Advantages and Disadvantages of Fixed Exchange Rate 2022: The whole world runs on the monetary system set by the government of the country. Currency is something that allows people in the country to deal with transactions happening in the country. Currency other than the country’s currency is not acceptable to people as it will not have the same impact and may not be acceptable to others. Fixed and fluctuating exchange rates, therefore, help in maintaining the changes in currencies. Let us now know more about the exchange rates.

A decent conversion standard is a system applied by an administration or national bank that ties the country’s true cash swapping scale to one more nation’s money or the cost of gold. The reason for a proper conversion standard framework is to keep a cash’s worth inside a thin band.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Fixed rates give more prominent assurance to exporters and shippers. Fixed rates additionally assist the public authority with keeping up with low expansion, which, over the long haul, keeps loan fees down and invigorates exchange and speculation.

Most major industrialized countries have had drifting conversion scale frameworks, where the going cost on the unfamiliar trade market (forex) sets its cash cost. This training started for these countries in the mid-1970s while creating economies go on with fixed-rate frameworks.

- Advantages of Fixed Exchange Rate

- Disadvantages of Fixed Exchange Rate

- Comparative Table for the Advantages and Disadvantages of Fixed Exchange Rate System

- FAQ’s on Pros and Cons of Fixed Exchange Rate

What are Exchange Rates? Advantages and Disadvantages of Fixed Exchange rate 2022

The exchange rate is the value of one currency concerning another for the purpose to convert the same. The exchange rate allows one country to deal in goods or services by exchanging their currency. There are two types of exchange rates that are flexible and fixed. In a flexible exchange rate, market forces, that is, demand and supply are responsible for exchange rates while in a fixed exchange rate, the value of currency concerning other countries’ currency values is tied to the value of gold. Let us see what a fixed exchange rate is and what are its advantages and disadvantages

What is a Fixed Exchange Rate?

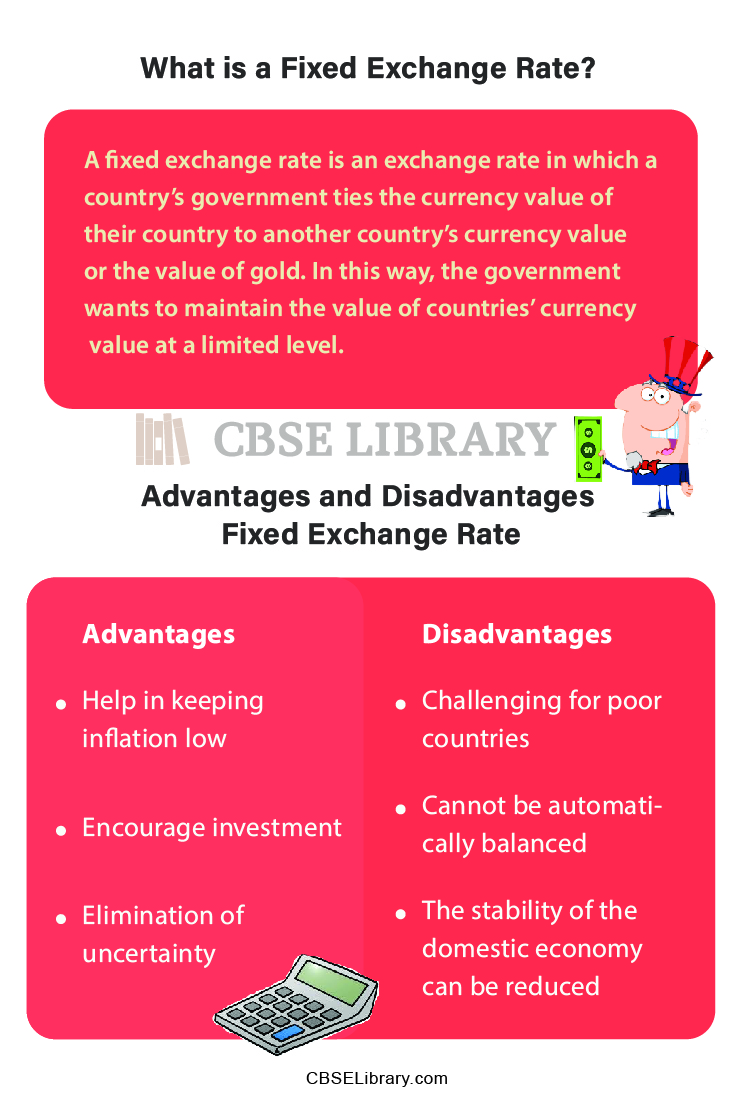

A fixed exchange rate is an exchange rate in which a country’s government ties the currency value of their country to another country’s currency value or the value of gold. In this way, the government wants to maintain the value of countries’ currency value at a limited level. It is also known as the pegged exchange rate system. When there is a pegging of one currency on another, there are fewer chances of fluctuation in the value of the currency; this fixed exchange rate is more stable and is least affected by market conditions. But still there exist disadvantages too of this type of exchange. Let us discuss the advantages and disadvantages of the currency’s fixed exchange rate.

