ICSE Economics Previous Year Question Paper 2014 Solved for Class 10

ICSE Paper 2014

ECONOMICS

(Two Hours)

Answers to this Paper must be written on the paper provided separately.

You will not be allowed to write during the first 15 minutes.

This time is to be spent in reading the Question Paper.

The time given at the head of this Paper is the time allowed for writing the answers.

Section I is compulsory. Attempt any four questions from Section II.

The intended marks for questions or parts of questions are given in brackets [ ].

SECTION-I (40 Marks)

(Attempt all questions from this Section)

Question 1:

(a) Briefly explain two methods that increase land productivity. [2]

(b) What is meant by price elasticity of demand? [2]

(c) Distinguish between sunk capital and floating capital. [2]

(d) Give two reasons for consumer exploitation in India. [2]

(e) Distinguish between an entrepreneur and an organiser. [2]

Answer:

(a) The two methods that increase land productivity are as follows:

- Permanent improvements done on land by generating artificial means of irrigation i.e., wells, tubewells, canals, tanks etc. help to keep the water supply regular, have a positive effect.

- New inventions, modem and scientific methods of production like using high yielding varieties of seeds, manure, etc. have increased the production.

(b) Price elasticity refers to the degree of responsiveness of change in quantity demanded due to the change in its price. In certain cases, the change in demand may be at higher rates, in some cases, it may be lower and sometimes there may not be change.

(c)

| Basic | Sunk Capital | Floating Capital |

1. Meaning | Sunk capital is that category of capital, which can Be used to produce only one type of commodity or service. | Floating capital includes all such items which can be put to alternate uses. The use of such commodities is not restricted for any specific purpose. |

| 2. Examples | An ice factory, Oil Mill etc. | Money, fuels, etc. |

(d)

The reasons for consumer exploitation are as follows:

- Limited Information: Producers provide incomplete and incorrect information about various products.

- Low Literacy: Illiteracy leads to exploitation. Lack of consumer awareness is the root cause for exploitation.

(e)

| Basis | Entrepreneur | Organiser |

| 1. Venture | An entrepreneur sets up a new enterprise or undertakes a venture for his personal gratification. | A manager does not take a new venture and renders service in an existing exterprise. |

| 2. Risk Bearing | An entrepreneur assumes risk of economic uncertainty involved in the enterprise. | A manager does not assume or share any risk involved in the enterprise he is serving. |

Question 2:

(a) State two factors affecting the market demand of a commodity. [2]

(b) Mention two factors that determine the supply of labour. [2]

(c) What is meant by demand pull inflation? [2]

(d) “Progressive taxation is suitable for the Indian economy.” Give reasons to support your answer. [2]

(e) Distinguish between a tax and a fee. [2]

Answer:

(a) Factors affecting market demand are as follows:

- Price of the Product: As price rises, the demand falls and vice-versa.

- Consumer’s Taste and Preference: As tastes and preferences shift from one commodity to the other, demand for the first commodity reduces and that of the other commodity rises.

(b) Factors determine the supply of labour are as follows:

- Population: The larger the population, the larger will be the number of persons who are available for work. Hence, the large will be the supply of labour.

- Wage Rate: The higher is the wage rate the larger becomes the supply of labour. This is because the rise in the wage rate makes work economically more attractive.

(c) Demand-pull inflation occurs when the demand for goods and services exceeds the supply available at existing prices. i.e., when there is excess demand for goods and service. Demand increases rapidly because of increase in purchasing power/money in economy which exceeds the limited supply and will bid up the prices. This pull up the price level and will lead to emergence of inflation.

(d) Progressive taxation is suitable for indian economy because of the following reasons:

- It is more suitable, as a larger part is taxed on higher incomes. In this, the rich should be taxed at a higher rate than the poor.

- It is more economical as the cost of collection does not rise when the rate of tax increases.

