Advantages And Disadvantages Of Buyback Of Shares: A buyback of shares occurs when the Board of Directors decides to repurchase its stock from shareholders on the open market. A buyback can occur at any time, although it’s most common in a downturn in the economy or stock market, or when the company is planning to make major capital expenditures (such as building a new factory). Both companies and shareholders have the opportunity to benefit from buybacks, but there are also potential drawbacks if you’re not careful. Here are some of the advantages and disadvantages of the buyback of shares from the perspective of both companies and shareholders.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

- Advantages of Buyback of Shares

- Disadvantages of Buyback of Shares

- Comparison Table for Advantages And Disadvantages Of Buyback Of Shares

- FAQ’s on Advantages And Disadvantages Of Buyback Of Shares

What is Buyback of Shares? What are the Advantages and Disadvantages of Buyback of Shares?

Buyback of shares is a process in which a company repurchases its shares from investors. This is done by publicly traded companies, which have to adhere to Securities Exchange Commission’s (SEC) guidelines. The buyback of shares aims to boost investor confidence. They also help companies retain cash that would otherwise be paid out as dividends. When companies buy back their stock, it reduces the number of outstanding shares. As a result, earnings per share increase because there are fewer shares outstanding.

- A buyback is when a company buys its shares. The idea behind it is that management believes its stock is undervalued. By increasing demand for shares, management can increase share price. A buyback also increases earnings per share (EPS) by reducing outstanding shares in the market.

- Examples of Buyback of Shares – Examples: When a company performs a share buy-back, it acquires its outstanding stocks from investors and then burns them. When Should Companies Perform Share Buybacks?: If a company is generating excess cash that is not needed for future investments or acquisitions, management can use it to repurchase shares.

Top 5 Indian Companies That Offer BuyBack Offer

Some top-notch Indian companies offer buyback options for their shareholders. A buyback is nothing but an alternative model through which a company acquires shares from shareholders at current market prices. Here is a list of the top 5 Indian companies that offer buyback offers:-

- Dr Reddy’s Laboratories Ltd: The leading pharmaceutical company in India, Dr Reddy’s has made its mark by making affordable medicines for all sections of society. It was founded in 1984 by Dr Anji Reddy, who also serves as its chairman.

- Larsen & Toubro: Another major Indian conglomerate, Larsen & Toubro has been behind some of India’s most ambitious infrastructure projects. Founded in 1938 by two Danish engineers, L&T is one of India’s largest engineering and construction companies, with projects in over 30 countries around the world.

- Mahindra & Mahindra: Started by Dr Vikram Sarabhai, the father of India’s space program, Mahindra & Mahindra has grown to become one of India’s leading industrial companies. Not only does it manufacture automobiles under its name, but it also makes machines for other manufacturers. It even owns a Formula One racing team that is competing in next year’s series.

- The largest IT company in India, Infosys is a leader in outsourcing services, providing technology solutions to large companies around the world. It was founded by Nandan Nilekani and six other engineers in 1981 with just $250 but has grown to be one of India’s largest companies today. It even competes with giants like IBM and Accenture for business all over the world!

- A major telecom provider, Bharti Airtel was started by Sunil Mittal in 1995 after he completed his first cellular license bidding process. It was one of India’s first GSM mobile service providers, which allowed it to gain a substantial foothold over its competitors. Today, Airtel is India’s largest telecom company, with almost 350 million subscribers as of 2017!

Advantages of Buyback of Shares

There are both positive and negative effects related to stock repurchases.

- The positive effects include an increase in shareholder value, a reduction in outstanding shares due to potential shareholders, increase liquidity in a particular stock, stimulating trading activity; as well as a reduction in income taxes as a result of management using tax benefits/deductions.

- The negative effects include an inefficient allocation of capital because it may be used for alternative purposes that could have generated higher returns. Another important reason is manipulation by company insiders or other parties with access to material non-public information about poor company performance which can cause artificially high share prices that can then justify buybacks.