Advantages of Fixed Exchange Rate

Let us see the advantages of the below-listed points.

- Help in keeping inflation low: The main motive behind the Fixed exchange rate is to keep inflation low for the exporters, importers, as well as the government as the value of a currency remains at the narrow band for keeping the inflation level low.

- Stability: To keep the currency value within the limit is the work of a fixed exchange rate therefore it provides stability. Also, there is a smooth flow of money from one nation to another. It is best for a nation that is still growing or developing and does not have any stable monetary policy.

- Encourage investment: Since there is a smooth flow of money and people of other nations are very much attracted to increase investment in other nations and earn more profit, therefore, it encourages investment to a large extent and increases the flow of foreign currencies.

- Currency fluctuation can be managed: The pegged exchange rate system currency fluctuates when the rate of other currency or the value of gold changes but this is so minimal that the effect of this fluctuation is minimized and is manageable.

- Elimination of uncertainty: The nature of the pegged system is to reduce the chances of fluctuation in price level and eliminate the uncertainty. A stable system of exchange reduces the chances of risk involved in the current status of a nation.

- Eliminate speculation: As people will already ascertain that the value of the currency will not change much thus people won’t speculate on the currency as a fixed exchange rate guarantees the minimum change in the value of the currency.

Disadvantages of Fixed Exchange Rate

- Challenging for poor countries: Poor countries generally have the value of their currency lower than others because the stability of a nation is affected to a large extent. A less valued currency makes its imports more expensive and exports less expensive; this makes the country’s economy unstable and unhealthy.

- Do not follow the concept of the free market: The free market depends on market and supply factors for fixing prices in the market, which is the most likely to be the feature of the flexible exchange rate system. But in a fixed or pegged exchange rate system, the value of a currency depends on other currencies or the value of gold. Therefore Fixed exchange rates don’t follow the concept of the free market.

- Cannot be automatically balanced: As the currency of other nations or the value of gold changes with the affluence of time and it’s not fixed how much changes will be there. Thus, each nation’s currency will differ and affect the economy; therefore, it cannot be automatically balanced.

- Government intervention is required: The government has proposed various monetary policies this is because, without government intervention, it is not possible for the level of inflation could be reduced. This directly helps in the reduction of the value of the currency. But government intervention can also reduce the good impact of fixed exchange rates.

- The stability of the domestic economy can be reduced: The exchange rate affects the economy of a nation as there demand changes for export or imports. With the devaluation of domestic currency, export becomes competitive, and imports become less competitive which brings instability to the domestic market.

- Too rigid: The fixed exchange rate is rigid as it depends on the value of gold which may or may not be beneficial for the nation and cannot be changed. Thus it is too rigid.

Comparative Table for the Advantages and Disadvantages of Fixed Exchange Rate System

Below is the comparison chart of the advantages and disadvantages of the fixed exchange rate system.

| Advantages of Fixed exchange rate system | Disadvantages of Fixed exchange rate system |

| Help in keeping inflation low | Challenging for poor countries |

| Stability | Do not follow the concept of free market |

| Encourage investment | Cannot be automatically balanced |

| Currency fluctuation can be managed | Government intervention is required |

| Elimination of uncertainty | The stability of the domestic economy can be reduced |

| Eliminate speculation | Too rigid |

FAQ’s on Pros and Cons of Fixed Exchange Rate

Question 1.

What is a Floating exchange rate system?

Answer:

Floating exchange rate system is also known as a flexible exchange rate system. It depends on the market forces to fix the value of the currency.

Question 2.

What is currency?

Answer:

Currency is the official money that is used in a nation for transactions of daily life. Every nation has a different currency than applies to a nation.

Question 3.

Who is responsible for the monetary policy of a nation?

Answer:

The monetary policies is generally made by the central government of that nation.