(e) The two contingent functions of money are as under:

| Basis | Tax | Fee |

| 1. Meaning | Tax is a compulsory contribution, imposed by the government on its citizen without any direct benefit. | Fee is a payment paid by those who are benefitted from the special services rendered by the government. |

| 2. Nature | It is unilateral in nature. | It is bilateral in nature. |

Question 3:

(a) Give two reasons for an increase in public expenditure in recent times. [2]

(b) Distinguish between limited legal tender and unlimited legal tender. [2]

(c) Define simple division of labour. [2]

(d) Give the full form of COPRA. How does it benefit consumers? [2]

(e) Discuss any two contingent functions of money. [2]

Answer:

(a) Refer Ans. 3(b), 2016.

(b)

| Limited Legal Tender | Unlimited Legal Tender |

| The coins of smaller denominations are considered as limited legal tenders (say 1/2/5 rupee coins) because they are acceptable only for meeting financial transactions of lower value (say meeting your short distance bus/auto fare) | The rupee notes of higher denominations (say 100/500/1000 rupee notes) are considered as unlimited legal tenders because they can be used settling claims relating to high value transactions. |

(c) Refer Ans. 4(e), 2016.

(d) COPRA: Consumer Protection Act, 1986

This Act recognises six consumer rights. These rights are: Right to be protected, to be informed, right to choose, to be heard, to seek redressal, to consumer education. It has also established a redressal system unique in the world.

(e) The two contingent functions of money are as follows:

- Credit System: It is the money which provides the basis of entire credit system. Without the existence of money, important credit instruments like cheques, bills of exchange cannot be used.

- Distribution of National Income: It made the distribution of national income among factors of production possible because the production is the outcome of various factors. These factors are recorded in terms of money.

Question 4:

(a) Explain the function of Central Bank as a “Banker to the Government”. [2]

(b) Mention any two sources of External Debt. [2]

(c) State two differences between tax on income and tax on a commodity. [2]

(d) Draw a supply curve. [2]

(e) Briefly explain any one exception to the law of demand. [2]

Answer:

(a) As a banker to the government, the central bank makes and receives payments on behalf of the government whenever it becomes necessary. It also floats public debts and manages it for a shorter or longer period as the case may be, for the government.

(b) Two sources of External Debt:

- Foreign government.

- IMF/World Bank/Intemational Financial Institutions.

(c)

| Tax on Income | Tax on Commodity |

| 1. It is a direct tax. | It is an Indirect tax. |

| 2. It is progressive tax. | It is regressive tax. |

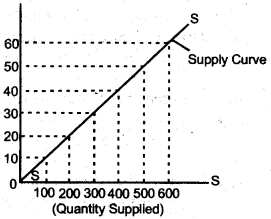

(d)

Supply curve is a graphical presentation of quantity supplied in market at various prices. On X axis, quantity supplied is taken whereas on Y-axis, different price level is taken. Supply curve has positive slope which shows direct and positive relationship between price and quantity supplied, i.e. if price increases supply increases, if price decreases, supply decreases.

(e) Status Symbol Goods: The purchase of such costly items adds to the status of the purchaser and in such a situation, the desirability of the goods is measured only by their price. The purchaser will only buy high priced goods.

Example: Diamonds, Rolex Watches, BMW Cars etc.

SECTION-II (40 Marks)

(Answer any four questions from this section)

Question 5:

(a) Define land. Explain four characteristics of land as a factor of production. [5]

(b) Define efficiency of labour.

Explain four factors that influence the efficiency of labour. [5]

Answer:

(a) In economics, the word ‘land’ is defined to include not only the surface of the earth but also all other free gifts of nature. For instance, mineral resources, forest resources and, indeed, anything that helps us to carry out the production of goods and services, but is provided by nature, free of cost. In fact, ‘Land is a stock of free gifts of nature.’

The features of land are as follows:

- Supply of land is fixed: The supply of land is fixed. It is given by nature. It is true that, from time to time, we can increase the quantity of operational land available in the country by clearing forests. However, the potentially available amount of land in the country is fixed.

- Production of land is costless: Another peculiarity of land is that, it does not have any cost of production. It is already there, ready to be used. All other agents of production have to be produced at a cost. For instance, labour has to meet his cost of living and his cost of training and education has also to be accounted for. Land, however, is a free gift of nature.

