Advantages and Disadvantages of Insurance: There is no guarantee of constancy in our lives. Sometimes we all face ups and downs in the daily course of life.

Similarly, in business scenarios, there are frequent imbalances. There is no guarantee that an unforeseen loss, sudden accident, or harm will not transpire in the lives of any individual or a company. These risks may or may not be due to financial losses but eventually, get reduced to financial terms.

To help individuals through these sudden uncertain events in daily life, insurance policies promise protection and financial aid.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Insurance? Advantages and Disadvantages of Insurance 2021

Insurance is a means to manage sudden risk. Buying insurance means that you are purchasing protection against unforeseen financial losses. The insurance corporation pays everyone or anyone nominated by you in case something unfortunate happens.

Types of Insurance

- Health insurance: Helps individuals pay for the consultant fees and sometimes medicine or prescribed drugs. Once they purchase health insurance coverage, the health insurer agrees to give a part of their medical expenses that are usually a specific cash amount or a percentage of the total expenses.

- Life insurance: It gives a person nominated by an insured individual a set amount of cash if or on the circumstances of their death. The money from their life insurance policy can help their family in paying bills and covering living expenses.

- Disability insurance: It protects individuals and their families from fiscal burdens in the cases of illness or injury and prevents them from obtaining a living. Many companies offer disability coverage to workers, or sometimes workers themselves buy an exclusive disability insurance policy.

- Auto insurance: It protects people from paying the complete cost for vehicle repairs and medical expenses that are caused due to a collision. In most provinces, the law needs people to hold auto insurance when operating any motor vehicle.

- Homeowner’s/renter’s insurance: It protects an individual’s home and personal assets against damage or loss and insures them in case someone gets hurt at the time of stay on their property.

If they have a mortgage on the property of the concerned individual, most lenders need them to hold a homeowner’s insurance as a loan provision.

This article aims to explain in great detail the following about Insurance:

- Advantages of Insurance

- Disadvantages of Insurance

- Comparison Table for the Advantages and Disadvantages of Insurance

- FAQS on Pros and Cons of Insurance

Advantages of Insurance

- Financial Security: There is no place for consistency in the course of life; hence we are often faced with accidents or losses in various areas every day. In both business-related and personal life-related cases, a loss is always difficult to carry, which is when Insurance protects us from sudden losses in financial courses. At times, family members may require some financial assistance from Insurances. Similarly, in the case of business losses, Insurance administers financial support to people. Thus, Insurance provides financial security.

- Diffusion of Risk factors: The idea behind Insurance is to diffuse the risk among several people. Risks in daily life or businesses are impossible to defeat but can be defeated and distributed or shared among individuals. Therefore, the role of insurance companies is to bear these risks for businesses and individuals to continue their lives smoothly.

- Stability of Living Standard: Insurance provides financial assistance to guarantee that people are able to sustain and preserve stability in the living standards of their life and also against all unforeseen circumstances.

- Encouragement to Savings: On the subject of Insurance, people usually pay a definite sum of money for a fixed time or a lifetime according to the specified agreement, which helps cultivate a habit of saving wealth. By understanding the importance of savings, people start preparing to make savings in various fields.

- Job Opportunities: Alike any other business, Insurance is one of the most desirable business ventures in the present world. It strikes many entrepreneurs and people in business towards savings. Due to this, a lot of cash flow results in businesses.

To handle and maintain the cash flow and run the business, companies require employees. To recruit employees, these companies open vacancies in the various desirable posts as per qualification and present job opportunities to people.

Disadvantages of Insurance

- Terms and Conditions: Insurance does not bear all kinds of losses that occur in an individual’s life and business scenarios. The terms and conditions of Insurance policies provide financial support to people solely based on those terms. Therefore, before taking any insurance, an individual must read the terms and conditions thoroughly and understand each point fully.