Let us see the advantages of the Buyback of shares:-

Flexibility:-

- The company can decide when to pay shareholders. This can be at a pre-agreed price whenever they feel their stock is undervalued in any market conditions, or whenever they want to issue more shares.

- Thus, it is an advantage as it enables investors to get out of a situation that may result in low returns such as during recessionary periods.

- Another advantage of buybacks is that no regulatory changes are required for buybacks, unlike dividends which have been seen to be affected by corporate governance changes.

Tax Benefit:-

- When a company buys back its shares, it can claim capital gains tax on it. Thus, if a company is paying out dividends to shareholders, then they are required to pay taxes on those dividends.

- When companies buy back their shares from investors, they don’t have to pay any taxes as they are not paying any dividends. It is just that they are buying their shares from investors at a higher price than what they were sold for.

- However, in case there is no tax benefit in your country or you do not want to use that tax benefit then you can sell your shares without triggering any capital gains taxes.

- The amount paid by you will be considered an expense by the company which will reduce its taxable income in future years.

Share Buyback as a signal:-

- When companies buy back their shares, it is seen as a sign that they have confidence in their business. It also shows that management has enough confidence to use its cash to buy back its shares instead of spending it on other things.

- Another advantage is that when companies decide to do share buybacks, they usually do so at lower prices than what they are trading at to make sure that shareholders get maximum value for their money.

- Thus, it can be seen as an indication that there are some good opportunities out there that management feels can give them better returns than what they would be getting if they were not doing any share buybacks.

Disadvantages of Buyback of Shares

The disadvantages of buybacks are that they do not help all shareholders. Those who hold stock options or convertible debt (loans that can be converted into stocks) may not benefit from buybacks. Shareholders may also vote against a share repurchase, in which case it cannot take place. Disadvantages of the buy share are as follows:-

Unrealistic Picture Through Ratios:-

- Ratio analysis is a method used to compare a company’s current performance with its past performance or that of its competitors.

- The main ratios that are used in the stock market analysis are price-earnings ratio, dividend yield, return on equity, debt-equity ratio etc.

- These ratios indicate what a company is worth. If these ratios are high, it indicates that investors hav confidence in future growth prospects.

Judgement Error in Valuation:-

- In valuation, there is always a risk of judicial error. The judgment error can be on account of overvaluation or undervaluation.

- Overvaluation occurs when an asset is priced higher than its intrinsic value.

- Undervaluation occurs when an asset is priced lower than its intrinsic value. In valuation, there is always a risk of judicial error.

- The judgment error can be on account of overvaluation or undervaluation.

- Overvaluation occurs when an asset is priced higher than its intrinsic value.

- Undervaluation occurs when an asset is priced lower than its intrinsic value.

