Advantages and Disadvantages of Accounting Standards 2022: Over centuries, people have been using the traditional method to record and analyze data or transactions, but now our modern world is encountering various challenges related to it. Therefore, certain laws and standards have been set to make the accounting system more reliable and authentic. We are already aware of the principles set by the accounting analysts. A few of the principles are entity concept, going concern concept, dual aspect, etc. These principles have provided the base to record the transactions.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

What is an Accounting Standard? Advantages and Disadvantages of Accounting Standard 2022

An accounting standard is a written policy statement covering the aspect of recognition, presentation, treatment, measurement, and disclosure of accounting transactions of financial statements. The ICAI has issued this accounting standard to bring uniformity of accounting policies to the whole of the nation. It also provides valuation norms and disclosure policies that need to be maintained by every organization. It enhances the credibility of accounting data and the comparability of both inter and intra-firms. These comparisons are very effective and are used for the assessment of firms.

Need for Accounting Standard

To avoid the variance which may arise due to different accounting principles and practices and to bring uniformity among the diverse principles of accounting, accounting standards are used. Let’s see what its further need is.

- Comparison between the two organizations is possible only when both of them maintain the same methodology and principle of accounting. But if they don’t, comparability becomes difficult; thus, accounting standards help to maintain the comparability criteria.

- Firms cannot present the accounts according to their own will or choice of financial statement to interested users. Therefore accounting standards help to maintain the standard to present the financial statement.

- To maintain fairness, transparency, and consistency of the accounting financial report, accounting standard provides a base so that the users may get fair information about the accounts.

Now let us see what are the advantages and disadvantages of accounting standards are.

