10 Lines on Plastic Bag And Its Harmful Effects: The production of plastic materials has increased because of the growing demand among people. Among other plastic objects, plastic bags have one of the highest demands among civilians because they cheap, have exceptional durability than paper bags, and have the use and throw accessibility. But with the wrong discarding of these plastic bags, they even end up at wrong places because of littering. Plastic bags are drastically dangerous for the environment because they are non-biodegradable, and it takes many years to decompose. Every year plastic bags end up killing millions of animals, including being a choking hazard for marine lives.

You can read more 10 Lines about articles, events, people, sports, technology many more.

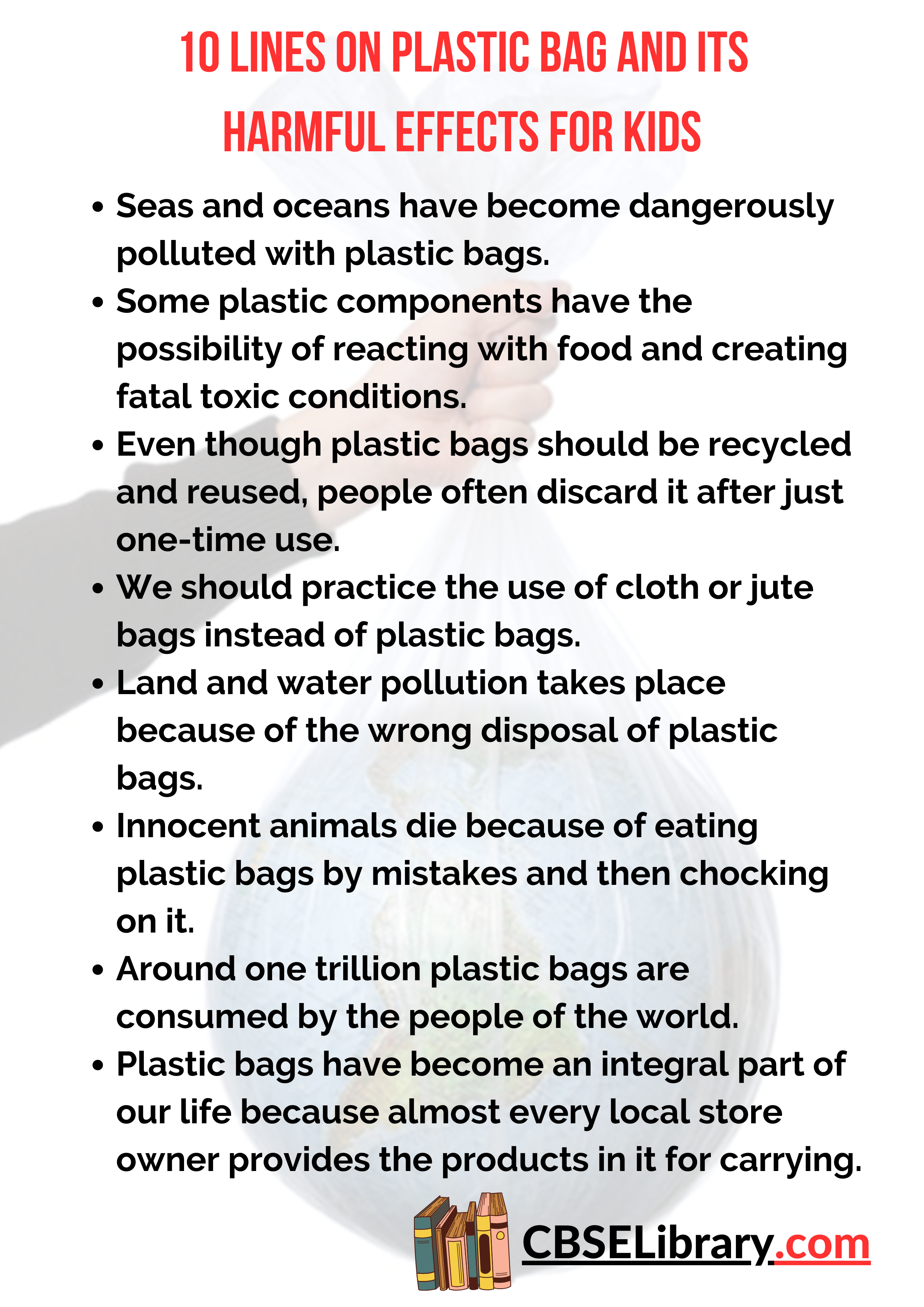

Set 1 – 10 Lines on Plastic Bag And Its Harmful Effects for Kids

Set 1 is helpful for students of Classes 1, 2, 3, 4 and 5.

