Bank Manager Cheque Book Request Application Letter 2022: Our life today is full of complexity and confusion. Therefore to reduce the stress economically our bank has given us a lot of services assistance that has made transactions of daily life simple and easy. One of the services of a bank is to provide cheques to the people just after they have opened an account. Cheques are mostly used for transactions that involve a huge amount and if cheques are bounced then the cheque holder can sue the first party who gave the cheque. Cheques are often considered money against the services provided. A cheque is also a medium of exchange. It is a preprinted format with the account holder’s name, address, and other identifying information. Let us see what a cheque is.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

- What is a Cheque? Bank Manager Cheque Book Request Application Letter

- Types of Cheques

- Format of the Letter to Bank Manager for Issuing Cheque Book

- Sample of a Letter to Manager for Issuing a New Cheque Book

- Request to Issue New Cheque Book

- FAQ’s on Bank Manager Cheque Book Request Application Letter

What is a Cheque? Bank Manager Cheque Book Request Application Letter 2022

A cheque is a negotiable instrument or medium of exchange of commodities. It is generally used by many people daily for a transaction that involves a huge amount. Cheques are used in place of money or cash. Although it’s a substitute for money it has its limitations. It cannot be converted into easy cash. One has to visit the bank to clear the payment or receipt. This involves a lot of bank intervention. It has to be signed and couldn’t be legalized till proper signatures are there of the holder and the proper name is described on the cheque. In simple words, we can say a cheque is a document that is issued to a bank specifying the name of the person to whom the payment has to be made.

Types of Cheques

There are many types of cheques issued by a person to the bank so that payment could be possible.

- Crossed cheque

- Self cheque

- Bearer cheque

- Open cheque

- Order cheque

- Traveler’s cheque

- Stale cheque

- Post-dated cheque

- Bankers cheque

Let us see each one of them one by one

- Crossed cheque: In a crossed cheque two parallel lines are drawn in the top left corner of the cheque in which the name of the person along with the account number is written this is called crossed cheque. This ensures that whoever is holding a cheque at the time of depositing the cheque the payment will be made only to the person whose name is written on the cheque.

- Self cheque: In this instead of the name of the receiver the word ‘self’ is written which signifies that the payment has to be made to the issuer’s bank.

- Bearer cheque: In this type of cheque the payment is made to the person who is carrying or bearing the cheque. These are transferable cheques. Also, the banker doesn’t need any authorization from the issuer to make a payment.

- Open cheque: Cheques that can be encashed at any bank and payment made to the bearer or holder of the cheque is called an open cheque. This is also a type of transferable cheque.

- Order cheque: In this type of cheque the word ‘or bearer’ is cancelled and only given to the person whose name is mentioned on it. The bank has to authenticate the identity of the person before making the payment for this they may ask the person for any identity proof.

- Traveller’s cheque: Travellers instead of carrying hard cash issue cheques from their bank that can be encashed through any bank where they are travelling along with the currency of the nation where the traveller is travelling.

- Stale cheque: A cheque that has been issued three months before and is withdrawn before the period of six months is called a stale cheque as it has already passed its validity of 3 months.

- Post-dated cheque: A cheque in which the date of encashing or drawing of cash is mentioned and before that particular date the bearer of the cheque is not able to encash the cheque even though it has been presented to the bank.

- Bankers cheque: This is a type of cheque where the bank issues a cheque on behalf of the account holder to make the remittance to another person. This is non-negotiable and an amount is cut from the account holder’s account and cheques are issued on behalf of the account holder by the bank.

Format of the Letter to Bank Manager for Issuing Cheque Book

| To The Bank Manager (Name of the bank ) (Name of the branch) Respected Sir/Madam Subject: State the subject or issue precisely and to point here, in this case, it is the issue of a new cheque book. Body: This consists of an explanation of writing the letter to the bank manager and it must be supported by documentation if necessary. In this case, you have to mention the reason for the issue of cheque book with proper evidence. Thank you Accounts details like account number and name must be given Yours faithfully (Signature) Date: Place: |

