FDI Advantages and Disadvantages: FDI is the acronym Foreign Direct Investment. It is a scheme used when any person or any business holds at least a 10% share of any foreign company.

In simple words, FDI is the investment made by any individual or firm in countries apart from the country of their origin.

When company investors own lower than a 10% rate, the IMF or International Monetary Fund describes it simply as part of a capital portfolio. Whereas a 10% rate holding in any company doesn’t give an exclusive investor any regulating interests in a foreign company, it only allows control over its administration, services, and overall policies.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

FDI is crucial for the development and rise of market countries. Developing countries are in need of multinational funding and expertise for the expansion, structuring, and guiding of their international sales. These global companies require private investments in their foundation, energy, and water supply to hike such jobs and salaries for their members.

What is Meant by FDI? Advantages and Disadvantages of FDI

FDI stands for Foreign Direct Investment. As the name signifies, it is an investment scheme where any particular firm or any such individual makes an investment in one country (apart from their home country) into business interests located in another foreign country. Usually, FDI occurs when an investor sets up a foreign business operation, or they acquire a foreign business asset in any foreign company.

There are four main types of FDI, like the following:

- Horizontal FDI: The most well-known type is Horizontal FDI, which initially revolves around the investment of funds in a foreign company that belongs to the same industry and is either owned or operated by the FDI investor. In horizontal FDI, a company invests in a different company which is located in a foreign country, where both companies manufacture similar goods.

- Vertical FDI: Vertical FDI is another variety of foreign investments. A vertical FDI happens when a particular asset is made within a regular supply chain in a said company, which may or may not inevitably belong to the same industrial category. When a vertical FDI takes place, a business invests in a firm located that may provide or sell its products. Vertical FDIs can be further classified into two groups; such as forward vertical integrations and backward vertical integrations.

- Conglomerate FDI: When specific individuals or companies make investments in two entirely different companies belonging to completely different industries, the transaction is termed as a conglomerate FDI. As such, the FDI is not connected directly to the investor’s business or company.

- Platform FDI: The last type falling under foreign direct investment is called platform FDI. In the instance of a platform FDI, a business extends into a particular foreign country, but the commodities manufactured are exported to another different, third country.

Importance of FDI

FDI is integral to investment plans. The solution to foreign direct investment or FDI is the factor of control. Control depicts the intention of actively managing and influencing a foreign company’s operations, which is the primary differentiating determinant between passive foreign portfolio investment and an FDI.

Due to this reason, a 10% stake in the foreign company’s balloting stock is required to define FDI. But there are situations where this principle is not always implemented.

For instance, it is probable to exercise control over more broadly traded firms despite owning a lower percentage of voting assets.

Lists

- The Advantages of FDI

- The Disadvantages of FDI

- Comparison Table for the Advantages and Disadvantages of FDI

- FAQS on Pros and Cons of FDI

Advantages of FDI

- Boost in Economy: One of the major significant reasons a country (especially a developing nation) attracts foreign direct investment is due to the creation of jobs. FDI increases the production and services sector, which creates jobs and helps to decrease unemployment rates in the said country. Elevated employment explicates higher incomes and awards the population with added buying powers, advancing the overall economy.

- Human capital expansion: Human capital is concerned with the knowledge and subsistence of any workforce. Employees’ various skills gained through different training and practices can advance a particular country’s education system and human capital. Through a prolonged impact, it helps to train individual resources in other areas, trades and companies.

- Increased exports: Many assets produced by the FDI have global markets, and they are not solely based on domestic consumption. The production of 100% export-oriented segments helps to serve FDI investors in supporting exports from other foreign countries.

- Advanced Flow of Capital: The capital inflow is especially beneficial for countries with limited domestic resources and limited chances to raise stocks in the global capital market.

- Competitive Market: By promoting the entrance of foreign organizations into domestic markets, FDI advocates the creation of a competitive environment and breaks domestic trusts.

A solid competitive environment always shoulders firms to enhance their product contributions continuously, whereby promoting innovation. Consumers also earn access to a broader range of competitively valued products.

Disadvantages of FDI

- Impediment in domestic investment: At times, FDI can interfere with domestic investments. Due to FDI, countries’ local businesses begin losing interest in financing their household assets.

- Negatory exchange valuations: Foreign direct investments can seldom affect exchange rates to the benefit of one country and the disadvantage of another.

- More expensive costs: When investors invest in businesses in foreign counties, they may notice the increased expense than domestic exported goods. Frequently, more money is invested into motors and intellectual resources than in earnings for local workers.

- Financial non-viability: Acknowledging that foreign direct investments may be capital-intensive from the point of view of investors, they can at times be very dangerous or economically non-reliable.

- Modern commercial colonialism: Third-world with a history of colonialism is often troubled that foreign direct investment would end in modern economic colonialism, revealing host countries and leaving them defenseless to oppression by foreign companies.

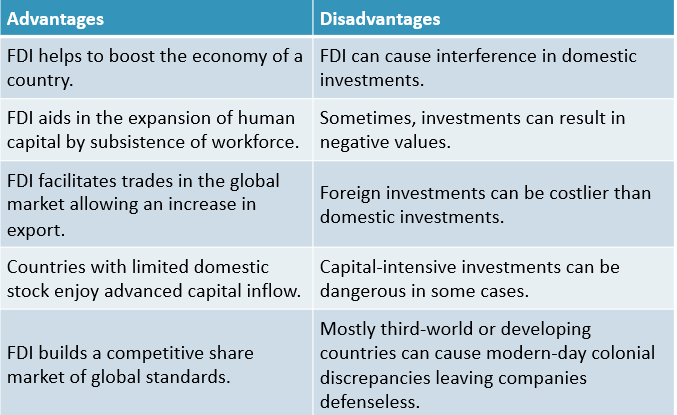

Comparison Table for Advantages and Disadvantages of FDI

| Advantages | Disadvantages |

| FDI helps to boost the economy of a country. | FDI can cause interference in domestic investments. |

| FDI aids in the expansion of human capital by subsistence of workforce. | Sometimes, investments can result in negative values. |

| FDI facilitates trades in the global market allowing an increase in export. | Foreign investments can be costlier than domestic investments. |

| Countries with limited domestic stock enjoy advanced capital inflow. | Capital-intensive investments can be dangerous in some cases. |

| FDI builds a competitive share market of global standards. | Mostly third-world or developing countries can cause modern-day colonial discrepancies leaving companies defenseless. |

FAQ’s on Pros and Cons of FDI

Question 1.

What are the directions for the transfer of shares against deferred payment in the case of FDI?

Answer:

In the case of transfer of shares among a non-resident seller and a resident buyer or vice-versa, not higher than twenty-five percent of the gross consideration can be met by the buyer on a deferred basis, within a term not surpassing eighteen months from the day of the transfer agreement. The amount deferred can also be each in the form of an indemnity or an Escrow. In any case, the price guidelines must be complied with.

Question 2.

On which does FDI depend?

Answer:

On the de-segregated level, FDI depends on the size and also growth potential of any national economy, tangible resources endowments and spirit of the workforce, openness to global trade and admittance to international markets, and state of physical, fiscal, and technological foundation.

Question 3.

Is FDI a practical option for developing countries?

Answer:

Both the commercial theory and recent experimental evidence suggest that FDI has a beneficial impact on developing host nations. Policy recommendations for such developing countries should improve the financing atmosphere for all kinds of capital, whether domestic or foreign.31