Credit Card Advantages and Disadvantages: Nowadays credit card has become one of the most used monetary media. These credit cards are basically a type of loan that is presented by the banks and at the end of the month, the cardholders have to pay the bill amount generated. With the increased prices and cost of living, people are more driven to use a credit card to fulfil their needs and luxuries too. If a credit card has its advantages then it has the associated disadvantages too. Let us know more in this article.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is a Credit Card?

A Credit card has turned into a vital piece of our lives, without hardly lifting a finger of utilization and advantageous compensation back choices. The limits, offers, and arrangements that a charge card offers are unequalled by some other monetary items and spell a treasure trove for the savvy client. Be that as it may, Credit cards can become obligation traps if not utilized accurately, or then again assuming you spend beyond what you can reimburse when the bill comes around. Credit cards regularly get a terrible standing, yet actually, they can be a critical monetary instrument whenever utilized dependably. Here is a portion of the top merits and demerits to consider before you add a sparkling new card to your wallet.

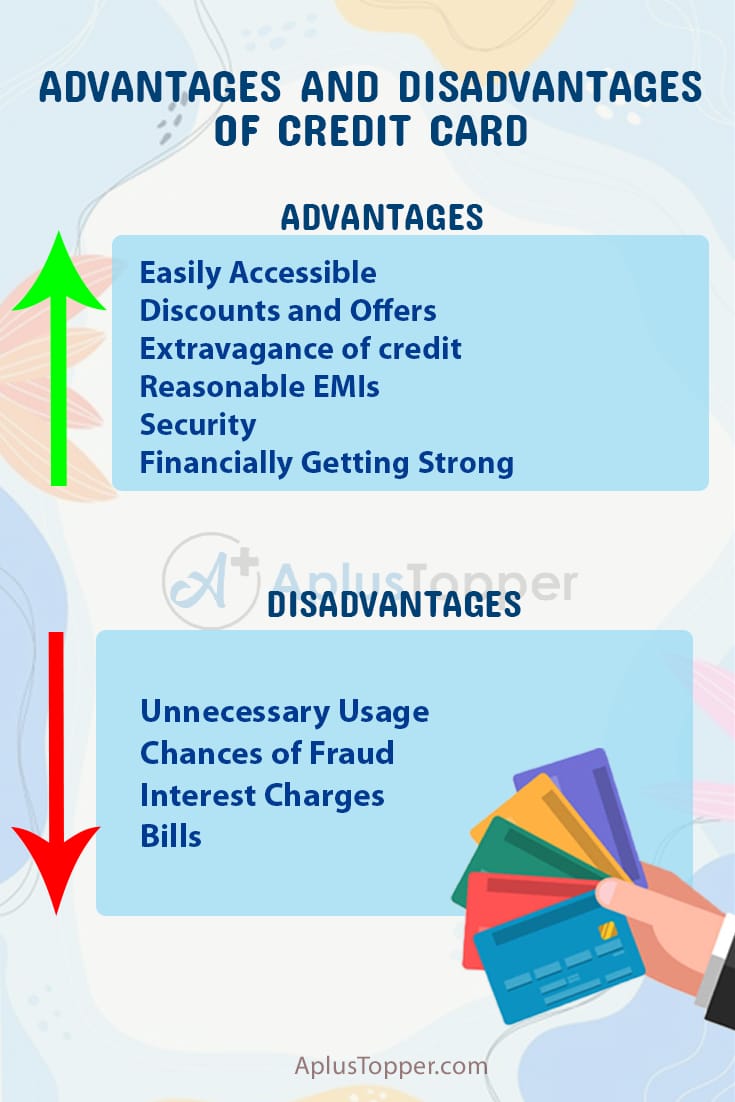

Advantages of Credit Card

Easily Accessible: The greatest benefit of a Credit card is its simple admittance to credit. Credit cards work on a conceded instalment premise, which implies you get to involve your card now and pay for your buys later.

Discounts and Offers: Most Credit cards come loaded with offers and motivations to utilize your card. These reach from cashback to rewards point aggregation each time you swipe your card, which can later be recovered as air miles or utilized towards taking care of your exceptional card obligations. Loan specialists likewise offer limits on buys made through a Credit card, for example, on flight tickets, occasions or huge buys, helping you save.

Extravagance of credit: Having a charge card provides you with the advantage of expenditure out of your pockets. Credit cards permit you to get cash from a bank and make fundamental buys for the present. You should simply design your accounts well so you can reimburse the credited sum well on schedule.

Reasonable EMIs: Making huge buys with your Credit card? Try not to stress over reimbursing the enormous sum. You can decide to change over your charged sum into simple, reasonable EMIs and pay the charged sum throughout an extensive stretch of time. This will keep away from the weight of making an enormous opening in your pocket as you cover your charge card bill.

Security: Charge cards are free from any dangerous monetary instrument. When contrasted with other monetary items, charge cards hold much more wellbeing highlights. Dissimilar to the old charge cards, the ones being given on the new occasions are gotten with EMV (Europay, Credit card and Credit card) chip, which at last saves you from being prey to any fakes. Furthermore, different banks and Credit card giving organizations have presented different safety efforts that guarantee the security of exchanges.

Financially Getting Strong: Convenient reimbursement of Credit card charges assist with building a sound monetary status. One of the significant Credit card benefits is that its appropriate use can really assist you with building and keeping a credit extension. This credit extension can be utilized by banks to see your card utilization and credit reimbursements.

Disadvantages of Credit Card

Unnecessary Usage: Some people use credit cards unnecessary for all the expenses, without having a fear that it can lead to a huge bill. Since Credit cards offer you credit to a tremendous degree, there might be examples where you make pointless acquisitions as far as possible and follow the debtor’s trap later.

Chances of Fraud: Despite the fact that Credit cards are viewed as one of the most secure monetary devices, they might in any case be vulnerable to online fakes. Fraudsters or criminals may likewise take your charge card data and utilize something similar. Moreover, in the event that the false exchange is made by any outsider, it turns into the cardholder’s liability to advise the bank within three days regarding the event of the exchange.

Interest Charges: There is an exceptionally exorbitant financing cost material on the charged sum utilizing a Credit card, which may ultimately lead you to high obligations. In any case, this interest is pertinent just if there should arise an occurrence of late instalments of the credit sum.

Bills: Some records have yearly expenses. There may likewise be charges for loans, alongside exorbitant financing costs. Also, you might spend more on revenue and charges than you make in limits or money back. Ensure the advantages offset the expenses.

FAQ’s on Credit Card Advantages and Disadvantages

Question 1.

What are the advantages and disadvantages of credit cards?

Answer:

The discounts, offers, and arrangements that a credit card offers are unequalled by some other monetary items and spell a gold mine for the insightful client. Be that as it may, charge credit cards can become obligation traps if not utilized accurately, or on the other hand assuming you spend beyond what you can reimburse when the bill comes around.

Question 2.

Is credit card bad or good?

Answer:

Credit cards are bad to have unless it is used appropriately.

Question 3.

What is the biggest advantage of credit cards?

Answer:

Assuming you have a decent credit score, you’ll quite often meet all requirements for the wellbeing rates, and you’ll pay lower finance charges on credit card adjusts and advances. The less cash you pay in revenue, the quicker you’ll take care of the obligation and the more cash you have for different costs.

Question 4.

Is it necessary to have a credit card?

Answer:

No, it is not necessary to have a credit card, but if your expenses are more then you can have a credit card to overcome your financial condition.