Bank Account Reactivation Letter: Bank runs frequently changing and the account holder may not have a clue about the most recent update at some point. Your saving or current record would have been suspended by the bank because of no exchange for quite a while (or over a half year). In this article, you will know how to compose a letter to the bank to reactivate your record to keep on executing with the bank. Here observe the example design.

We may at some point get the SMS or email or letter or an alternate warning from the Bank that our financial record has been suspended due to defective for a long term. The Bank sends it because of different reasons and one of them is that they might want to know the status from you on the bank exchange and updates or to close the record forever on the off chance that assuming there is no reaction from the worry for a long time. We overlook the message from the Bank because of an alternate responsibility or no opportunity to circle back to them. At the point when we want a similar Bank to represent the exchange, we come to realize that our record is suspended/lethargic impermanent because of no exchange for a long span. Thus, incapable to store or pull out and so forth.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

Now, how to reactivate the Bank account? The main techniques are, moving toward the bank, filling the Bank structure with expected reports to reactivate it or composing a letter to save money with their structure and expected certification to reactivate the record for future exchange.

How to Write Bank Account Reactivation Letter?

We can reactivate an inactive bank account by writing a formal letter to the branch manager or bank manager. The reactivation of the bank account will differ from one bank to another. You can just go to your bank branch and request the application form for the reactivation of your bank account.

While writing the application letter to reactivate your bank account make sure to mention all the required details. Banks will strictly check all the provided details before reactivating the account. The procedure of closing the bank account will also be the same.

For the reactivation of bank account the account holder need to be physically present in the bank along with required documents such as Aadhar card, PAN card, and previous bank passbook. We have provided a format of bank account reactivation letter for you which can be used as an application letter. You just need to fill the required details in it.

- Bank Account Reactivation Letter Format

- Bank Account Reactivation Letter Sample

- Application Letter to Reactivate Bank Account

- FAQ’s on Bank Account Reactivation Letter

Present a letter for Reactivation: A letter or an application should be submitted to the bank specialists like the bank administrator, to reactivate a record.

- Present the necessary archives, for example, the ‘Know Your Customer’ records, which incorporate

- Photos

- Evidence of Identity

- Evidence of Address

- Old checkbook

- Set aside some installment in the record: Any limited quantity of cash store should be made, to enact the record.