- Land is immobile: A third peculiarity of land is that, it is immobile. Land can not move in the sense in which labour or capital can. Therefore, there are persistent differences between the rent of land in different regions. Such differences may be caused by differences in fertility, location etc.

- Land is heterogeneous: Different types of land indicate wide variations in productive capacity. It depends on the chemical composition of the soil, availability of irrigatiorihl facilities, climatic conditions etc. Hence, some plots of land may be so infertile that cultivation is not worthwhile in such cases, while some other plots of land may be very fertile.

(b) Efficiency of labour implies the quality and quantity of goods and services which can be produced within a given time and under certain conditions. In other words, productive capacity of a worker is termed as efficiency of labour.

By ‘efficiency of labour1 means the productive capacity or productivity of labour.

The efficiency of labour depends on the following factors:

- Climatic Factors: Climatic differences also affect the efficiency of labour. Working under extreme climatic conditions is always more difficult than working in the temperate zones.

- Geographical differences: Locational differences also sometimes play a significant role. A person who has been bom and brought up in the plains, will find it hard to display much efficiency if he is forced to work at high altitudes hilly areas.

- Mental abilities: Mental abilities are also important. General training helps a worker in assimilating new skills and technical knowledge. Moral qualities also play a role in this connection. A worker is likely to be more efficient, the greater is his Sense of discipline, self respect, self-sufficiency, punctuality etc.

- Favourable Working conditions: A healthy and conducive work environment increases the level of efficiency. The facilities enjoyed by the worker determine labour efficiency to a significant extent. Employer-employee relations also plays an important part of the work environment. An employer, therefore, can contribute to labour efficiency by building a cordial relationship with his workers.

Question 6:

(a) Define capital formation. Explain three important stages of capital formation. [5]

(b) Draw a demand curve with the help of a hypothetical individual demand schedule. [5]

Answer:

Capital Formation: “Capital formation consists of both tangible assests like plants, tools and machinery and intangible Assets like high standard of education, health, scientific progress and research.”

Stages of Capital Formation:

A change in the stock of capital in any economy during any particular time period is called capital formation. The process of capital formation consists of the following steps:

- Creation of Savings: It is the first step in the process of capital formation. It is savings which are transformed into capital. If there is no saving, there can not be any capital formation, even if all other conditions are favourable for capital formation. Savings are done by households and it depends on their income and willingness to save.

- Mobilization of Savings: If savings are kept in the form of idle cash at home, they will not lead to capital formation. In this case, the rate of investment in the country will be low, even though the rate of saving is high. The savings must be mobilized from the savers. In a modern society, financial and other institutions as well as the capital markets perform this function. People may keep their savings in the banks or other financial institutions. They can also buy shares or bonds issued by companies.

- Investment of Mobilized Savings: Even mobilization of savings is not sufficient for a high rate of capital formation. The mobilized savings must be actually used by producers for-the purpose of investment. For instance, the money kept by the people in the banks must be lent out by the banks to the producers who can use the money, for ex., installing new machines in their factories.

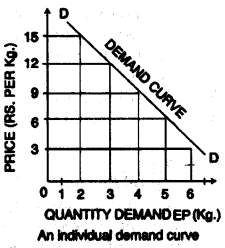

(b) According to Samuelson: “Law of demand states that people will buy more at lower prices and buy less at higher prices, (ceteris paribus) other things remaining constant.”

Demand Schedule: According to Prof. Marshall, demand schedule is a fist of prices and quantities. It is a tabular statement of price-quantity relationship between two variables.

| Price of Oranges (Rs. per kg.) | Demand by consumer (in kg) |

| 15 | 2 |

| 12 | 3 |

| 9 | 4 |

| 6 | 5 |

| 3 | 6 |

Demand Curves: The demand curve is a graphic statement or presentation of quantities of a commodity, which will be demanded by the consumer at various possible prices at a given period of time. Demand curve does not tell us the price. It only tells us how much quantity of goods would be purchased by the consumer at various possible prices. The demand curve will be:

Question 7:

(a) Define supply. Explain three reasons for the rightward shift of the supply curve. [5]

(b) Define public debt. Explain four types of public debt. [5]

Answer:

(a) Definition of Supply:

“Supply refers to the quantity of a commodity offered for sale at a given price in a given market at a given time.”