- Advantages of Accounting Standards

- Disadvantages of Accounting Standards

- Comparison Table for Advantages and Disadvantages of Accounting Standards

- FAQs on Pros and Cons of Accounting standard

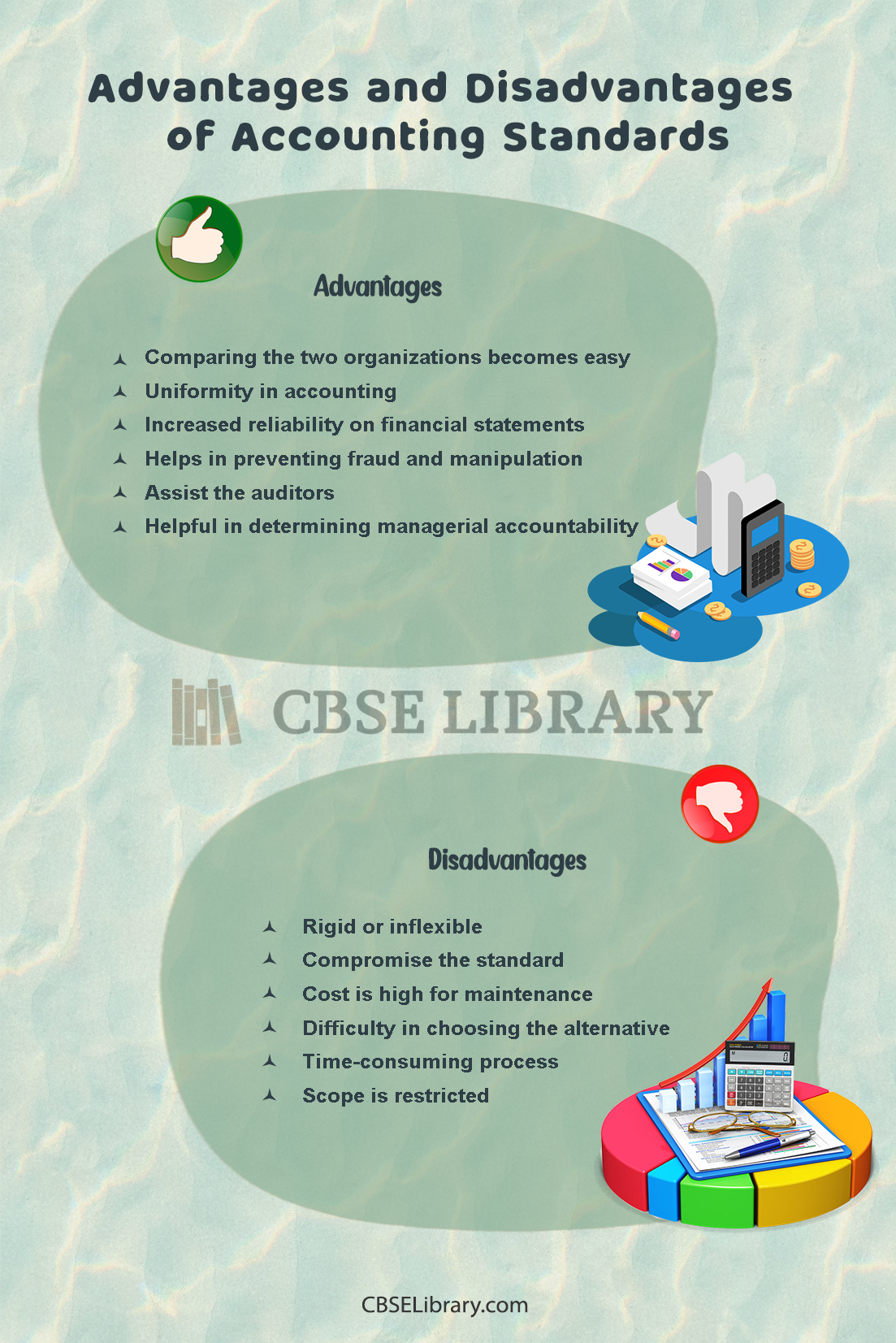

Advantages of Accounting Standards

Below listed are a few advantages and disadvantages of accounting standards.

- Comparing the two organizations becomes easy: Comparison helps the users of the financial statement to make decisions as soon as they have gone through the financial statement of each of the organizations. If both organizations use different accounting methodologies, it will be difficult to compare the two. Therefore the accounting standard provides the benefit to compare whenever needed.

- Uniformity in accounting: Accounting standards set rules and regulations that need to be followed at any cost by the firm for recording the transaction. They have a standard format applied for every firm for financial statements as well as for different valuations to bring out uniformity in the whole accounting process.

- Increased reliability on financial statements As there is a set format for the valuation of financial statements, the user, whether external or internal, relies totally on this financial statement to make any decision. The notes to account also describe different contingencies of a firm and the working notes of the headings, making the system more transparent and, therefore, adopting the feature of reliability.

- Helps in preventing fraud and manipulation: As described above, there is a set format of the financial statement no one can manipulate or commit fraud in the whole accounting process. Therefore the accounting standard has already reduced the chances of manipulation and fraud and made the accounting system more effective and reliable.

- Assist the auditors: The rules, policies, and format has already been laid down by the accounting standard; therefore, it provides aid to the auditors to analyze the accounting statements. The work of the auditor is to check whether the financial statements made by the companies are according to the policies and rules laid down by accounting standards or not.

- Helpful in determining managerial accountability: Accounting standards help in measuring the managerial aspect of the firm. It also measures the performance of the management and the ability to increase the increased profitability, maintain the solvency of an entity, and other duties of the management. Good management will be consistent in their methods and policies so as not to confuse the user’s mind.

Disadvantages of Accounting Standards

Let us briefly understand the disadvantages of accounting standards.

- Rigid or inflexible: The policies are already made and have to be followed by the entity at any cost; thus, making the financial statement is rigid no one can change it according to their convenience. The format is already set, which has to be followed. Thus, it lacks flexibility.

- Compromise the standard: sometimes, the accounting standard is compromised due to lobbying or government pressure. This is because the government or powerful authority wants to give advantages only to the big powerful companies. Therefore standards are compromised and cannot be relied on.

- Cost is high for maintenance: The cost is high for maintaining the books of account according to the format set by the accounting standard. The detailed paperwork and the use of standard equipment also increase the cost of maintaining books of accounts.

- Difficulty in choosing the alternative: There are many methods to record the transaction in the books of account; thus, it becomes difficult to choose which method to adopt and what not to. And also, sometimes, due to restrictions on the method of choice, the entity has to forgo its best convenient method and adopt the secondary method of recording transactions.

- Time-consuming process: The whole process of following accounting standards takes time as every note and schedule according to the format must be produced by the user and has to go through a lengthy, time-consuming process.

- Scope is restricted: Accounting standard has to be framed according to the rules set presently in the nation. They cannot override the statute. Thus the scope for providing policies gets restricted.

Comparison Table for Advantages and Disadvantages of Accounting Standards

Below is the comparison chart for the advantages and disadvantages of accounting standards.

| Advantages of Accounting standards | Disadvantages of Accounting standards |

| Comparing the two organization become easy | Rigid or inflexible |

| Uniformity in accounting | Compromise the standard |

| Increased reliability on financial statement | Cost is high for maintenance |

| Helps in preventing fraud and manipulation | Difficulty in choosing the alternative |

| Assist the auditors | Time-consuming process |

| Helpful in determining managerial accountability | Scope is restricted |

FAQs on Pros and Cons of Accounting standard

Question 1.

What are Accounting Standards?

Answer:

Accounting standard refers to a set of written rules and policies made for financial reporting and is the primary source of GAAP.

Question 2.

What are the two accounting standards?

Answer:

The two accounting standards are GAAP and IFRS.

Question 3.

Give a few examples of accounting standards.

Answer:

Below is are a few Accounting standards:

AS 1: Disclosure of accounting policies

AS 2: Valuation of inventories

AS 3: cash flow statement

AS 4: Contingencies and events occurring after the balance sheet date

AS 5:Net profit and or loss for the period, prior period items, and changes in accounting policies

AS 6: Depreciation Accounting

AS 7: Construction contracts

AS 9: Revenue recognition

AS 10: Property, plant, and equipment

AS 11: The effects of change in foreign exchange rates.