Insurance Advantages And Disadvantages: Insurance is probably the most talked-about burning topic always, and it has gripped even more in the market since the corona period started. Insurance can be understood as a type of contract between a company and an individual. In this, the concerned individual can ensure the financial reimbursement against the life loss or the loss to the company or business. In the contract, the customer has to pay the premium amount to the company, and then the company will return the payments in any type of emergency, for example, the accident, death, damage, financial or company loss, etc.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is an Insurance? What are the Advantages And Disadvantages of Insurance?

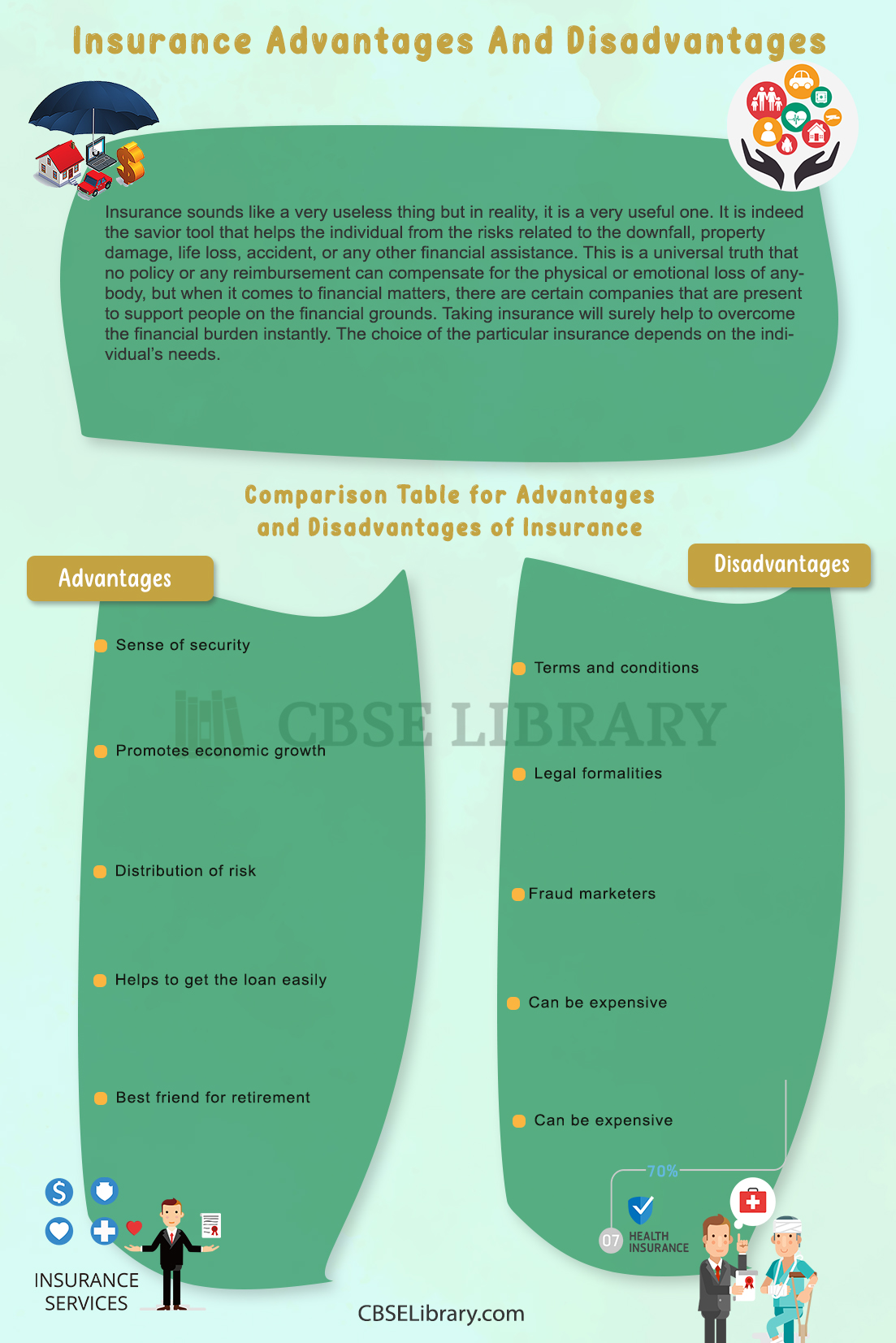

Insurance sounds like a very useless thing but in reality, it is a very useful one. It is indeed the savior tool that helps the individual from the risks related to the downfall, property damage, life loss, accident, or any other financial assistance. This is a universal truth that no policy or any reimbursement can compensate for the physical or emotional loss of anybody, but when it comes to financial matters, there are certain companies that are present to support people on the financial grounds. Taking insurance will surely help to overcome the financial burden instantly. The choice of the particular insurance depends on the individual’s needs.

