Advantages And Disadvantages Of Indirect Tax: Indirect taxes are the ones that are imposed on goods and services. Indirect tax is applied to the manufacturers who sell the products to consumers. This type of tax has no relation to the income of the person. Rather, the customer has to pay the indirect tax associated with the goods sold by the seller. Therefore both, the people who pay tax to the government from their salary and the person who pays the taxes in the shops for products are two different people.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is an Indirect Tax? What are the advantages and disadvantages of Indirect Tax?

Indirect taxes are the taxes that are imposed on the modes of entertainment, goods, and services. They are an entirely different and separate type of tax from the direct tax that is imposed on the income of employees. The manufacturers and retailers are supposed to pay these taxes to the government. So they drift a part of it to the customers and consumers. Hence, when the customer buys a product, he pays tax to the shopkeeper and he further pays the tax to the government. Some examples of indirect taxes are Excise Duty, Customs Duty, VAT, and GST.

- Advantages of Indirect Tax

- Disadvantages of Indirect Taxes

- Comparison Table for Advantages and Disadvantages of Indirect Tax

- FAQ’s on Advantages And Disadvantages Of Indirect Tax

Types Of Indirect Taxes

As already discussed above indirect taxes are quite different from income taxes. They are imposed on materialistic goods. Following are a total of seven types of indirect taxes in India.

- Service tax: Service taxes are applied to the services provided by the seller or the company and have to be paid by the recipients in return for using the services. Your restaurant bill could be the best example to have the service taxes.

- VAT: VAT also known as Value Added Tax, is imposed on the goods that are to be transported or being directly sold to the consumers. The VAT may differ from state to state. Value-added taxes are levied on all the goods, starting from the raw material to the final distribution.

- Excise Duty: The term Duty also means Tax. Excise duty is imposed on the goods that are manufactured within the boundaries of India. This tax is paid by the producers and these producers recover their paid taxes from their customers.

- Custom Duty: Custom Duty is an import-export duty. It is levied on the products that are imported into India from foreign countries and also on the products and goods being exported from India.

- Entertainment Tax: The name in itself is self-explanatory, the tax which is levied on all the sources of entertainment as per the directions of the state government. It could be a movie, any amusement park, or any sports activity.

- Stamp Duty: Under section 3 Indian Stamp Act, 1899, the stamp duty is imposed on the legal documents of the sale of any property.

- Securities Transaction Tax: This type of tax applies to the trading of securities on the stock exchange.

Features of Indirect Taxes

Indirect Taxes have some very common but important features as follows-

- It is imposed on commodities: Indirect Taxes are always applied on materialistic things like goods and services provided to the customers. It has no link with the income of an individual.

- Taxes are rolled over: The taxes which we pay are had to pay by the manufacturers and producers. However, they shift their burden to the customers and impose taxes on them.

- Tax Exemption: Whenever any customer pays the price after using any service or buying a product, then the taxes are included in the total bill. Therefore the customer doesn’t have to pay any extra charges over it.

- Revenue for government: indirect taxes cannot be escaped, and they have applied to almost all the types of commodities, hence it provides a greater margin to the government revenue.

- Consumers are at no financial loss: Since the Indirect Taxes are not included with the income taxes, hence they are of no great loss to the customers.

Advantages of Indirect Tax

- Convenient to pay: Since the Indirect Taxes are not attached to the income of people, they are easy to pay, and no need to have any strict records as such. It is a simple concept, the more expensive product you buy, the higher tax you will pay.

- Easy collection: Indirect taxes are easier to collect and pay. There is no definite tax amount for every commodity, so you need not file any tax return statement, unlike the income tax.

- Expedient: Indirect taxes are imposed directly on sale and purchase commodities, unlike income tax, which is levied on all the types of earnings, it is convenient to pay.

- Good for health: Yes, you read that right. Indirect taxes are relatively higher on harmful products like tobacco. For example, cigarettes are taxed at 38% of the retail price. If a person is actually health conscious, then this idea will save them.

- Wider context of Tax: When you pay the direct taxes, they are relatively higher. On the contrary, indirect taxes are imposed on the goods, so you don’t have to pay bigger amounts.

- Contribution from every section: It is important to note that still there are many sections in the society that fall in the category who don’t earn more than 2.5lakh p.a. . Hence, they are exempted from the direct taxes. However, buying any product and paying indirect taxes is a contribution from their side to the nation.

Disadvantages of Indirect Taxes

- Regression oriented: Since the tax remains the same on all the commodities and unlike income tax, it has no mercy on the poor, this return in continuous taxes implementation on them and results in regression.

- Can lead to inflation: When the government increases the tax slab, the manufacturers and producers increase the tax on the products, which automatically becomes high. Such condition results in inflation.

- Tax on raw materials: Indirect Taxes are also imposed on the raw material, which becomes costlier for the producers to buy and discourages them to proceed further with processing the raw material.

- Uncertain revenue collection: Since the indirect taxes are imposed on the goods and commodities, so they vary in terms of the amount of taxes applied on the product. Hence, there is no certain definite amount fixed to be paid to the government.

