Bank Account Cancellation Letter: Bank account cancellation letter is a letter that is written to the bank by a customer. It informs the bank of their decision to close their account and gives information on how to proceed with the account closure. The main reason for writing this letter is because customers want to close their accounts and move to another bank for various reasons. The letter informs the bank about the customer’s intention, so there are no surprises at the end of it.

As we know, a bank account is a place where people deposit their money. It can also be a place where they borrow money, invest money and make payments. The bank account can be closed for many reasons like if the customer is not satisfied with the services of the bank or if he has found another better service provider. The customer must first contact the bank before closing his account to ensure that all his transactions are completed and he does not lose any money.

- How To Write Bank Account Cancellation Letter?

- Documents Required to Close a Bank Account

- Bank Account Cancellation Letter Format

- Bank Account Cancellation Letter Sample

- Request to Cancellation of Bank Account

- FAQ’s on Bank Account Cancellation Letter

Generally, there are many reasons for a customer to want to cancel a bank account. Some of the reasons are:

- The customer is moving and there is no need for the account.

- The customer wants to close the account because they don’t want it anymore.

- The customer is changing banks and wants to cancel their current account.

- The bank has been charging too many fees and the customer doesn’t want to pay them anymore.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

How To Write Bank Account Cancellation Letter?

A bank account cancellation letter is a formal letter, which is written to the bank by the account holder requesting the cancellation of their bank account. The following are some of the things to be included while writing a bank account cancellation letter:

- The date on which the person is writing the letter.

- The name of the bank where they have their account.

- The person’s full name and address with contact details.

- A request for closing or cancelling their account with a reason for doing so.

- If there are any outstanding dues on their account, they should mention them in this section as well as how much they owe the bank before closing it down.

Documents Required to Close a Bank Account

The documents required to close a bank account vary depending on the type of account, the type of closure, and the account holder’s relationship with their financial institution. Some of the common documents required for closing an account are:

- A letter requesting closure of an account

- Proof of identity

- Proof of address

- A void cheque or cheques for any outstanding balance

- A completed transfer form if a joint account holder is being removed from the account

- For accounts that are being closed because they have been inactive for one year, a copy of proof that they were notified about inactivity

Every time you wish to close a bank account, you must give the bank manager a letter detailing your reasons in it. To help you, below are a few letter examples.