Sample of a Letter to Manager for Issuing a New Cheque Book

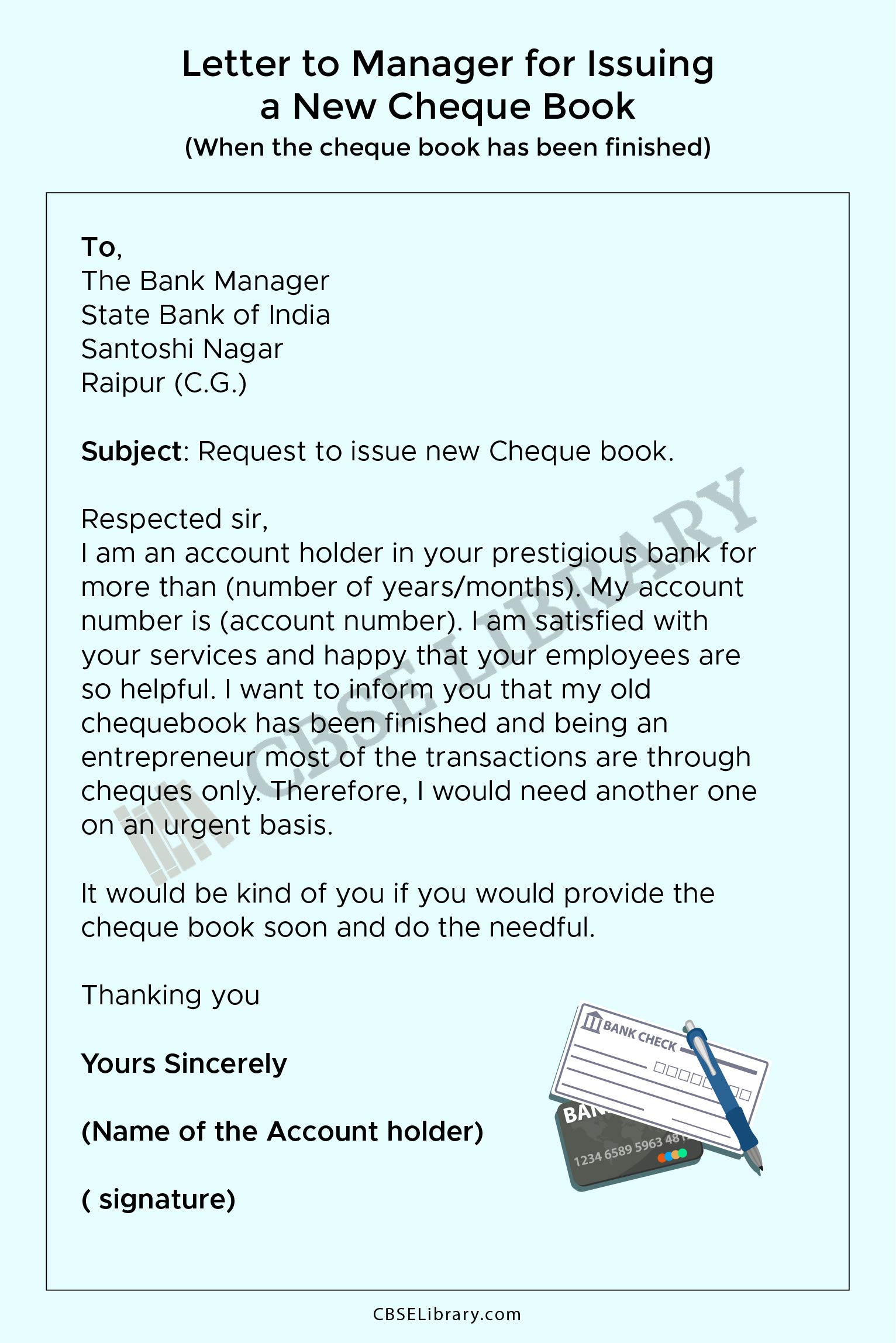

When the cheque book has been finished: When your cheque book is finished and you need another cheque then you can follow the given format for application or letter.

| To, The Bank Manager State Bank of India Santoshi Nagar Raipur (C.G.) Respected sir, Subject: Request to issue new Cheque book. I am an account holder in your prestigious bank for more than (number of years/months). My account number is (account number). I am satisfied with your services and happy that your employees are so helpful. I want to inform you that my old chequebook has been finished and being an entrepreneur most of the transactions are through cheques only. Therefore, I would need another one on an urgent basis. It would be kind of you if you would provide the cheque book soon and do the needful. Thanking you Yours Sincerely (Name of the Account holder) ( signature) |