In simple words, supply means that quantity of a particular commodity which a seller is ready to sell at a given price. It is the price which vitally affects the supply of goods.

The rightward shift of the supply curve denotes the increase in supply. Increase in supply is a situation when quantity supplied increases due to the favourable changes in factors other than price.

The reasons for rightward shift of the supply curve are as under:

- Fall in the price of factors of Production: When prices of factors of production (wages, cost of raw material etc.) decreases, it increases the profit margin of produce seller which induces him to increase the supply.

- Increase in the number of firms in the Market: When new firms enter into the market then total supply increases.

- When the firm expects a fall in the Price of the Commodity: If firms expects that in near future prices are going to be decreased then they increase their present supply at higher prices in order to fetch out more and more profits.

(b) Public Debt: Public Debt refers to “Obligation of Government particularly those evidenced by securities, to pay certain sums to the holders at some future date. In,simple words, Public Debt can be defined as the amount of debt taken by government from internal as well as external sources to meet out its deficit. Government needs to borrow when current revenue falls short of public expenditure.

Types of Public Debt

- Internal and External Debt: Public loans floated within the country, are called Internal Debt. Public borrowings from other countries, are referred to as External Debt. External debt permits import of real resources. It enables the country to consume more then it produces. The sources of internal debts are RBI, commercial banks, etc. and of external debts are loans from foreign government, IMF, World Bank etc.

- Productive and Unproductive Debt: When government borrows for development expenditure like on power projects, establishing heavy industries, etc. so that it generates revenue then the debt is productive.

When government borrows for non-development uses, such as war finance, etc. the debt becomes unproductive as it does not create any income in return. - Compulsory and Voluntary Debt: When government borrows from people by using coercive methods, loans so raised are referred to as compulsory public debts, e.g. Tax.

When government floats loans by issuing securities, the members of the public and institutions like commerial banks may subscribe to them. e.g. Public Borrowings. - Redeemable and Irredeemable Debt: Loans which the govt, promises to pay off at some future date are called redeemable debts.

Loans for which no promise is made by the government regarding the exact date of maturity and all that the govt, does is to agree to pay interest regularly for the bonds issued, are called irredeemable debts.

Question 8:

(a) Define a Commercial Bank. [5]

How do Commercial Banks mobilise deposits from the public?

(b) Explain five advantages of division of labour. [5]

Answer:

(a) Commercial bank is a financial institution which deals in money i.e. borrowing and lending of money. It performs the functions of accepting deposits from the general public and giving loans for investing to them with the aim of earning profit.

The three methods adopted by commercial banks to mobilise funds from the public are as under:

- Cash Credit: In cash credit, the bank advances a ‘cash loan’ upto a specified limit to the customer against a bond or other security. A borrower is required F to open a current account and bank allows the borrowers to withdraw upto the full amount of the loan. The interest is charged only on the amount actually utilized by the borrower and not on the loan sanctioned.

- Loans: A loan is granted against some kind of security of assets or personal security of the borrower and the interest is charged on the full amount sanctioned as loan, irrespective of the fact whether full amount or part of it has been used. In case of loans, the borrower is provided with the facility to repay the loan in installment or as a lump-sum.

- Overdraft: The overdraft facility is allowed to the depositor maintaining a current account with the bank. According to this facility, a borrower is allowed to withdraw more amount than what he has deposited. The excess amount so withdrawn has to be repaid to the bank in a short period and that too with interest. The rate of interest is usually charged more than that charged in case of loans. However, the overdraft facility is given only against security of some assets or on personal security of the customer.

(b) Advantages of division of labour:

- Reduction in Cost of Production: The specialised worker with the help of machines, produces, more quantity of goods in less time and with minimum wastage. This reduces the cost of production thereby resulting in more profits to the producer.

- Improvement in Quality: As the worker acquires greater skill in performing the work, the quality of the commodity produced is better. Quality product leads to increment in overall turnover and net profit of the producer.