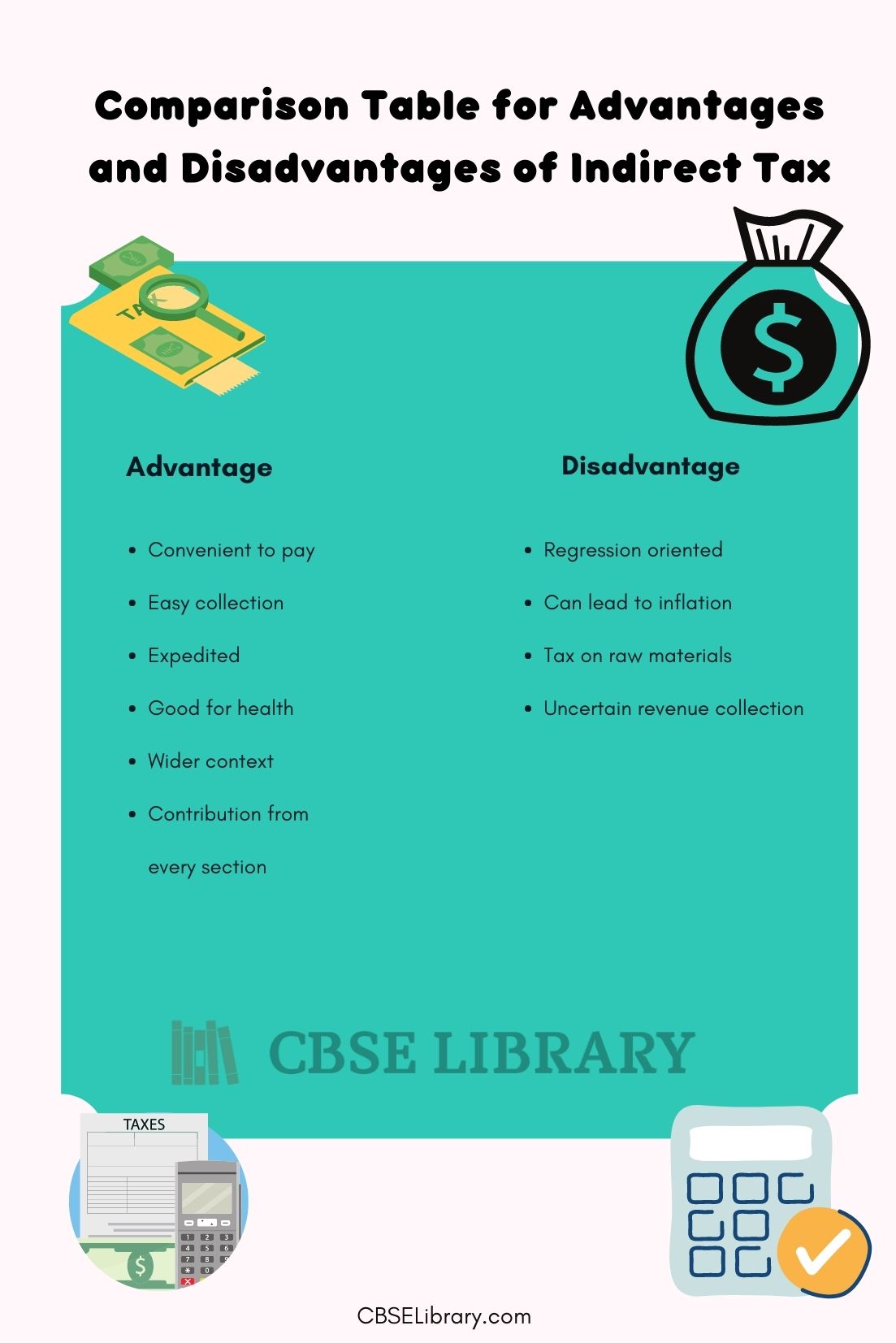

Comparison Table for Advantages and Disadvantages of Indirect Tax

| Advantages | Disadvantages |

| Convenient to pay | Regression oriented |

| Easy collection | Can lead to inflation |

| Expedited | Tax on raw materials |

| Good for health | Uncertain revenue collection |

| Wider context | |

| Contribution from every section |

FAQ’s on Advantages And Disadvantages Of Indirect Tax

Question 1.

Are Goods and Services Taxes included in Indirect taxes?

Answer:

Yes, Goods and Services Taxes, aka GST are a part of Indirect Taxes. It was brought to the public by GOI in 2017, where it covers all the important indirect taxes in one regime.

Question 2.

Who imposes and collects the Indirect taxes?

Answer:

Indirect Taxes are actually imposed on the manufacturers and suppliers. They further delegate this tax to the people and recover their tex reduced amounts from the customers.

Question 3.

Are Indirect Taxes tentative in nature?

Answer:

Yes, indirect taxes are quite uncertain and not fixed. So it can vary accordingly in terms of political, and economical changes.

Question 4.

Do the manufacturers need to get a license to pay the excise duty?

Answer:

No, the manufacturers are not required to get any license to pay excise duty. Just a simple registration will be enough.