- Lengthy Legal formalities and Expensive: It may take a lengthy legal procedure to receive the claims an individual has made. Hence, sometimes it may cause hindrances during emergencies. Frequently, depending on the kind of policy an individual has selected and specific factors, the insurance plan’s cost can vary; sometimes, this cost can be more expensive than the Insurance promised. So, individuals must be aware of the cost.

- Fraudulent Agency: There are many fraud agencies existing in the market. Nowadays, individuals opting for insurances before taking any Insurance must handle themselves and the situation well or take the help of an expert when selecting insurance agencies.

- Not for all People: Some insurance such as life insurance and health insurance, in most cases, does not grant Insurance for unhealthy and older adults, which can be a problem to some people.

- Potential crime: It could lead to civil crimes as the policy users are influenced to commit potential fraud or crimes to obtain the promised Insurance money.

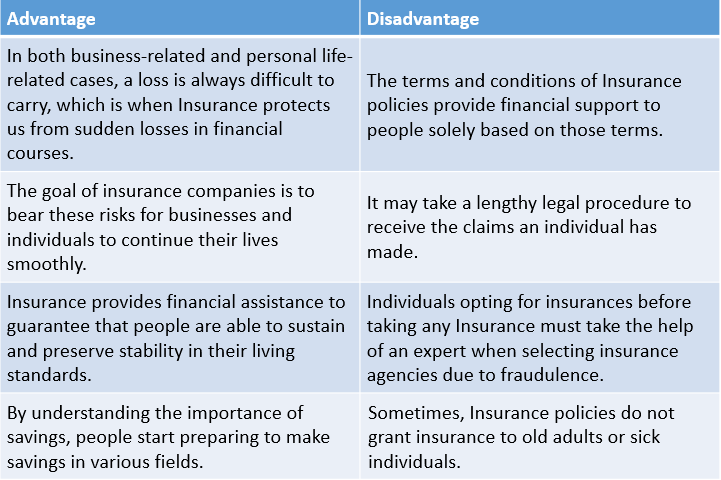

Comparison Table for Advantages and Disadvantages of Insurance

| Advantages | Disadvantages |

| In both business-related and personal life-related cases, a loss is always difficult to carry, which is when Insurance protects us from sudden losses in financial courses. | The terms and conditions of Insurance policies provide financial support to people solely based on those terms. |

| The goal of insurance companies is to bear these risks for businesses and individuals to continue their lives smoothly. | It may take a lengthy legal procedure to receive the claims an individual has made. |

| Insurance provides financial assistance to guarantee that people are able to sustain and preserve stability in their living standards. | Individuals opting for insurances before taking any Insurance must take the help of an expert when selecting insurance agencies due to fraudulence. |

| By understanding the importance of savings, people start preparing to make savings in various fields. | Sometimes, Insurance policies do not grant insurance to old adults or sick individuals. |

| Insurance strikes many entrepreneurs towards savings. Due to this, a lot of cash flow results in businesses. | Sometimes civil crimes could be committed by policy managers to obtain the insured money. |

FAQ’s on Pros and Cons of Insurance

Question 1.

What should be covered in any insurance policy?

Answer:

All insurance policies consist of five parts: declarations, insurance agreements, definitions, omissions, and terms and conditions. Many policies may include a sixth section to cover endorsements.

Individuals must use these sections as guides in examining the policies. It is advisable for everyone to identify the insurance’s principal provisions and requirements.

Question 2.

In the case of Life Insurance, what do insurance companies check?

Answer:

Life insurance companies will review your application, driving records, and medical examinations to have an idea about your drinking habits. Consuming less alcohol, or quitting entirely, makes your risk factors lower for the company, and therefore you’ll probably be compensated with a lower premium amount.

Question 3.

What are the expected coverage benefits under any health insurance?

Answer:

Health insurance privileges vary from policy to policy. However, primary health insurance privileges include cover for a patient hospitalization and also pre & post-hospitalization. It usually includes day-care procedures, emergency ambulance charges, organ donor fees, domiciliary hospitalization, OPD charges, and more.