- Increase in Production: With the division of labour, the workers become more skilled and efficient. They acquire higher speed in work which ultimately results in more production quantitatively and qualitatively.

- Economy of Large Scale Production: With the help of the division of labour, the commodities are being produced on large scale and in an efficient and quick way. This results in all kinds of interned and external economies for the production units. As such the cost of production is reduced and simultaneously, the quality of manufactured goods is improved. This ultimately yields more profit to the producer.

- Utilisation and Employment of Unskilled Labour: Due to simplification and bifurcation of complex processes into several small tasks, even the less skilled workers can be employed to perform these tasks. This reduces the cost of production on account of lower wages of an unskilled or semi-skilled worker. In addition, this increases overall employment in the country.

Question 9:

(a) Define inflation. Explain four causes of inflation. [5]

(b) What is meant by Quantitative Credit Control?

Describe two quantitative credit control measures of the Central Bank. [5]

Answer:

(a)

“The rise in price level after the point of full employment is true inflation.” —JM. KEYNES—

In simple words, inflation is a situation in which prices of goods and services constantly rise, at a fast pace.

The cause of inflation are as follows:

- Increase in Population: Increase in population refers to increased demand of consumer goods which puts a pressure on existing supply of goods and service thus resulting in inflation.

- High Rate of Investment: The heavy investments made by the Government as well as private industrialists have resulted in continuous increase in the prices of capital goods and other items of production.

- Increase in Income: With the increased income of the people, rises the demand for their goods and services and hence their prices also increases.

- Enhanced Taxation: With every year budget, the Government imposes fresh commodity taxes, where the tax payers can easily shift the tax. It leads to increase in prices of different commodities, which in turn push up their prices.

(b) Quantitative Credit Control: Quantitative Credit control are traditional methods which aims at controlling the cost and quantity of credit. Quantitative credit control methods influence the availability of credit indiscriminately. Bank rate, open market operations, cash reserve and statutory liquidity ratio are the methods of Quantitative Credit Control.

Quantitative Credit Control Measures of the Central Bank

- Open Market Operations: It refers to the purchase or sale of Govt, securities, public securities, etc. in an open market by the central bank. In case of inflation, central bank sells securities on which buyer’s draw cheques from their A/c’s which reduces the cash reserve of the commercial banks. This reduces the power to create credit thereby commercial banks have to reduce their advance and loans and vice-versa in case of deflation.

- Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR):

Cash Reserve Ratio (CRR) refers to that percentage of total deposits of commercial bank which it has to keep with the RBI in the form of cash reserves. Statutory Liquidity Ratio (SLR) refers to that portion of the total deposits of commercial bank which it has to keep with itself in the form of cash reserves, gold and govt, securities. This is in addition to CRR.

In case of inflation, the central bank increases the CRR and SLR which restricts the credit-granting capacity of the commercial banks and vice-versa in case of deflation.

Question 10:

(a) Explain five ways in which Consumers are exploited in India. [5]

(b) With the help of suitable diagrams explain the following degrees of elasticity of supply.

- Ep = ∞

- Ep > 1 [5]

Answer:

(a) Refer Ans. 7(b), 2016.

(b)

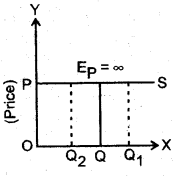

- Ep = ∞ i.e. Perfectly Elastic Supply

In this figure, PS is perfectly elastic supply curve. It is parallel to X-axis. At price OP supply may OQ1 or OQ2 Symbolically, it can be said that Ep = ∞ or elasticity of supply is infinity. It is purely an imagonary concept. When a minute change or without any change in price, supply may change to any extent, then the supply is perfectly elastic.

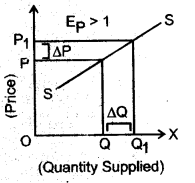

- Ep > 1 i.e. More Elastic Supply

In this figure, supply curve SS is more elastic as in this case ΔP < ΔQ. Mathematically, more elastic supply can be represented as Ep > 1.

Supply is said to be more elastic when a small change in the price brings about a large change in quantity supplied.