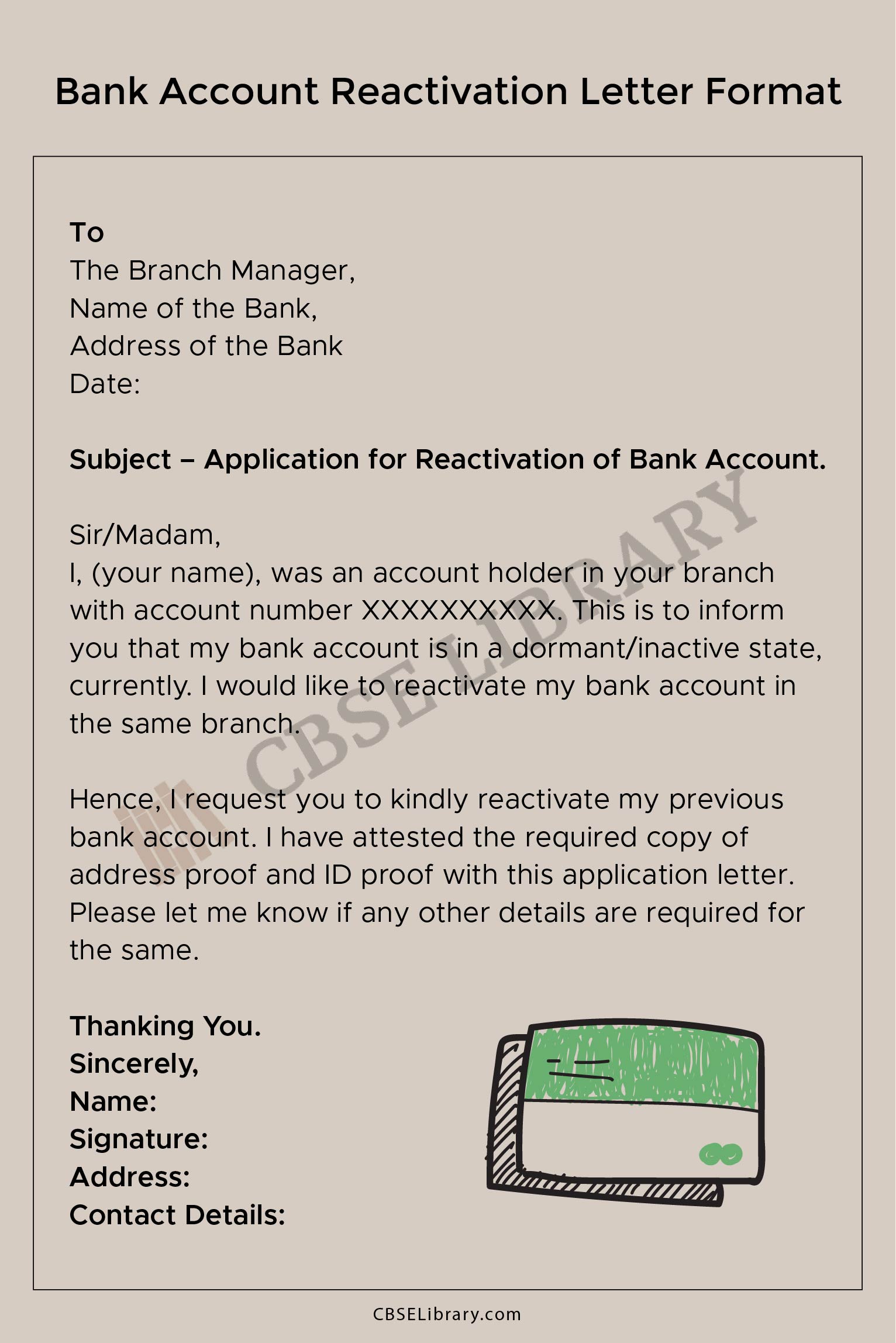

Bank Account Reactivation Letter Format

| To The Branch Manager, Name of the Bank, Address of the Bank Date: Subject – Application for Reactivation of Bank Account. Sir/Madam, I, (your name), was an account holder in your branch with account number XXXXXXXXXX. This is to inform you that my bank account is in a dormant/inactive state, currently. I would like to reactivate my bank account in the same branch. Hence, I request you to kindly reactivate my previous bank account. I have attested the required copy of address proof and ID proof with this application letter. Please let me know if any other details are required for the same. Thanking You. Sincerely, Name: Signature: Address: Contact Details: |

Bank Account Reactivation Letter Sample

| Prachi Singh 4th Main, Jayanagar 4th Block Bangalore – 29 To The Branch Manager, ICICI Bank Jayanagar Branch Bangalore, Karnataka Date: 29/04/2022 Subject – Application for Reactivation of Bank Account. Sir/Madam, I, Prachi Singh, was an account holder in your branch with account number 303003145XX. This is to inform you that my bank account is in a dormant/inactive state, currently. I would like to reactivate my bank account in the same branch. Hence, I request you to kindly reactivate my previous bank account. I have attested the required copy of address proof and ID proof with this application letter. Please let me know if any other details are required for the same. Thanking You. Sincerely, Prachi Singh Signature Mobile No. 8989938xxxx Email id: [email protected] |

Application Letter to Reactivate Bank Account

| Akshay Kumar 45, Saroj Nagar Baikunth To The Branch Manager, Indian Bank Saroj Nagar Branch Bangalore, Karnataka Date: 29/04/2022 Subject – Application Letter to Reactivate Bank Account. Sir/Madam, I am Akshay Kumar and this is to inform you that my bank account with account number 948924884xxxxx is in an inactive state, currently. I would like to reactivate my bank account in the same branch. Hence, I request you to kindly reactivate my bank account. I have attested the required copy of address proof and ID proof with this application letter. Please let me know if any other details are required for the same. Thanking You. Sincerely, Akshay Kumar Signature Mobile No. 8989938xxxx Email id: [email protected] |

FAQs on Bank Account Reactivation Letter

Question 1.

How to reactivate a bank account?

Answer:

You can reactivate your dormant bank account by basically visiting your home branch and giving a composed solicitation to reactivate your account. Then, at that point, in a couple of days, your record will be reactivated.

Question 2.

What is the format to write a bank account reactivation letter?

Answer:

First and foremost you need to ask them the justification for your account deactivation and afterwards compose a resume application in light of your explanation. You need to give your financial balance subtleties first in the application. Then, at that point, indicate the justification behind shutting your financial balance, and afterwards deferentially demand your bank director to resume your account.

Question 3.

Is it possible to reopen a bank account?

Answer:

Yes, we can reopen the bank account by providing a proper application letter to the bank addressing the manager.