- Advantages of Insurance

- Disadvantages of Insurance

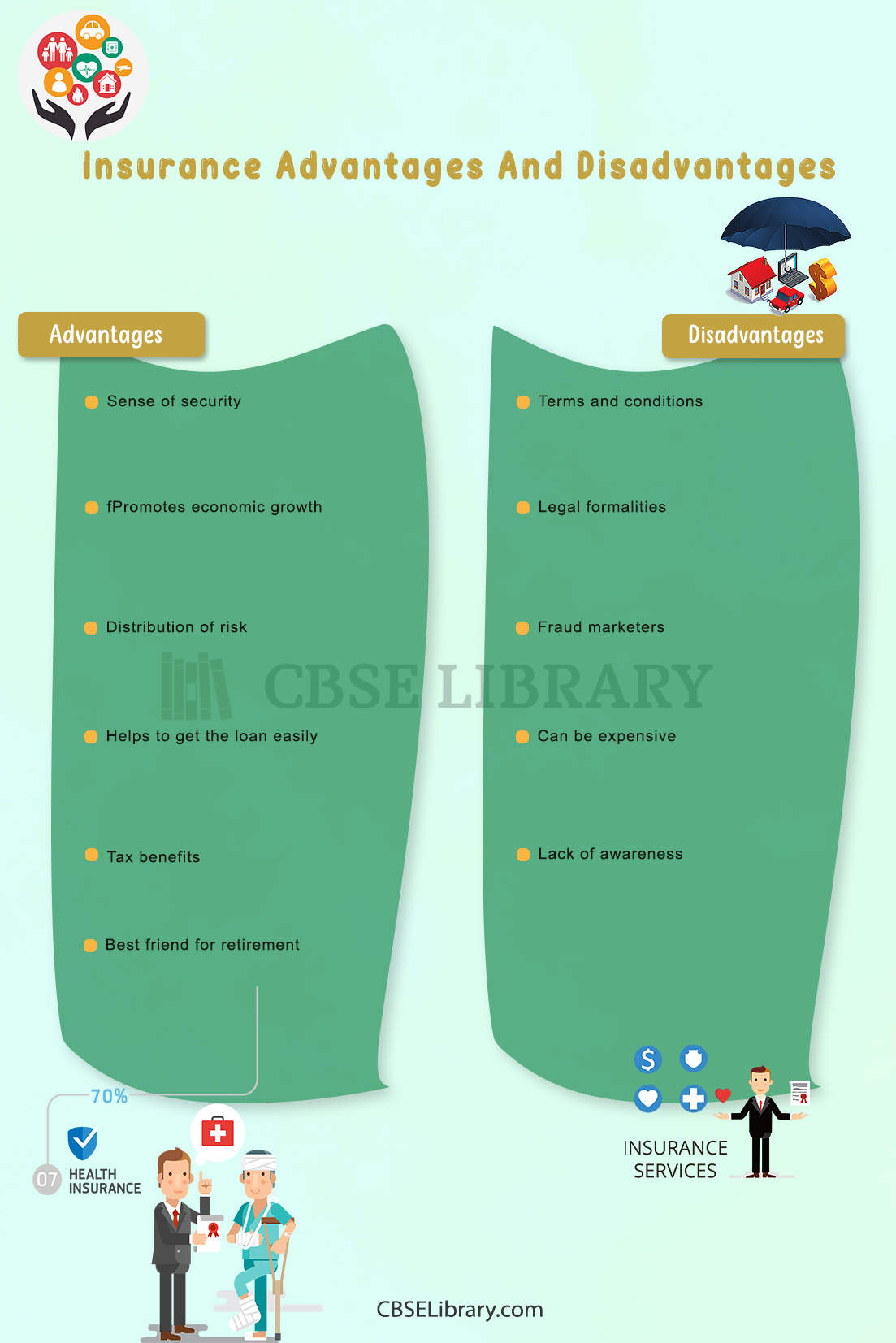

- Comparison Table for Advantages and Disadvantages of Insurance

- FAQ’s on Insurance Advantages And Disadvantages

How Does Insurance Work?

As we already understood that insurance is a legal undertaking between the policyholder and the insurance company which holds both of them together. The agreement paper has all the details regarding the conditions under which the individual is authorized to claim the insurance benefits. Insurance is the method to protect ourselves from any type of financial crisis. It can be either for life, a business entity, or any type of finance-related entity. In this case, you have to buy an insurance policy, and the rest of the other risks are at the side of the company. The company provides you with the insurance cover at the time of need.

