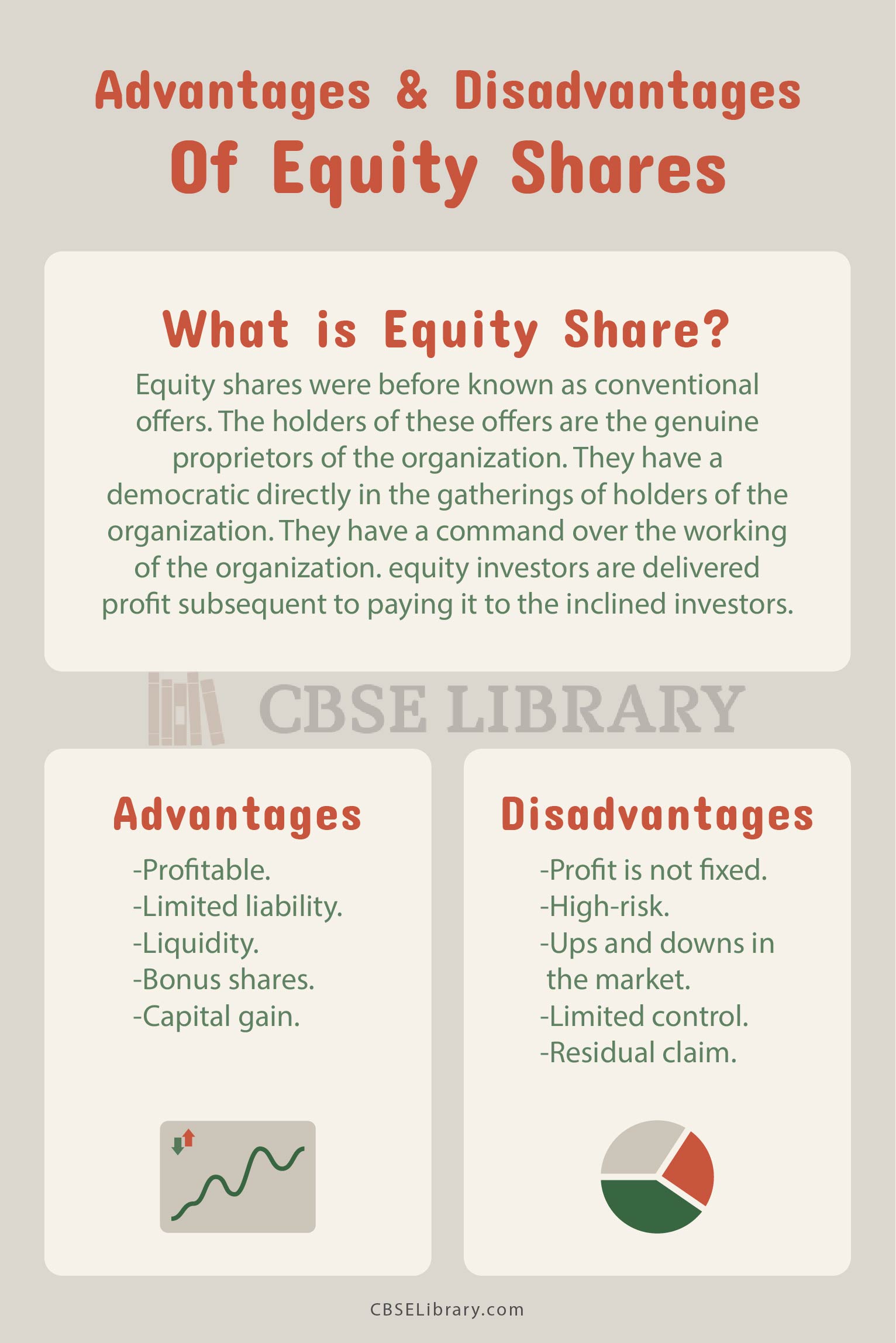

Advantages And Disadvantages Of Equity Shares: Advantages of an equity share venture are profit qualification, capital additions, restricted risk, control, guarantee over pay and resources, right offers, extra offers, liquidity, and so forth. Hindrances are profit vulnerability, high gambling, vacillation in market cost, restricted control, leftover case, and so forth. Allow us to see more top to bottom the benefits and burdens of equity share speculation.

Equity share is taken a gander at according to alternate points of view by various partners. There are two significant points of taking a gander at it – the Company and Investor Angle. Thus, any assertion about equity capital would have alternate importance for an organization and a financial backer. We will take a gander at the financial backer point of the equity share venture.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is Equity Share? Advantages And Disadvantages Of Equity Shares 2022

Equity shares were before known as conventional offers. The holders of these offers are the genuine proprietors of the organization. They have a democratic directly in the gatherings of holders of the organization. They have a command over the working of the organization. equity investors are delivered profit subsequent to paying it to the inclined investors.

The pace of profit on these offers relies on the benefits of the organization. They might be delivered at a higher pace of profit or they may not get anything. These investors face more challenges when contrasted with inclination investors.

equity capital is paid subsequent to meet any remaining cases including that of inclination investors. They face challenges both in regard to profit and return of capital. Equity share capital can’t be reclaimed during the existing season of the organization.