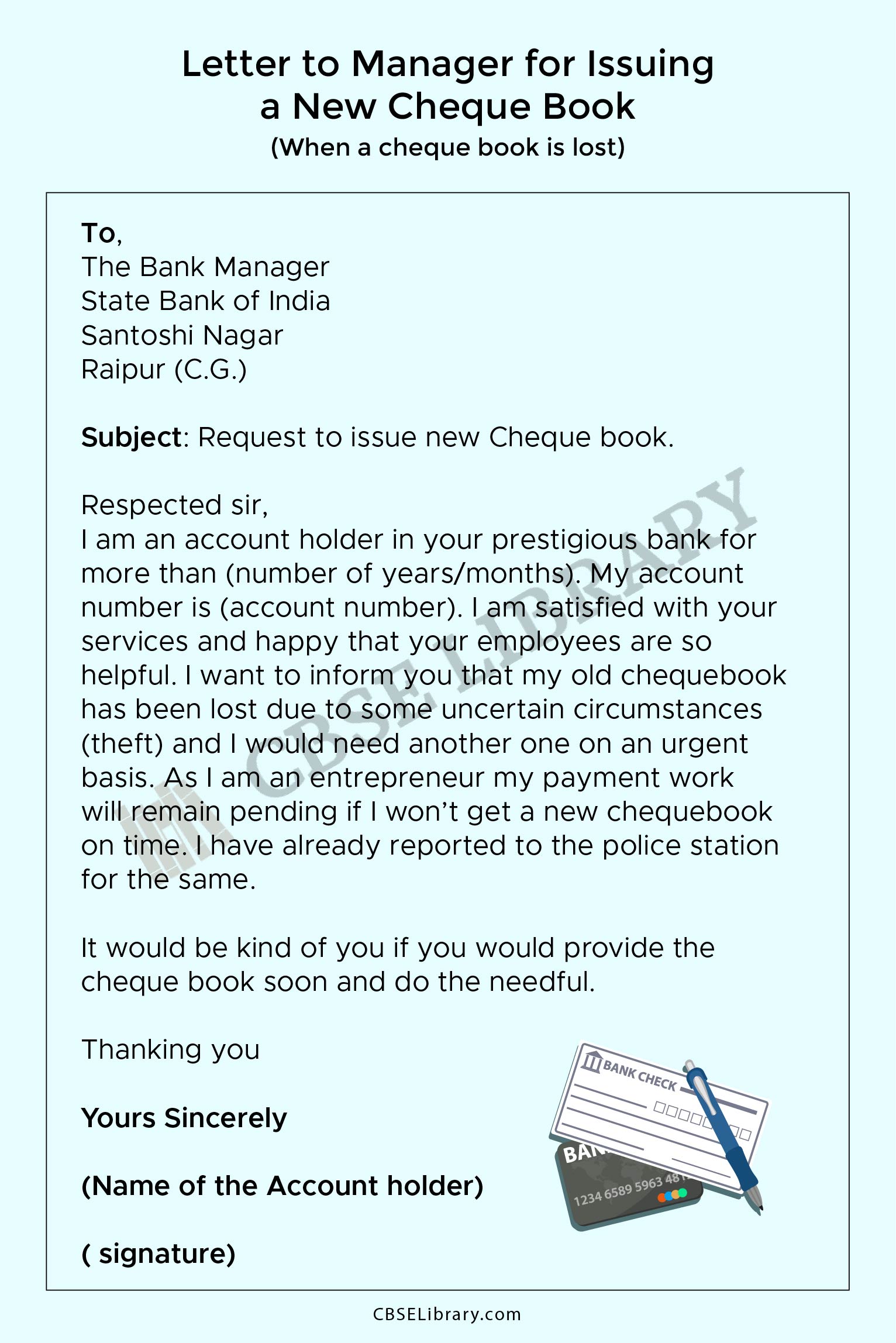

When a cheque book is lost: When due to some reason like theft or fire you have lost your cheque book and want to reissue the cheque book you can follow up the given format.

Request to Issue New Cheque Book

| To, The Bank Manager State Bank of India Santoshi Nagar Raipur (C.G.) Respected sir, Subject: Request to Issue New Cheque book. I am an account holder in your prestigious bank for more than (number of years/months). My account number is (account number). I am satisfied with your services and happy that your employees are so helpful. I want to inform you that my old chequebook has been lost due to some uncertain circumstances (theft) and I would need another one on an urgent basis. As I am an entrepreneur my payment work will remain pending if I won’t get a new chequebook on time. I have already reported to the police station for the same. It would be kind of you if you would provide the cheque book soon and do the needful. Thanking you Yours Sincerely (Name of the Account holder) ( signature) |

FAQ’s on Bank Manager Cheque Book Request Application Letter

Question 1.

What is a Cheque?

Answer:

A cheque is an instrument or a document stating to pay a certain sum of the money or to the order of the person bearing it. It is used to make safe and secure payments.

Question 2.

For how many days a chequebook is valid?

Answer:

According to the RBI guidelines, a cheque book is valid up to 6 months from the date of issue of the cheque. But from the effect of April 1st, 2012, it has been reduced from 6 to 3 months.

Question 3.

What are the types of cheques?

Answer:

There are many types of cheques available they are:

- Crossed cheque

- Self cheque

- Bearer cheque

- Open cheque

- Order cheque

- Traveler’s cheque

- Stale cheque

- Post-dated cheque

- Bankers cheque