Under any circumstances, the registered insured person or the nominee on the behalf of the insured person can claim the insurance. Seeing the conditions, matching with the criteria, if they match, then the insurer settles the claim. In case you don’t claim any insurance during the period specified, you won’t be benefitted from any type of money reimbursements.

Types of Insurances

Life has no certainties. You may encounter any mishappening at any point in time. To avoid such conditions, insurance companies are present to help you in incidents to minimize the financial burden. There is a wide range of insurances of specific domains that can be claimed by the individual to safeguard themselves.

- Life insurance: Any person, who has dependents on him or her, would never want their loved ones to get distraught. Life insurance is the master key and savior to such an insured. In life insurance, the nominee gets the assured sum coverage on behalf of the person insured in case of accident or death.

- Motor insurance: This type of insurance helps to recover the damage of any motor vehicle (primarily classified into three categories- the two-wheeler, car, and commercial vehicle insurance). Motor insurance assists in case of accidents in your motor vehicle.

- Health insurance: Health has become the most important concern, especially after the arrival of covid. Therefore, keeping the constantly increasing expensiveness in mind the insurance companies offer the facility of the health insurance where the insured can claim the coverage from the company in case of any emergency or medical urgency.

- Property insurance: Property insurance is for the building, homes, or any other immovable property, which if in a worst-case scenario, collapsed or got damaged due to any reason, can be claimed if insured by a legit company. Bonus to this, the insurance also safeguards the properties inside the building.

- Accident and disability insurance: Accidents are miserable. In case of any worst accident, the rider gets injured badly and gets victimized to any temporary or permanent disability the ability to earn becomes zero. In such a case, the insurance provides the stability to the family.

Advantages of Insurance

- Sense of security: Insurance is surely a savior to the people. It helps in providing security from the uncertainties of life. Being insured gives a sense of security that even in the reversed condition the family won’t suffer.

- Promotes economic growth: The insurance process is of great economic help to the government as well as provides employment also. The insurance funds are used in government projects, in addition to the direct and indirect taxes.

- Distribution of risk: The working pattern of insurance is based on risk management. Hence, the risk involved is distributed evenly among individuals and organizations.

- Helps to get the loan easily: Insurance also provides the home loan cover. Instead of getting a home loan, you can have an insurance cover that helps to get the loan faster.

- Best friend for retirement: Some of the insurance plans provide pension plans too. They can be claimed as soon as the person retires.

- Tax benefits: As per Section 80(C) and 10(10D) of the Income Tax Act, if you buy the insurance policy and pay the premium regularly, you can save a good amount of money.

- Easy to apply: Applying for Insurance is no big deal. With advanced technology, today you can choose the best of the premiums after comparing them sitting back at home.

Disadvantages of Insurance

- Terms and conditions: The terms and conditions section in any document or agreement is the most hidden and unnoticed section. Most of the time T&C section is skipped by the reader, which results later in fraud or confusion.

- Legal formalities: Legal formalities are known for their long waiting processes. And same is the process with the insurance policy too. Sometimes it takes too long to get insurance.

- Fraud marketers: Since insurance has become the most important need of life, numerous fraudsters in the market cheat on people. Therefore, before getting insurance, make sure you get it from a reputed, registered, and safe firm.

- Can be expensive: Insurance policy can be expensive at times. Not all and not always, but some external factors may affect the cost of the premiums, hence buying the best premiums at the best time is beneficial to pocket also.

- Lack of awareness: Since policy culture is more prominent in urban culture, therefore the semi-urban and rural population gets detached from so many benefits of life.

- Conditions applied: The condition applied says that if the insured doesn’t suffer any type of loss, his paid premium wont be of any use, and he can’t claim the money.

Comparison Table for Advantages and Disadvantages of Insurance

| Advantages | Disadvantages |

| Sense of security | Terms and conditions |

| Promotes economic growth | Legal formalities |

| Distribution of risk | Fraud marketers |

| Helps to get the loan easily | Can be expensive |

| Best friend for retirement | Lack of awareness |

| Tax benefits | Conditions applied |

| Easy to apply |

FAQs on Insurance Advantages And Disadvantages

Question 1.

What are the components of Insurance?

Answer:

The components of insurance are-

- Premium

- Policy limit

- Deductible

- Special considerations

Question 2.

What is the bandwidth of insurance?

Answer:

The bandwidth of insurance is very wide and covers numerous factors, the most important are the accidents, and the loss of an earning member of the family.

Question 3.

Why do we need insurance?

Answer:

Insurance is required for the safety of the individual and family. Insurance helps to protect the individual, family, and financial losses by the insured coverages.

Question 4.

Who is the nominee?

Answer:

A nominee is a person in the family, whom the policyholder wishes to hold the financial help after his death.