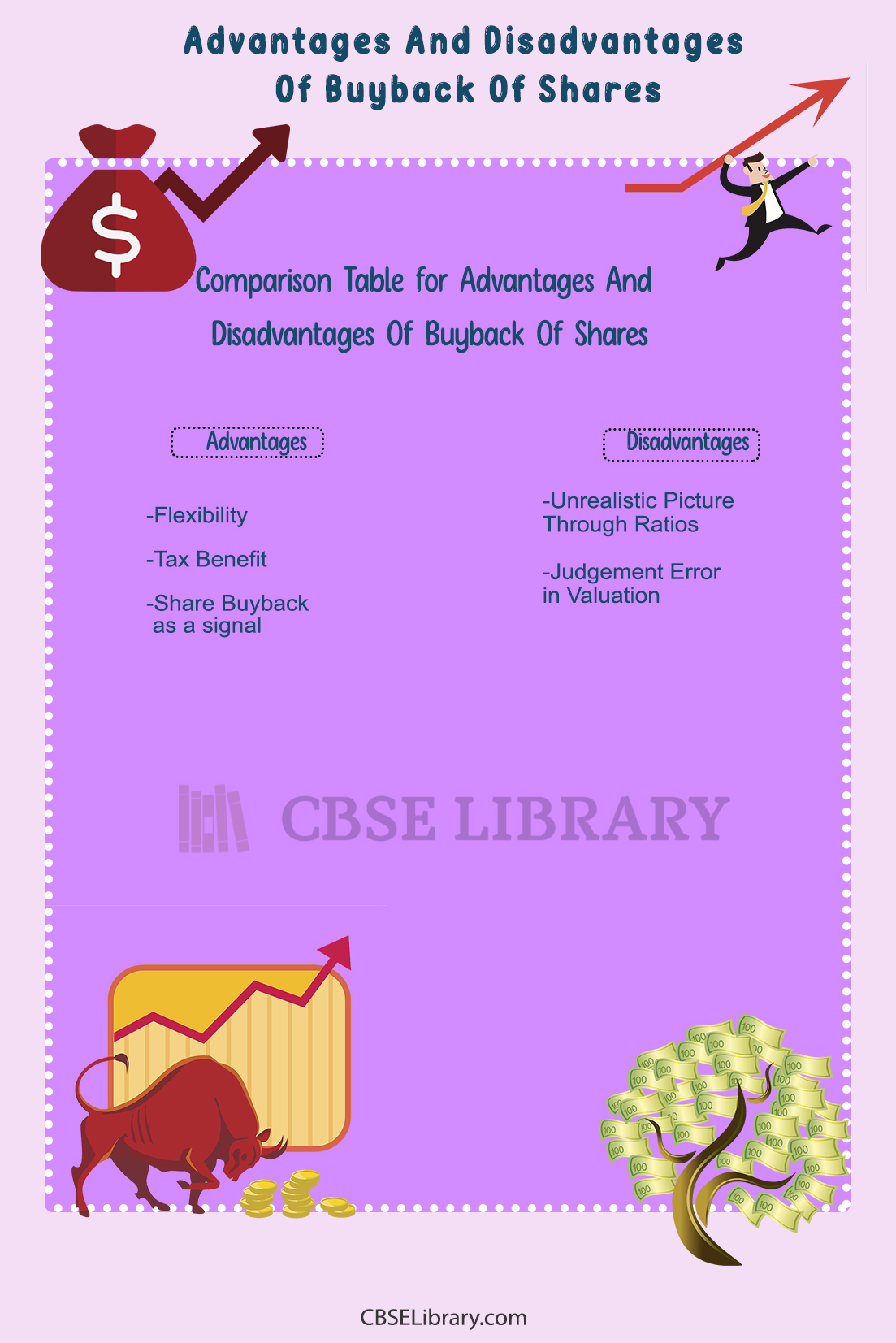

Comparison Table for Advantages And Disadvantages Of Buyback Of Shares

| Advantages | Disadvantages |

| Flexibility | Unrealistic Picture Through Ratios |

| Tax Benefit | Judgement Error in Valuation |

| Share Buyback as a signal |

FAQ’s on Advantages And Disadvantages Of Buyback Of Shares

Question 1.

Why would a company buy back shares?

Answer:

It has been speculated that it can give a company’s stock price a short-term boost as investors see it as a sign that management is confident in their business.

Question 2.

How do you profit from stock buybacks?

Answer:

Earnings per share (EPS) is a measurement of net income divided by outstanding shares. By reducing its number of outstanding shares, a company increases its EPS.

Question 3.

What is the advantage of the buyback of shares?

Answer:

The main advantage is that it can be used to potentially increase a company’s share price. If management feels that shares are undervalued, they will buy back stock to raise its price.

Question 4.

What are the disadvantages of buyback?

Answer:

The main disadvantage is that it can reduce a company’s cash reserves. By purchasing back shares, a company reduces its cash on hand by how much it paid for those shares.