- Advantages of Equity Shares

- Disadvantages of Equity Shares

- Comparison Table for Advantages And Disadvantages Of Equity Shares

- FAQs on Pros and Cons of Equity Shares

Characteristics of Equity Shares

- Equity shares capital remains parts forever with the organization. It is returned just when the organization is twisted up.

- Equity investors have cast a ballot right and choose the administration of the organization.

- The pace of profit on equity capital relies on the accessibility of excess assets. There is no decent pace of profit on equity capital.

Advantages of Equity Shares

- Benefit Potential: Values can possibly bring great returns. As a matter of fact, these profits might possibly be a slight bit better compared to most other speculation choices. Values are known to give returns when you stay contributed for the long run.

- Potential returns that tackle expansion: equity shares can possibly give returns that are higher than expansion. This matters on the grounds that any profits lower than expansion can mean you lose your buying power.

- Profit Income: The profit is the pay of the organization that it disseminates to its investors out of the benefits. The profit pay goes about as a type of revenue for the investors of the organization. It wouldn’t be inappropriate to say that profit is one of the courses through which a financial backer procures a profit from his speculation. The pace of profit shifts from one organization to another as per their benefits. Most long haul designers favour putting resources into those organizations which have a decent and reliable record of circulating profit to the investors.

- Practice Control: At the point when you put resources into a load of an organization, you get the democratic privileges in it. Consequently, with the acquisition of portions of an organization, you can practice control and get possession of the organization. You might partake in the investors or some other significant gathering of the organization.

- Directly Over Assets and Income: At the point when you buy the portions of an organization, you get a piece of the possession in the organization. This makes you the proprietor of the resources that the organization possesses. Likewise, financial backers can get a portion of the benefits through profits. They additionally stand to in a roundabout way benefit when the organization creates gains after some time via an expansion in the offer’s worth.

- Extra Shares: Commonly the organizations choose to give extra offers to their investors. Extra offers can be said as a kind of profit where the organizations give the investors free offers. At various events, extra offers are given instead of profits.

- Right Shares: Whenever an organization requires further capital for extension or some other business use, it gives the right offers. Right offers are those offers that are first proposed to the current investors of the organization. The ongoing financial backers have been needed over other general financial backers during the right issue of offers. Right offers are for the most part given at equity that is lower than the ongoing business sector cost of the stock. In this manner, the current investor can take the advantage of buying the offers at a lower cost or they can articulate their solidly in support of somebody to get a worth right.

- Liquidity: Liquidity is one of the primary benefits of putting resources into equity shares. Liquidity implies the volume of offers that are exchanged in the stock trade. At the point when you buy the portions of an organization, you have the choice to sell them on the trade without any problem. The accessibility of purchasers to buy your stocks during the market meeting makes the equity market engaging. Consequently, at whatever point you are needing cash you can without much of a stretch sell your stocks on the trade and get the cash credited into your ledger.

- Share in Growth: At the point when you put resources into the equity market, you become the proprietor of the organization. So being an investor in the organization you get the potential chance to observe the development and ascent of the organization. As a financial backer, it is a superb encounter to be a piece of an organization that ascents from the base and arrive at the magnificence. Moreover, you additionally get compensation for the development of the organization as enthusiasm for the offer cost.

Disadvantages of Equity Shares

- Profit: The profit that an investor gets is neither fixed nor controllable by the financial backer. The administration of the organization concludes how much profit ought to be given. On the off chance that there is a misfortune, there is no doubt of profit. On the off chance that there is a benefit, financial backers won’t get the profit except if the Board of Directors proposes a profit.

- High Risk: equity share speculation is a hazardous venture contrasted with some other speculation like obligations and so forth. The cash is put in view of a financial backer’s confidence in the organization. There is no guarantee of security connected to it.

- Variance in Market Price: The market cost of any equity share has a wide variety. Booking benefits from the market is in every case truly challenging. Running against the norm, there are equivalent possibilities of misfortunes.

- Restricted Control: A equity financial backer is a little financial backer in the organization, in this manner, it is not really imaginable to affect the choice of the organization utilizing the democratic privileges.

- Remaining Claim: The equity investor has a remaining case over both the resources and the pay. Pay that is accessible to equity investors is after the installment of any remaining partners’ viz., debenture holders, and so forth.

Comparison Table for Advantages And Disadvantages Of Equity Shares

| Advantages of equity share | Disadvantages of equity share |

| Profitable | Profit is not fixed |

| Limited liability | High-risk |

| Liquidity | Ups and downs in the market |

| Bonus shares | Limited control |

| Capital gain | Residual claim |

FAQs on Pros and Cons of Equity Shares

Question 1.

What are the advantages of equity shares?

Answer:

Advantages of equity share speculation are profit privilege, capital increases, restricted obligation, control, guarantee over pay and resources, right offers, extra offers, liquidity, and so on.

Question 2.

What are the disadvantages of equity shares?

Answer:

Drawbacks are profit vulnerability, high gamble, variance in market cost, restricted control, lingering guarantee, and so forth.