cashless payments.

Improved Security: Mobile banking is very safe to use. Banks also update their app on a regular basis so the security feature must be up to date without any worry. It is safer than internet banking.

We can keep a check on Transactions: Mobile banking is an easy way to keep a check on our expenses.

Available 24 hours: There is no time limit for using mobile banking can be used for 24 hours which makes it better.

Question 3.

What are the limitations of mobile banking?

Answer:

The following are the limitation of mobile banking:

- Without internet service cannot be accessed

- Only some amount of transaction which is in the range is allowed

- Installation charges may be applied

- We must beware of fraud