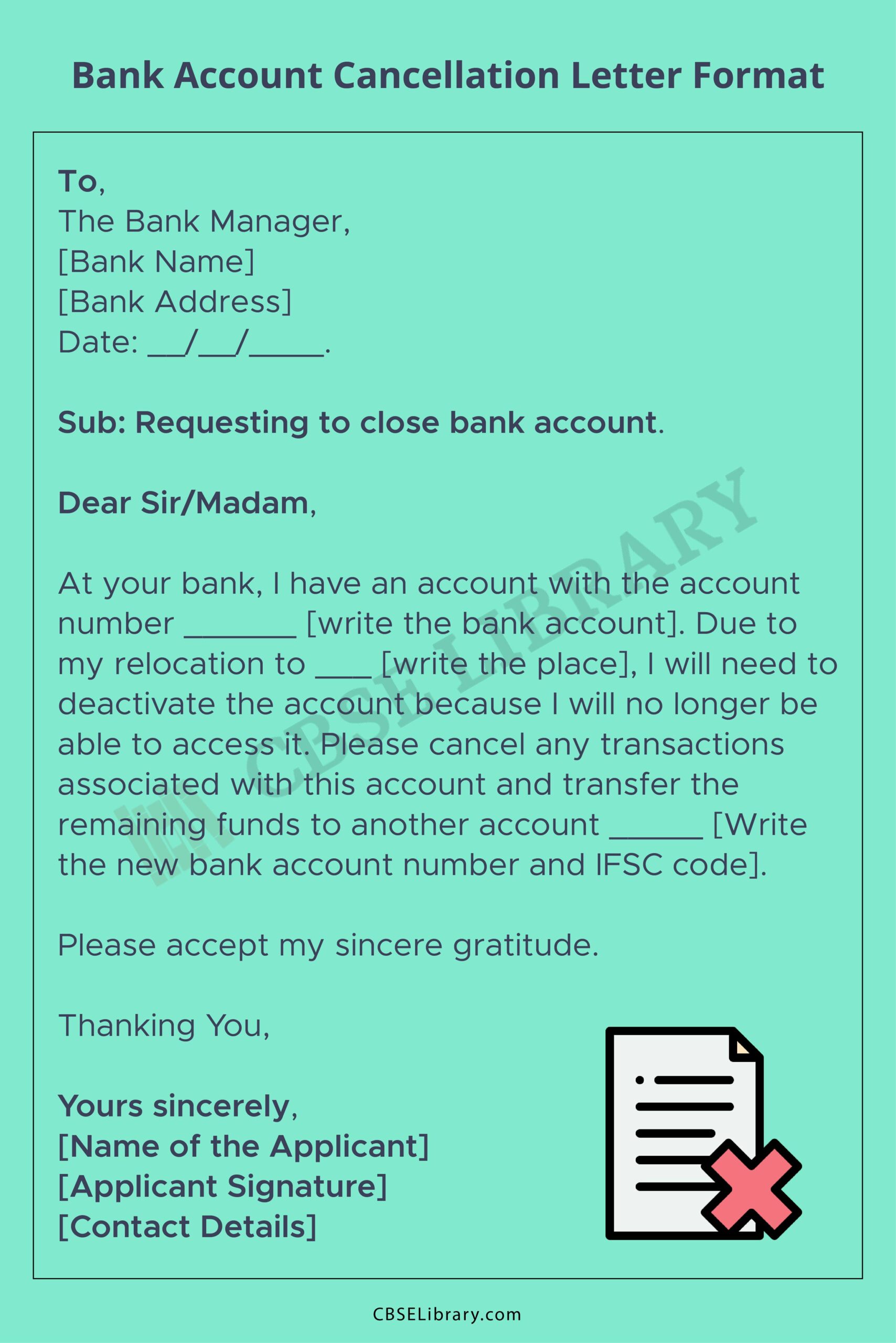

Bank Account Cancellation Letter Format

To,

The Bank Manager,

[Bank Name]

[Bank Address]

Date: __/__/____.

Sub: Requesting to close bank account.

Dear Sir/Madam,

At your bank, I have an account with the account number ______ [write the bank account]. Due to my relocation to ___ [write the place], I will need to deactivate the account because I will no longer be able to access it. Please cancel any transactions associated with this account and transfer the remaining funds to another account _____ [Write the new bank account number and IFSC code].

Please accept my sincere gratitude.

Thanking You,

Yours sincerely,

[Name of the Applicant]

[Applicant Signature]

[Contact Details]

Bank Account Cancellation Letter Sample

To,

The Bank Manager,

[Bank Name]

[Bank Address]

Date: __/__/____.

Sub: Request to close bank account

Dear Sir/Madam,

Due to various personal circumstances, I am now unable to maintain Account No. ____ [write the account number] with your Branch. Please shut my savings account and don’t conduct any more transactions. Along with my application, I will return my cards, passbook and cheque book.

Please transfer the remaining balance to the accounts listed below and shut my bank account. If you take the necessary steps to start the process at the earliest, it would be very appreciated.

Account Number: _____ [write the account number]

IFSC Code: ______ [Write the IFSC code]

Thanking You,

Yours sincerely,

[Name of the Applicant]

[Applicant Signature]

[Contact Details]

Request to Cancellation of Bank Account

To,

The Bank Manager,

[Bank Name]

[Bank Address]

Date: __/__/____.

Sub: Request to the cancellation of bank account

Dear Sir/Madam,

I am writing to request cancellation of my account with your bank. I would like to thank you for the time that I have been a customer of your bank. It has been a pleasure doing business with you over the years.

However, due to personal circumstances and changes in my life, I am no longer able to continue banking with your institution. Please close my account ______ [write the account number] and send me a confirmation email as soon as possible.

Thank you for your understanding in this matter.

Thanking You,

Yours sincerely,

[Name of the Applicant]

[Applicant Signature]

[Contact Details]

FAQ’s on Bank Account Cancellation Letter

Question 1.

What is the bank account cancellation letter?

Answer:

In order to close a bank account, a person needs to write a letter of cancellation. The letter should contain the reason for cancelling the account and the date on which it will be closed. The bank account cancellation letter is a formal request letter that is sent by an individual or organisation to their bank in order to close their current account.

Question 2.

Why do customers usually want to cancel the bank account?

Answer:

A bank account is a financial account that is held at a bank and allows the customer to deposit or withdraw money. It can also be used to pay bills, make purchases, and transfer money. The reasons for customers to want to close their bank account are usually because they want to open an account at another bank, they are dissatisfied with the services provided by the bank such as not having enough ATMs near them or being charged too much for using other banks ATMs, or because of changes in their financial situation such as getting a new job.

Question 3.

When can we send a bank account cancellation letter?

Answer:

It is possible to close a bank account at any time, but there are some requirements that have to be met. First of all, it is important that the account holder has no pending balance. Secondly, the account should not contain any unclaimed funds. Thirdly, if the account holder has a line of credit or loan on their account, they should cancel the line of credit or loan before closing the account. Finally, if there are other accounts with different banks connected to this one (e.g., through direct deposit), those accounts need to be closed as well before closing this one.