- The non-biodegradable synthetic product is called plastic.

- Around one trillion plastic bags are consumed by the people of the world.

- Plastic bags have become an integral part of our life because almost every local store owner provides the products in it for carrying.

- Seas and oceans have become dangerously polluted with plastic bags.

- Some plastic components have the possibility of reacting with food and creating fatal toxic conditions.

- Even though plastic bags should be recycled and reused, people often discard it after just one-time use.

- We should practice the use of cloth or jute bags instead of plastic bags.

- Land and water pollution takes place because of the wrong disposal of plastic bags.

- Innocent animals die because of eating plastic bags by mistakes and then chocking on it.

- We shouldn’t let little children play with plastic bags because they can be dangerous.

Set 2 – 10 Lines on Plastic Bag And Its Harmful Effects for School Students

Set 2 is helpful for students of Classes 6, 7 and 8.

- We thoughtlessly use plastic bags in our daily life without thinking about the consequences.

- One of the significant causes of soil pollution is because of the accumulation of plastic bags.

- Plastic bags often clog drains and water supply because of their illegal disposal.

- The government should pass a strict and punishable act that will reduce the misuse and wrong disposal of plastic bags by people.

- On burning plastic bags, toxic fumes are produced.

- Nature is way too contaminated with plastic bags at present.

- Many species go extinct every day because of the pollution caused by plastic bags.

- With the increasing population and increasing industrialization, the demand for plastic bags also keeps rising daily.

- Plastic bags when littered on fertile soil, turns they are infertile with due time.

- Everyone should be aware of the harmful effects of plastic so that they decide on banning plastic products.

Set 3 – 10 Lines on Plastic Bag And Its Harmful Effects for Higher Class Students

Set 3 is helpful for students of Classes 9, 10, 11, 12 and Competitive Exams.

- Plastic bags are commonly made of poly-ethylene and some other chemical toxins that include Xylene, Ethylene Oxide, and Benzene.

- The manufacturing units of plastic bags consume a large amount of energy daily.

- One of the primary reasons why the sewage channels get jammed is because of plastic bags.

- On being burnt, plastic bags release gases like Nitrogen Oxide and Sulphur Dioxide, which are toxic.

- During the decomposition or burning of plastic bags, the gases that are produced are poisonous and are also potent to cause cancer.

- The recycling of plastic costs more than the production of plastic, hence people choose to discard it after one or two uses.

- From the waste that is to be recycled, it is difficult for plastic bags to be segregated.

- Plastic bags might be cheap and readily available, but massively harmful by not decomposing in the environment quickly.

- It is also advised by healthcare providers to ban food being served and conserved in plastic containers.

- The labourers of the plastic bag manufacturing industry suffer from several respiratory and skin diseases.

FAQ’s on 10 Lines on Plastic Bag And Its Harmful Effects

Question 1.

Why should we completely ban the use of plastic bags?

Answer:

Plastic bags are responsible for many problems like pollution, species extinction, health hazard, excessive waste production, etc.

Question 2.

What can we use in place of plastic bags?

Answer:

for carrying things, you can use bags made out of cloth, rope, jute, or other biodegradable but eco-friendly materials. for serving and conserving food products, people can use storage objects made of aluminium, steel, etc.

Question 3.

How are the plastic bags a health hazard for us?

Answer:

Other than being a health hazard for wildlife, plastic bags can be dangerous for us because children might cause an accident while playing with it. Also, plastic bags when reaching groundwater source because of pollution causes mixing of toxins in drinking water and causing diseases. Likewise, insects that spread diseases breed on wrongly disposed plastic bags which are equally a dangerous health hazard that should be looked into.

Question 3.

Provide one reason why plastic bags should be entirely banned in India?

Answer:

According to statistical reports, India solely produces around twenty-thousand tons of plastic wastes every year.